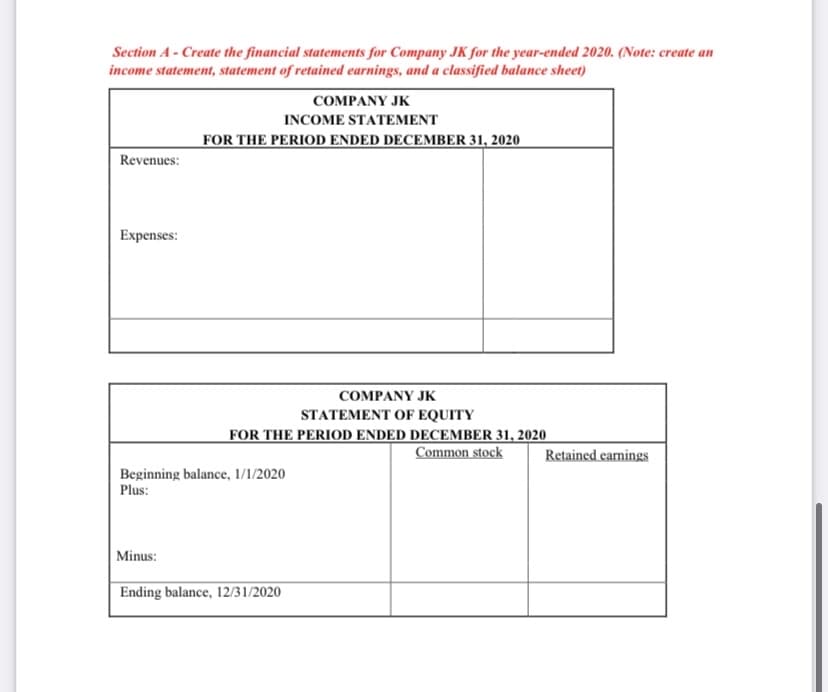

Section A- Create the financial statements for Company JK for the year-ended 2020. (Note: create an income statement, statement of retained earnings, and a classified balance sheet) COMPANY JK INCOME STATEMENT FOR THE PERIOD ENDED DECEMBER 31, 2020 Revenues: Expenses: COMPANY JK STATEMENT OF EQUITY FOR THE PERIOD ENDED DECEMBER 31, 2020 Common stock Retained carnings Beginning balance, 1/1/2020 Plus: Minus: Ending balance, 12/31/2020

Section A- Create the financial statements for Company JK for the year-ended 2020. (Note: create an income statement, statement of retained earnings, and a classified balance sheet) COMPANY JK INCOME STATEMENT FOR THE PERIOD ENDED DECEMBER 31, 2020 Revenues: Expenses: COMPANY JK STATEMENT OF EQUITY FOR THE PERIOD ENDED DECEMBER 31, 2020 Common stock Retained carnings Beginning balance, 1/1/2020 Plus: Minus: Ending balance, 12/31/2020

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 11EA: Prepare adjusting journal entries, as needed, considering the account balances excerpted from the...

Related questions

Question

complete section A based on adjusted trial balance sheet

Transcribed Image Text:Section A - Create the financial statements for Company JK for the year-ended 2020. (Note: create an

income statement, statement of retained earnings, and a classified balance sheet)

COMPANY JK

INCOME STATEMENT

FOR THE PERIOD ENDED DECEMBER 31, 2020

Revenues:

Expenses:

COMPANY JK

STATEMENT OF EQUITY

FOR THE PERIOD ENDED DECEMBER 31, 2020

Common stock

Retained earnings

Beginning balance, 1/1/2020

Plus:

Minus:

Ending balance, 12/31/2020

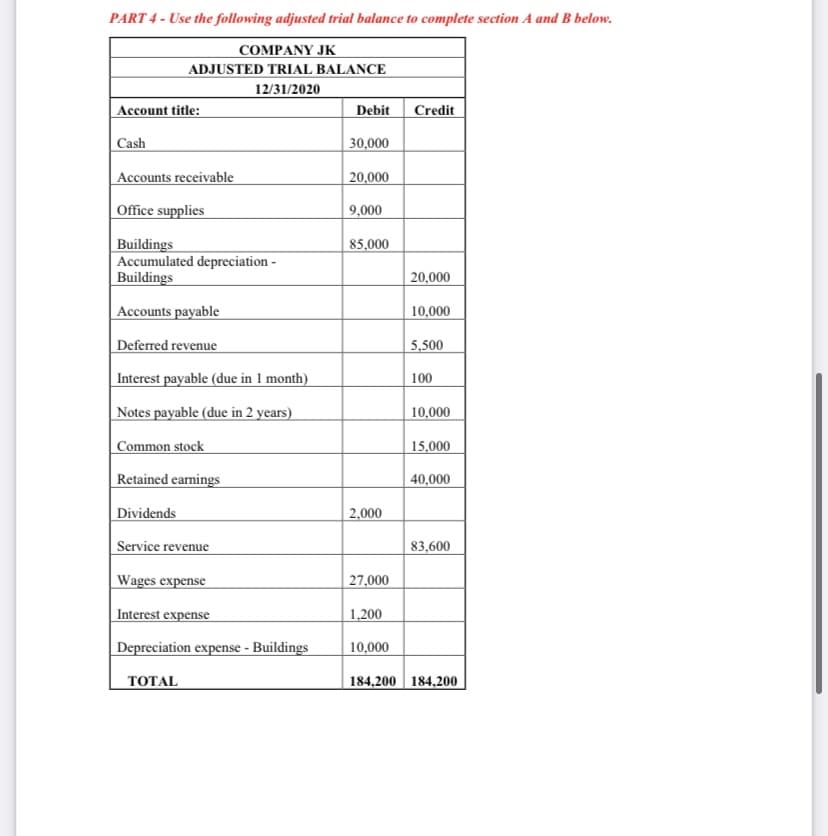

Transcribed Image Text:PART 4 - Use the following adjusted trial balance to complete section A and B below.

COMPANY JK

ADJUSTED TRIAL BALANCE

12/31/2020

Account title:

Debit

Credit

Cash

| 30,000

Accounts receivable

| 20,000

Office supplies

9,000

Buildings

Accumulated depreciation -

Buildings

85,000

20,000

Accounts payable

10,000

Deferred revenue

5,500

Interest payable (due in 1 month)

100

Notes payable (due in 2 years)

10,000

Common stock

15,000

Retained earnings

40,000

Dividends

2,000

Service revenue

83,600

Wages expense

27,000

Interest expense

1,200

Depreciation expense - Buildings

10,000

ΤΟΤAL

184,200 184,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning