A person's social security benefit is based upon a. How much she/he earned their entire life b. Their average earning for their three highest years C. Their average earnings for the highest five years d. Their average earnings for their highest thirty-five years Social security taxes are levied on a. all one's wages b. the first $50,000 of their wages half of their wages C. d. None of their wages (their employer pays this tax, not the employee) e. None of the above The analysts' recommendation summary on Yahoo finance for a particular stock just went from 1.7 to 6.7 a. This means that the stock has been upgraded b. This means the stock has been downgraded This means the stock has been de-listed d. This cannot happen C.

A person's social security benefit is based upon a. How much she/he earned their entire life b. Their average earning for their three highest years C. Their average earnings for the highest five years d. Their average earnings for their highest thirty-five years Social security taxes are levied on a. all one's wages b. the first $50,000 of their wages half of their wages C. d. None of their wages (their employer pays this tax, not the employee) e. None of the above The analysts' recommendation summary on Yahoo finance for a particular stock just went from 1.7 to 6.7 a. This means that the stock has been upgraded b. This means the stock has been downgraded This means the stock has been de-listed d. This cannot happen C.

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter20: Poverty, Inequality, And Discrimination

Section: Chapter Questions

Problem 5DQ

Related questions

Question

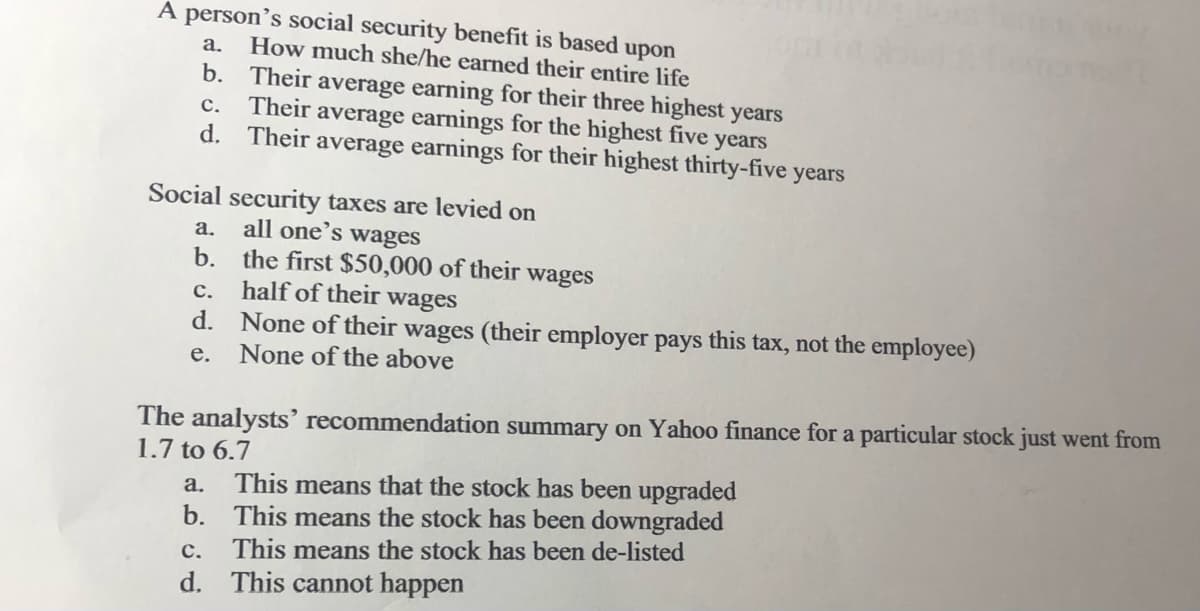

Transcribed Image Text:A person's social security benefit is based upon

a. How much she/he earned their entire life

b. Their average earning for their three highest years

Their average earnings for the highest five years

Their average earnings for their highest thirty-five years

C.

d.

Social security taxes are levied on

a.

all one's wages

b. the first $50,000 of their wages

half of their wages

C.

d. None of their wages (their employer pays this tax, not the employee)

e. None of the above

The analysts' recommendation summary on Yahoo finance for a particular stock just went from

1.7 to 6.7

a. This means that the stock has been upgraded

b.

This means the stock has been downgraded

C.

This means the stock has been de-listed

d. This cannot happen

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning