A) Prepare in good form a single step statement of earnings (income statement) of Palm Realtors Ltd. for the year ended December 31, 2019 B)Prepare in good form a statement of retained earnings of Palm Realtors Ltd. for the year ended December 31, 2019. C)Prepare in good form a classified statement of financial position for Palm Realtors Ltd as at December 31, 2019, by completing the table below.

A) Prepare in good form a single step statement of earnings (income statement) of Palm Realtors Ltd. for the year ended December 31, 2019 B)Prepare in good form a statement of retained earnings of Palm Realtors Ltd. for the year ended December 31, 2019. C)Prepare in good form a classified statement of financial position for Palm Realtors Ltd as at December 31, 2019, by completing the table below.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 16E: Dudley Company failed to recognize the following accruals. It also recorded the prepaid expenses and...

Related questions

Topic Video

Question

100%

A) Prepare in good form a single step statement of earnings (income statement) of Palm Realtors Ltd. for the year ended December 31, 2019

B)Prepare in good form a statement of

C)Prepare in good form a classified

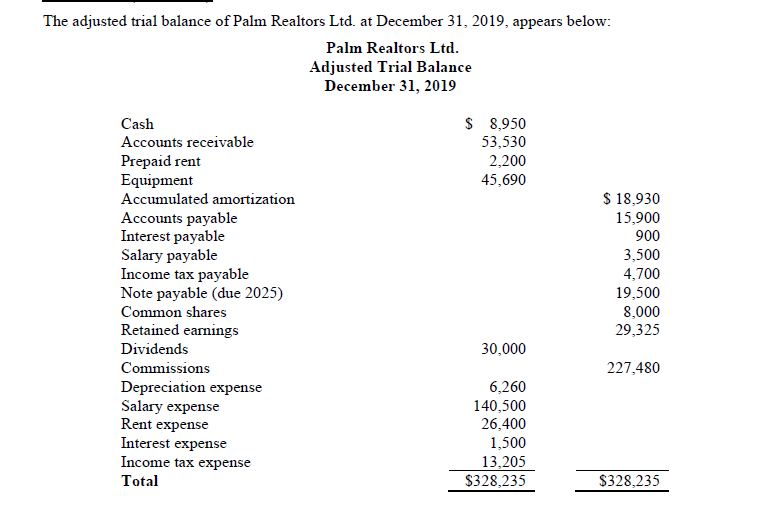

Transcribed Image Text:The adjusted trial balance of Palm Realtors Ltd. at December 31, 2019, appears below:

Palm Realtors Ltd.

Adjusted Trial Balance

December 31, 2019

Cash

$ 8,950

Accounts receivable

Prepaid rent

Equipment

53,530

2,200

45,690

$ 18,930

15,900

900

Accumulated amortization

Accounts payable

Interest payable

Salary payable

Income tax payable

Note payable (due 2025)

Common shares

3,500

4,700

19,500

8,000

29.325

Retained earnings

Dividends

30,000

Commissions

227,480

Depreciation expense

Salary expense

Rent expense

Interest expense

6,260

140,500

26,400

1,500

13,205

$328,235

Income tax expense

Total

$328,235

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning