A IS sted at an annual interest rate of 2.5%. At the end of 20 years, the total in the two funds is P 10,00 end of 31 years, the amount in Fund A is twice the amount in Fund B. Calculate the to two funds at the end of 10 years. Hint: Let A₁ = P₁(1.03)' and B = P(1.025)' be the AV's of Funds A and B at time t resp

A IS sted at an annual interest rate of 2.5%. At the end of 20 years, the total in the two funds is P 10,00 end of 31 years, the amount in Fund A is twice the amount in Fund B. Calculate the to two funds at the end of 10 years. Hint: Let A₁ = P₁(1.03)' and B = P(1.025)' be the AV's of Funds A and B at time t resp

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter2: Descriptive Statistics

Section: Chapter Questions

Problem 17P: Suppose that you initially invested 10,000 in the Stivers mutual fund and 5,000 in the Trippi mutual...

Related questions

Question

100%

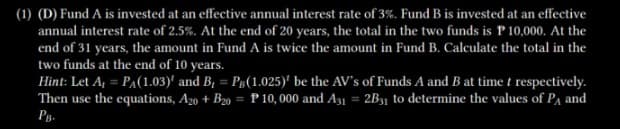

Transcribed Image Text:(1) (D) Fund A is invested at an effective annual interest rate of 3%. Fund B is invested at an effective

annual interest rate of 2.5%. At the end of 20 years, the total in the two funds is P 10,000. At the

end of 31 years, the amount in Fund A is twice the amount in Fund B. Calculate the total in the

two funds at the end of 10 years.

Hint: Let A₁ = P₁(1.03)' and B, = P(1.025)' be the AV's of Funds A and B at time t respectively.

Then use the equations, A20 + B20 = P10,000 and A31 = 2B31 to determine the values of PA and

PB.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College