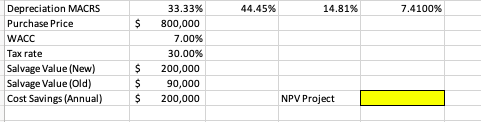

Depreciation MACRS Purchase Price 33.33% 44.45% 14.81% 7.4100% 800,000 7.00% 30.00% 200,000 WACC Тах rate Salvage Value (New) Salvage Value (Old) Cost Savings (Annual) 90,000 200,000 NPV Project

Equipment Replace

ABC is looking to purchase a new machine for a 3 year project, that will cost $800,000 and replace the old machine that they were using. The old machine was being

Cost of new machine = $800,000

Book value of old machine = 20%*$500,000 = $100,000

After tax salvage value of old machine = Salvage value – Tax(Salvage Value – Book value)

=$90,000 – 30%*($90,000 - $100,000)

=$90.000 + $3,000

=$93,000

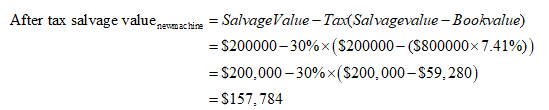

After tax salvage value of new machine:

Step by step

Solved in 2 steps with 3 images