A manager is trying to decide whether to purchase a certain part or to have it produced internally. Internal production could use either of 2 processes. One would ntail a VC of $17 per unit & annual FC of $180k; the other would entail a VC of $15 per unit & annual FC of $230k. Two vendors are willing to provide the part. Vendor A as a price of $30 per unit for any volume up to 50k units. Vendor B has a price of $32 per unit for demand of 5k units or less & $28 per unit for larger quantities. ) If selling price per unit is $45 what is the breakeven point. If the manager anticipates an annual volume of 10k units, which alternative would be best from a cost standpoint? Which Alternative would entail the highest profit?

A manager is trying to decide whether to purchase a certain part or to have it produced internally. Internal production could use either of 2 processes. One would ntail a VC of $17 per unit & annual FC of $180k; the other would entail a VC of $15 per unit & annual FC of $230k. Two vendors are willing to provide the part. Vendor A as a price of $30 per unit for any volume up to 50k units. Vendor B has a price of $32 per unit for demand of 5k units or less & $28 per unit for larger quantities. ) If selling price per unit is $45 what is the breakeven point. If the manager anticipates an annual volume of 10k units, which alternative would be best from a cost standpoint? Which Alternative would entail the highest profit?

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 1PB: Variety Artisans has a bottleneck in their production that occurs within the engraving department....

Related questions

Question

Transcribed Image Text:2)

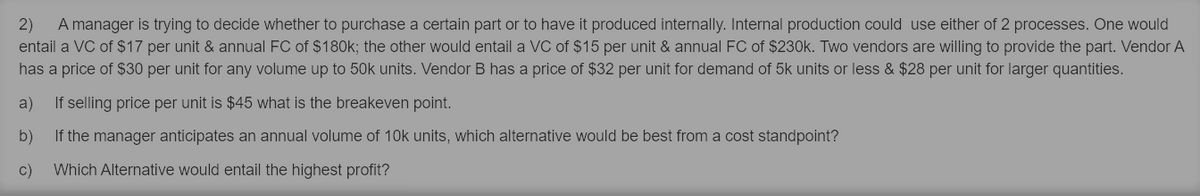

A manager is trying to decide whether to purchase a certain part or to have it produced internally. Internal production could use either of 2 processes. One would

entail a VC of $17 per unit & annual FC of $180k; the other would entail a VC of $15 per unit & annual FC of $230k. Two vendors are willing to provide the part. Vendor A

has a price of $30 per unit for any volume up to 50k units. Vendor B has a price of $32 per unit for demand of 5k units or less & $28 per unit for larger quantities.

a)

If selling price per unit is $45 what is the breakeven point.

b)

If the manager anticipates an annual volume of 10k units, which alternative would be best from a cost standpoint?

c)

Which Alternative would entail the highest profit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning