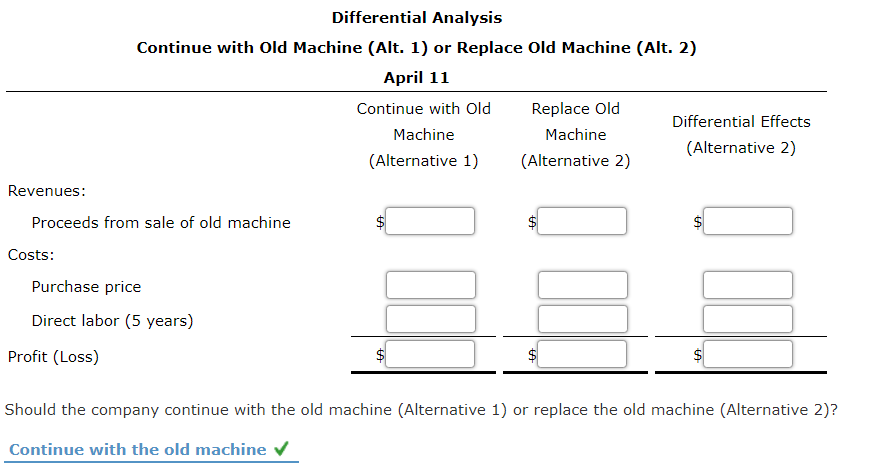

A machine with a book value of $86,000 has an estimated five-year life. A proposal is offered to sell the old machine for $40,500 and replace it with a new machine at a cost of $67,000. The new machine has a five-year life with no residual value. The new machine would reduce annual direct labor costs from $10,300 to $9,700. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Prepare a differential analysis dated April 11 on whether to continue with the old machine (Alternative 1) or replace the old machine (Alternative 2). If an amount is zero, enter "0". Use a minus sign to indicate costs, losses, or negative differential effect on income.

Replace equipment

A machine with a book value of $86,000 has an estimated five-year life. A proposal is offered to sell the old machine for $40,500 and replace it with a new machine at a cost of $67,000. The new machine has a five-year life with no residual value. The new machine would reduce annual direct labor costs from $10,300 to $9,700.

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

Prepare a differential analysis dated April 11 on whether to continue with the old machine (Alternative 1) or replace the old machine (Alternative 2). If an amount is zero, enter "0". Use a minus sign to indicate costs, losses, or negative differential effect on income.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps