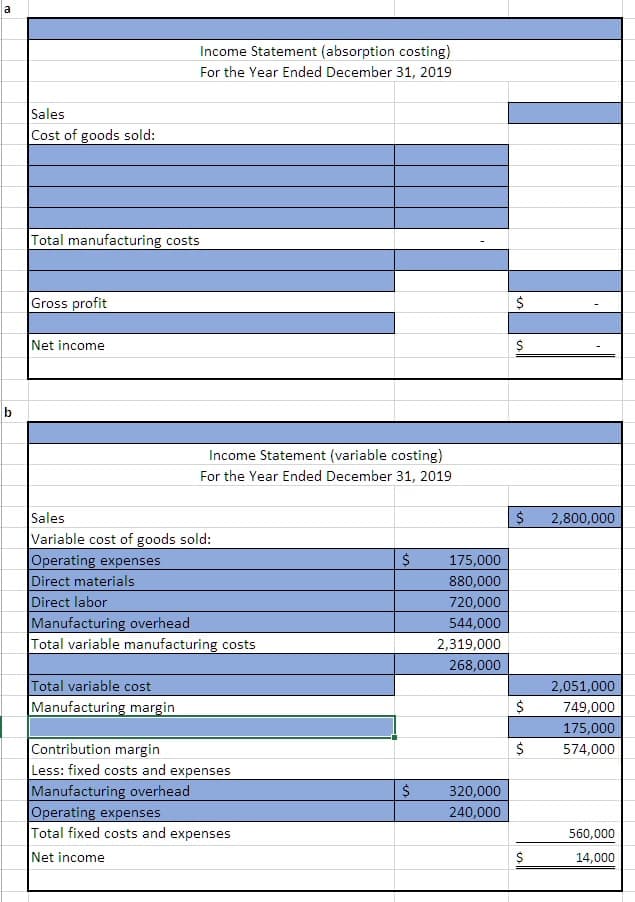

a Income Statement (absorption costing) For the Year Ended December 31, 2019 Sales Cost of goods sold: Total manufacturing costs Gross profit Net income Income Statement (variable costing) For the Year Ended December 31, 2019 Sales 2,800,000 Variable cost of goods sold: Operating expenses Direct materials Direct labor Manufacturing overhead Total variable manufacturing costs 175,000 880,000 720,000 544,000 2,319,000 268,000 Total variable cost Manufacturing margin 2,051,000 $ 749,000 175,000 Contribution margin Less: fixed costs and expenses Manufacturing overhead Operating expenses Total fixed costs and expenses 574,000 $ 320,000 240,000 560,000 Net income 14,000

Summarized data for 2019 (the first year of operations) for Gorman Products, In. are as follows

| Sales (70,000 units) | $2,800,00 |

| Production costs (80,000 units): | |

| Direct materials | 880,000 |

| Direct labor | 720,000 |

| Manufacturing |

|

| Variable | 544,000 |

| Fixed | 320,000 |

| Operating expenses: | |

| Variable | 175,000 |

| Fixed | 240,000 |

| 60,000 | |

| Real estate taxes | 18,000 |

| Personal property taxes (inventory and equipment | 28,000 |

| Personnel department expenses | 30,000 |

a.) Prepare an income statement based on full absortion costing

b) Prepare an income statement based on variable costing (I completed this, see attached spreadsheet. I just need help on a, c, and d)

c) Assume that you must decide quickly whether to accept a special one-time order for 1000 units for $25 per unit. Which income statement presentthe most relevant data? Determine the apparent profit or loss on the special order based solely on these data.

d) If the ending inventory is destroyed by fire, which costing approach would you use as a basis for filing an insurance claim for the fire loss? Why?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images