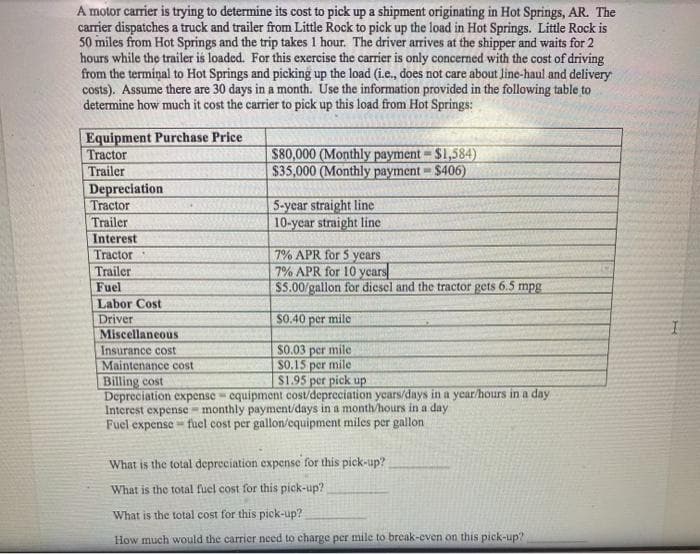

A motor carrier is trying to determine its cost to pick up a shipment originating in Hot Springs, AR. The carrier dispatches a truck and trailer from Little Rock to pick up the load in Hot Springs. Little Rock is 50 miles from Hot Springs and the trip takes 1 hour. The driver arrives at the shipper and waits for 2 hours while the trailer is loaded. For this exercise the carrier is only concerned with the cost of driving from the terminal to Hot Springs and picking up the load (i.e., does not care about line-haul and delivery costs). Assume there are 30 days in a month. Use the information provided in the following table to determine how much it cost the carrier to pick up this load from Hot Springs: Equipment Purchase Price Tractor $80,000 (Monthly payment = $1,584) $35,000 (Monthly payment = $406) %3! Trailer %3D Depreciation Tractor Trailer Interest Tractor 5-year straight line 10-year straight line 7% APR for 5 years 7% APR for 10 years $5.00/gallon for diesel and the tractor gets 6.5 mpg Trailer Fuel Labor Cost Driver Miscellaneous $0.40 per mile Insurance cost Maintenance cost Billing cost Depreciation expense - cquipment cost/depreciation years/days in a year/hours in a day Interest expense - monthly payment/days in a month/hours ina day Fuel expense - fuel cost per gallon/cquipment miles per gallon S0.03 per mile SO.15 per mile $1.95 per pick up What is the total depreciation expense for this pick-up? What is the total fuel cost for this pick-up? What is the total cost for this pick-up? How much would the carrier need to charge per mile to break-even on this pick-up?

A motor carrier is trying to determine its cost to pick up a shipment originating in Hot Springs, AR. The carrier dispatches a truck and trailer from Little Rock to pick up the load in Hot Springs. Little Rock is 50 miles from Hot Springs and the trip takes 1 hour. The driver arrives at the shipper and waits for 2 hours while the trailer is loaded. For this exercise the carrier is only concerned with the cost of driving from the terminal to Hot Springs and picking up the load (i.e., does not care about line-haul and delivery costs). Assume there are 30 days in a month. Use the information provided in the following table to determine how much it cost the carrier to pick up this load from Hot Springs: Equipment Purchase Price Tractor $80,000 (Monthly payment = $1,584) $35,000 (Monthly payment = $406) %3! Trailer %3D Depreciation Tractor Trailer Interest Tractor 5-year straight line 10-year straight line 7% APR for 5 years 7% APR for 10 years $5.00/gallon for diesel and the tractor gets 6.5 mpg Trailer Fuel Labor Cost Driver Miscellaneous $0.40 per mile Insurance cost Maintenance cost Billing cost Depreciation expense - cquipment cost/depreciation years/days in a year/hours in a day Interest expense - monthly payment/days in a month/hours ina day Fuel expense - fuel cost per gallon/cquipment miles per gallon S0.03 per mile SO.15 per mile $1.95 per pick up What is the total depreciation expense for this pick-up? What is the total fuel cost for this pick-up? What is the total cost for this pick-up? How much would the carrier need to charge per mile to break-even on this pick-up?

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 12EB: Able Transport operates a tour bus that they lease with terms that involve a fixed fee each month...

Related questions

Question

Transcribed Image Text:A motor carrier is trying to determine its cost to pick up a shipment originating in Hot Springs, AR. The

carrier dispatches a truck and trailer from Little Rock to pick up the load in Hot Springs. Little Rock is

50 miles from Hot Springs and the trip takes 1 hour. The driver arrives at the shipper and waits for 2

hours while the trailer is loaded. For this exercise the carrier is only concerned with the cost of driving

from the terminal to Hot Springs and picking up the load (i.e., does not care about line-haul and delivery

costs). Assume there are 30 days in a month. Use the information provided in the following table to

determine how much it cost the carrier to pick up this load from Hot Springs:

Equipment Purchase Price

Tractor

$80,000 (Monthly payment = $1,584)

$35,000 (Monthly payment = $406)

%3!

Trailer

%3D

Depreciation

Tractor

5-year straight line

10-ycar straight line

Trailer

Interest

Tractor

7% APR for 5 years

7% APR for 10 years

$5.00/gallon for diesel and the tractor gets 6.5 mpg

Trailer

Fuel

Labor Cost

Driver

Miscellaneous

$0.40 per mile

S0.03 per mile

SO.15 per mile

$1.95 per pick up

Insurance cost

Maintenance cost

Billing cost

Depreciation expense cquipment cost/depreciation years/days in a year/hours in a day

Interest expense - monthly payment/days in a month/hours in a day

Fuel expense fuel cost per gallon/equipment miles per gallon

What is the total depreciation expense for this pick-up?

What is the total fuel cost for this pick-up?

What is the total cost for this pick-up?

How much would the carrier need to charge per mile to break-even on this pick-up?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning