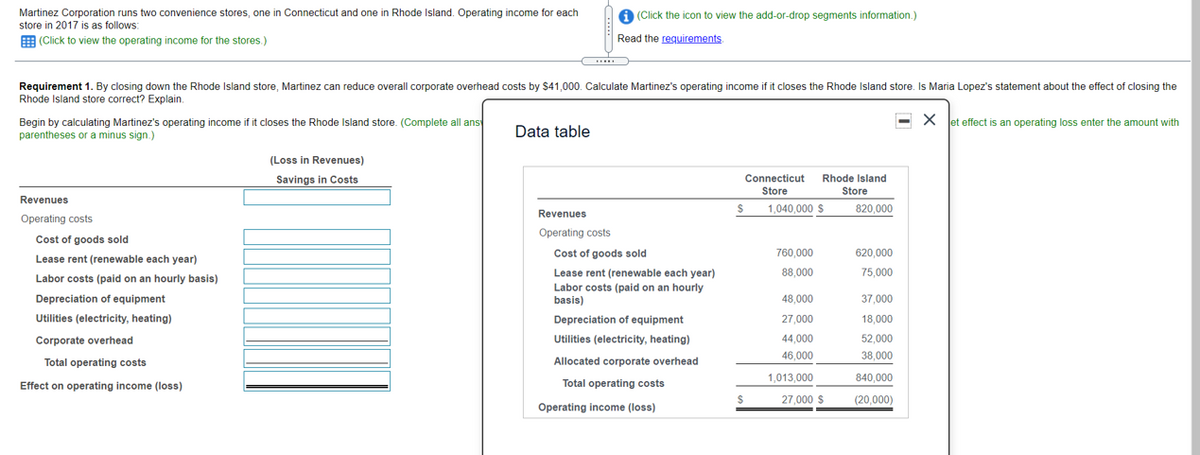

Martinez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each store in 2017 is as follows: O (Click the icon to view the add-or-drop segments information.) |(Click to view the operating income for the stores.) Read the reguirements Requirement 1. By closing down the Rhode Island store, Martinez can reduce overall corporate overhead costs by $41,000. Calculate Martinez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the Rhode Island store correct? Explain. Begin by calculating Martinez's operating income if it closes the Rhode Island store. (Complete all ans parentheses or a minus sign.) - X X et effect is an operating loss enter the amount with Data table (Loss in Revenues) Savings in Costs Rhode Island Store Connecticut Store Revenues $ 1,040,000 S 820.000 Revenues Operating costs Operating costs Cost of goods sold Cost of goods sold 760,000 620,000 Lease rent (renewable each year) 88,000 75,000 Lease rent (renewable each year) Labor costs (paid on an hourly basis) Labor costs (paid on an hourly basis) Depreciation of equipment 48,000 37,000 Utilities (electricity, heating) Depreciation of equipment 27,000 18,000 Corporate overhead Utilities (electricity, heating) 44,000 52,000 46,000 38,000 Total operating costs Allocated corporate overhead 1,013,000 840,000 Effect on operating income (loss) Total operating costs 27,000 $ (20,000) Operating income (loss)

Martinez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each store in 2017 is as follows: O (Click the icon to view the add-or-drop segments information.) |(Click to view the operating income for the stores.) Read the reguirements Requirement 1. By closing down the Rhode Island store, Martinez can reduce overall corporate overhead costs by $41,000. Calculate Martinez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the Rhode Island store correct? Explain. Begin by calculating Martinez's operating income if it closes the Rhode Island store. (Complete all ans parentheses or a minus sign.) - X X et effect is an operating loss enter the amount with Data table (Loss in Revenues) Savings in Costs Rhode Island Store Connecticut Store Revenues $ 1,040,000 S 820.000 Revenues Operating costs Operating costs Cost of goods sold Cost of goods sold 760,000 620,000 Lease rent (renewable each year) 88,000 75,000 Lease rent (renewable each year) Labor costs (paid on an hourly basis) Labor costs (paid on an hourly basis) Depreciation of equipment 48,000 37,000 Utilities (electricity, heating) Depreciation of equipment 27,000 18,000 Corporate overhead Utilities (electricity, heating) 44,000 52,000 46,000 38,000 Total operating costs Allocated corporate overhead 1,013,000 840,000 Effect on operating income (loss) Total operating costs 27,000 $ (20,000) Operating income (loss)

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 1PA: Artisan Metalworks has a bottleneck in their production that occurs within the engraving department....

Related questions

Question

Transcribed Image Text:Martinez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each

store in 2017 is as follows:

A (Click the icon to view the add-or-drop segments information.)

(Click to view the operating income for the stores.)

Read the requirements

.

Requirement 1. By closing down the Rhode Island store, Martinez can reduce overall corporate overhead costs by S41,000. Calculate Martinez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the

Rhode Island store correct? Explain.

- X

Begin by calculating Martinez's operating income if it closes the Rhode Island store. (Complete all ans

parentheses or a minus sign.)

let effect is an operating loss enter the amount with

Data table

(Loss in Revenues)

Savings in Costs

Connecticut

Rhode Island

Store

Store

Revenues

Revenues

1,040,000 $

820,000

Operating costs

Operating costs

Cost of goods sold

Cost of goods sold

760,000

620,000

Lease rent (renewable each year)

Lease rent (renewable each year)

88,000

75,000

Labor costs (paid on an hourly basis)

Labor costs (paid on an hourly

basis)

Depreciation of equipment

48,000

37,000

Utilities (electricity, heating)

Depreciation of equipment

27,000

18,000

Corporate overhead

Utilities (electricity, heating)

44,000

52,000

46,000

38,000

Total operating costs

Allocated corporate overhead

1,013,000

840,000

Effect on operating income (loss)

Total operating costs

27,000 S

(20,000)

Operating income (loss)

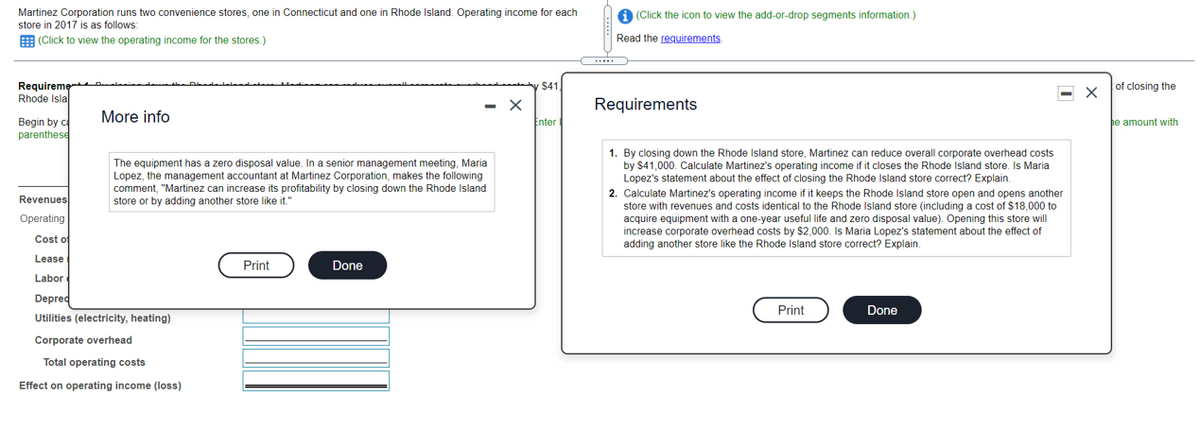

Transcribed Image Text:Martinez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each

store in 2017 is as follows:

E (Click to view the operating income for the stores.)

1 (Click the icon to view the add-or-drop segments information.)

Read the reguirements

of closing the

Requireme

Rhode Isla

$41

- X

Requirements

More info

Enter

Begin by c

parenthese

he amount with

The equipment has a zero disposal value. In a senior management meeting, Maria

Lopez, the management accountant at Martinez Corporation, makes the following

comment, "Martinez can increase its profitability by closing down the Rhode Island

store or by adding another store like it.

1. By closing down the Rhode Island store, Martinez can reduce overall corporate overhead costs

by $41,000. Calculate Martinez's operating income if it closes the Rhode Island store. Is Maria

Lopez's statement about the effect of closing the Rhode Island store correct? Explain.

2. Calculate Martinez's operating income if it keeps the Rhode Island store open and opens another

store with revenues and costs identical to the Rhode Island store (including a cost of $18,000 to

acquire equipment with a one-year useful life and zero disposal value). Opening this store will

increase corporate overhead costs by $2,000. Is Maria Lopez's statement about the effect of

adding another store like the Rhode Island store correct? Explain.

Revenues

Operating

Cost o

Lease

Print

Done

Labor

Depred

Print

Done

Utilities (electricity, heating)

Corporate overhead

Total operating costs

Effect on operating income (loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning