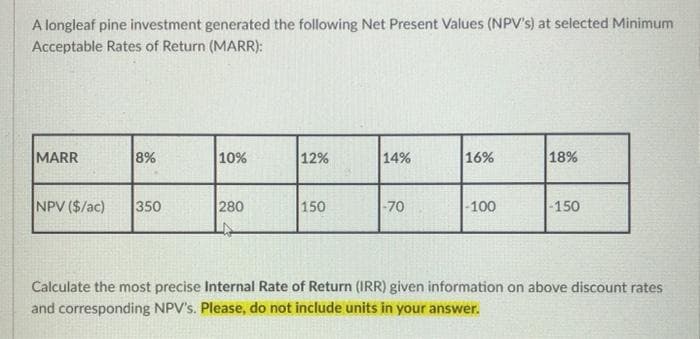

A longleaf pine investment generated the following Net Present Values (NPV's) at selected Minimum Acceptable Rates of Return (MARR): MARR 8% 10% 12% 14% 16% 18% NPV ($/ac) 350 280 150 -70 -100 -150 Calculate the most precise Internal Rate of Return (IRR) given information on above discount rates and corresponding NPV's. Please, do not include units in your answer.

A longleaf pine investment generated the following Net Present Values (NPV's) at selected Minimum Acceptable Rates of Return (MARR): MARR 8% 10% 12% 14% 16% 18% NPV ($/ac) 350 280 150 -70 -100 -150 Calculate the most precise Internal Rate of Return (IRR) given information on above discount rates and corresponding NPV's. Please, do not include units in your answer.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:A longleaf pine investment generated the following Net Present Values (NPV's) at selected Minimum

Acceptable Rates of Return (MARR):

MARR

8%

10%

12%

14%

16%

18%

NPV ($/ac)

350

280

150

-70

-100

-150

Calculate the most precise Internal Rate of Return (IRR) given information on above discount rates

and corresponding NPV's. Please, do not include units in your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT