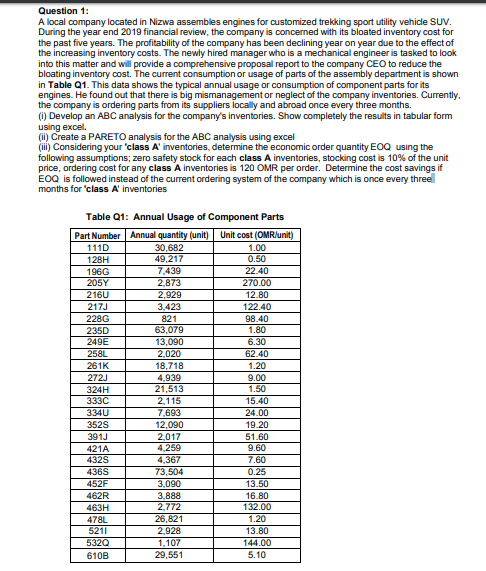

A local company located in Nizwa assembles engines for customized trekking sport utility vehice SUV. During the year end 2019 financial review, the company is concerned with its bloated inventory cost for the past five years. The profitability of the company has been declining year on year due to the effect of the increasing inventory costs. The newly hired manager who is a mechanical engineer is tasked to look into this matter and will provide a comprehensive proposal report to the company CEO to reduce the bloating inventory cost. The current consumption or usage of parts of the assembly department is shown in Table Q1. This data shows the typical annual usage or consumption of component parts for its engines. He found out that there is big mismanagement or neglect of the company inventories. Currently, the company is ordering parts from its suppliers locally and abroad once every three months. (1) Develop an ABC analysis for the company's inventories. Show completely the results in tabular form using excel. (i) Create a PARETO analysis for the ABC analysis using excel (ili) Considering your 'class A' inventories, determine the economic order quantity EOQ using the following assumptions; zero safety stock for each class A inventories, stocking cost is 10% of the unit price, ordering cost for any class A inventories is 120 OMR per order. Determine the cost savings if EOQ is followed instead of the current ordering system of the company which is once every threel months for 'class A' inventories Table Q1: Annual Usage of Component Parts Part Number Annual quantity (unit) Unit cost (OMR/unit) 1.00 0.50 22.40 270.00 111D 128H 30,682 49,217 7,439 196G 205Y 216U 2,873 2,929 3,423 821 63,079 13,090 2.020 18,718 4,939 21,513 2,115 12.80 122.40 98.40 1.80 6.30 217J 228G 235D 249E 258L 261K 62.40 1.20 9.00 1.50 15.40 24.00 19.20 272J 324H 333C 334U 352S 391J 421A 4328 7,693 12,090 2,017 4,259 51.60 9.60 7.60 4,367 73,504 3,090 3,888 2,772 26,821 2,928 1,107 29,551 436S 0.25 13.50 452F 462R 463H 16.80 132.00 1.20 13.80 478L 5211 5320 610B 144.00 5.10

A local company located in Nizwa assembles engines for customized trekking sport utility vehice SUV. During the year end 2019 financial review, the company is concerned with its bloated inventory cost for the past five years. The profitability of the company has been declining year on year due to the effect of the increasing inventory costs. The newly hired manager who is a mechanical engineer is tasked to look into this matter and will provide a comprehensive proposal report to the company CEO to reduce the bloating inventory cost. The current consumption or usage of parts of the assembly department is shown in Table Q1. This data shows the typical annual usage or consumption of component parts for its engines. He found out that there is big mismanagement or neglect of the company inventories. Currently, the company is ordering parts from its suppliers locally and abroad once every three months. (1) Develop an ABC analysis for the company's inventories. Show completely the results in tabular form using excel. (i) Create a PARETO analysis for the ABC analysis using excel (ili) Considering your 'class A' inventories, determine the economic order quantity EOQ using the following assumptions; zero safety stock for each class A inventories, stocking cost is 10% of the unit price, ordering cost for any class A inventories is 120 OMR per order. Determine the cost savings if EOQ is followed instead of the current ordering system of the company which is once every threel months for 'class A' inventories Table Q1: Annual Usage of Component Parts Part Number Annual quantity (unit) Unit cost (OMR/unit) 1.00 0.50 22.40 270.00 111D 128H 30,682 49,217 7,439 196G 205Y 216U 2,873 2,929 3,423 821 63,079 13,090 2.020 18,718 4,939 21,513 2,115 12.80 122.40 98.40 1.80 6.30 217J 228G 235D 249E 258L 261K 62.40 1.20 9.00 1.50 15.40 24.00 19.20 272J 324H 333C 334U 352S 391J 421A 4328 7,693 12,090 2,017 4,259 51.60 9.60 7.60 4,367 73,504 3,090 3,888 2,772 26,821 2,928 1,107 29,551 436S 0.25 13.50 452F 462R 463H 16.80 132.00 1.20 13.80 478L 5211 5320 610B 144.00 5.10

Chapter17: Property Transactions: § 1231 And Recapture Provisions

Section: Chapter Questions

Problem 11DQ

Related questions

Question

Transcribed Image Text:A local company located in Nizwa assembles engines for customized trekking sport utility vehice SUV.

During the year end 2019 financial review, the company is concerned with its bloated inventory cost for

the past five years. The profitability of the company has been declining year on year due to the effect of

the increasing inventory costs. The newly hired manager who is a mechanical engineer is tasked to look

into this matter and will provide a comprehensive proposal report to the company CEO to reduce the

bloating inventory cost. The current consumption or usage of parts of the assembly department is shown

in Table Q1. This data shows the typical annual usage or consumption of component parts for its

engines. He found out that there is big mismanagement or neglect of the company inventories. Currently,

the company is ordering parts from its suppliers locally and abroad once every three months.

(1) Develop an ABC analysis for the company's inventories. Show completely the results in tabular form

using excel.

(i) Create a PARETO analysis for the ABC analysis using excel

(ili) Considering your 'class A' inventories, determine the economic order quantity EOQ using the

following assumptions; zero safety stock for each class A inventories, stocking cost is 10% of the unit

price, ordering cost for any class A inventories is 120 OMR per order. Determine the cost savings if

EOQ is followed instead of the current ordering system of the company which is once every threel

months for 'class A' inventories

Table Q1: Annual Usage of Component Parts

Part Number Annual quantity (unit) Unit cost (OMR/unit)

1.00

0.50

22.40

270.00

111D

128H

30,682

49,217

7,439

196G

205Y

216U

2,873

2,929

3,423

821

63,079

13,090

2.020

18,718

4,939

21,513

2,115

12.80

122.40

98.40

1.80

6.30

217J

228G

235D

249E

258L

261K

62.40

1.20

9.00

1.50

15.40

24.00

19.20

272J

324H

333C

334U

352S

391J

421A

4328

7,693

12,090

2,017

4,259

51.60

9.60

7.60

4,367

73,504

3,090

3,888

2,772

26,821

2,928

1,107

29,551

436S

0.25

13.50

452F

462R

463H

16.80

132.00

1.20

13.80

478L

5211

5320

610B

144.00

5.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning