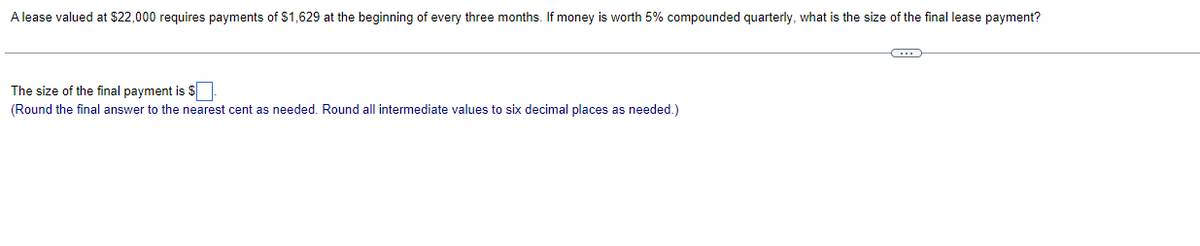

A lease valued at $22,000 requires payments of $1,629 at the beginning of every three months. If money is worth 5% compounded quarterly, what is the size of the final lease payment? The size of the final payment is $| (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

A lease valued at $22,000 requires payments of $1,629 at the beginning of every three months. If money is worth 5% compounded quarterly, what is the size of the final lease payment? The size of the final payment is $| (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 10GI: Owens Company leased equipment for 4 years at 50,000 a year with an option to renew the lease for 6...

Related questions

Question

(please solve within 15 minutes I will give thumbs up)

Transcribed Image Text:A lease valued at $22,000 requires payments of $1,629 at the beginning of every three months. If money is worth 5% compounded quarterly, what is the size of the final lease payment?

The size of the final payment is $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub