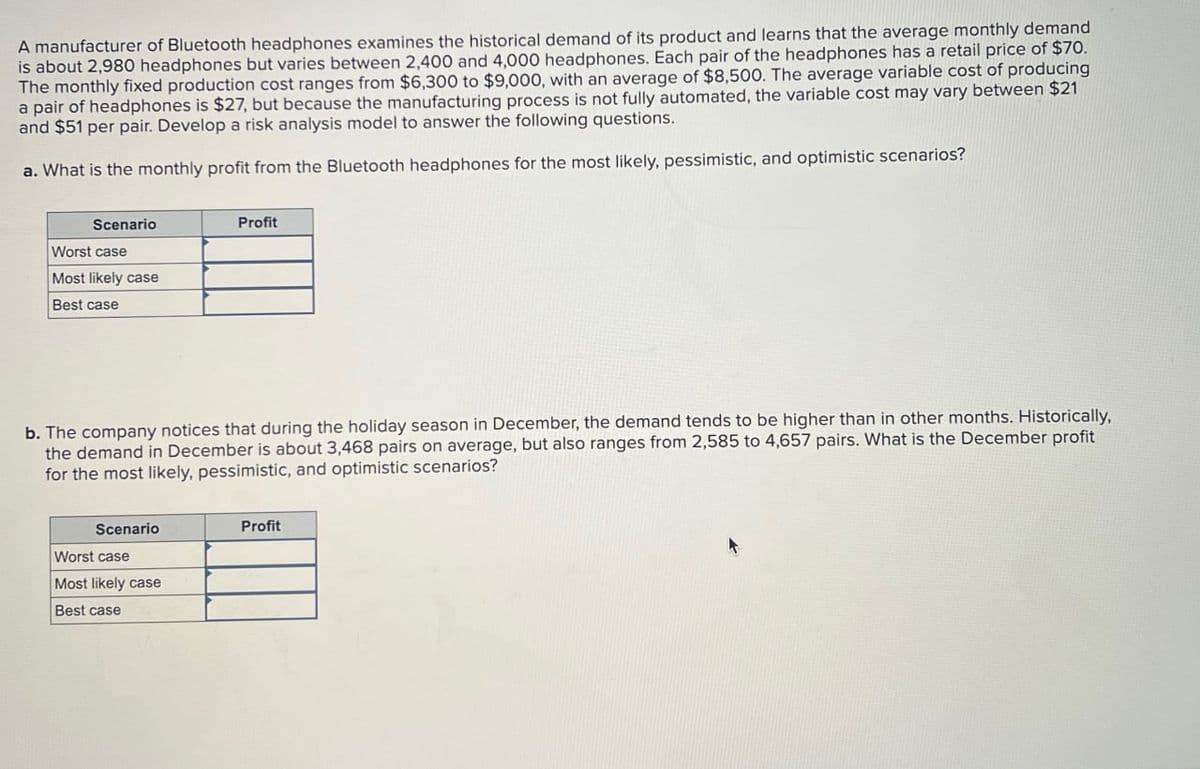

A manufacturer of Bluetooth headphones examines the historical demand of its product and learns that the average monthly demand is about 2,980 headphones but varies between 2,400 and 4,000 headphones. Each pair of the headphones has a retail price of $70. The monthly fixed production cost ranges from $6,300 to $9,000, with an average of $8,500. The average variable cost of producing a pair of headphones is $27, but because the manufacturing process is not fully automated, the variable cost may vary between $21 and $51 per pair. Develop a risk analysis model to answer the following questions. a. What is the monthly profit from the Bluetooth headphones for the most likely, pessimistic, and optimistic scenarios? Scenario Worst case Most likely case Best case Profit b. The company notices that during the holiday season in December, the demand tends to be higher than in other months. Historically, the demand in December is about 3,468 pairs on average, but also ranges from 2,585 to 4,657 pairs. What is the December profit for the most likely, pessimistic, and optimistic scenarios? Scenario Worst case Most likely case Best case Profit

A manufacturer of Bluetooth headphones examines the historical demand of its product and learns that the average monthly demand is about 2,980 headphones but varies between 2,400 and 4,000 headphones. Each pair of the headphones has a retail price of $70. The monthly fixed production cost ranges from $6,300 to $9,000, with an average of $8,500. The average variable cost of producing a pair of headphones is $27, but because the manufacturing process is not fully automated, the variable cost may vary between $21 and $51 per pair. Develop a risk analysis model to answer the following questions. a. What is the monthly profit from the Bluetooth headphones for the most likely, pessimistic, and optimistic scenarios? Scenario Worst case Most likely case Best case Profit b. The company notices that during the holiday season in December, the demand tends to be higher than in other months. Historically, the demand in December is about 3,468 pairs on average, but also ranges from 2,585 to 4,657 pairs. What is the December profit for the most likely, pessimistic, and optimistic scenarios? Scenario Worst case Most likely case Best case Profit

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter8: Cost Analysis

Section: Chapter Questions

Problem 5E

Related questions

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

Transcribed Image Text:A manufacturer of Bluetooth headphones examines the historical demand of its product and learns that the average monthly demand

is about 2,980 headphones but varies between 2,400 and 4,000 headphones. Each pair of the headphones has a retail price of $70.

The monthly fixed production cost ranges from $6,300 to $9,000, with an average of $8,500. The average variable cost of producing

a pair of headphones is $27, but because the manufacturing process is not fully automated, the variable cost may vary between $21

and $51 per pair. Develop a risk analysis model to answer the following questions.

a. What is the monthly profit from the Bluetooth headphones for the most likely, pessimistic, and optimistic scenarios?

Scenario

Worst case

Most likely case

Best case

Profit

b. The company notices that during the holiday season in December, the demand tends to be higher than in other months. Historically,

the demand in December is about 3,468 pairs on average, but also ranges from 2,585 to 4,657 pairs. What is the December profit

for the most likely, pessimistic, and optimistic scenarios?

Scenario

Worst case

Most likely case

Best case

Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning