A Problem 21-5A B C Question 1 Unit Selling Price Unit Variable Cost Unit Contribution Margin Break-even Sales (Units) Question 2 1,612 2,418 Question 3 Unit Selling Price Unit Variable Cost Unit Contribution Margin Break-even Sales (Units) 1,922 1,922 D $620 4,030 units of laptops units of tablets $650 3,844 units of laptops units of tablets E

A Problem 21-5A B C Question 1 Unit Selling Price Unit Variable Cost Unit Contribution Margin Break-even Sales (Units) Question 2 1,612 2,418 Question 3 Unit Selling Price Unit Variable Cost Unit Contribution Margin Break-even Sales (Units) 1,922 1,922 D $620 4,030 units of laptops units of tablets $650 3,844 units of laptops units of tablets E

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter21: Cost Behavior And Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.17EX

Related questions

Question

Please read the intructions for 21-5A, and answer the missing boxes on the page 2.

thanks for your time!

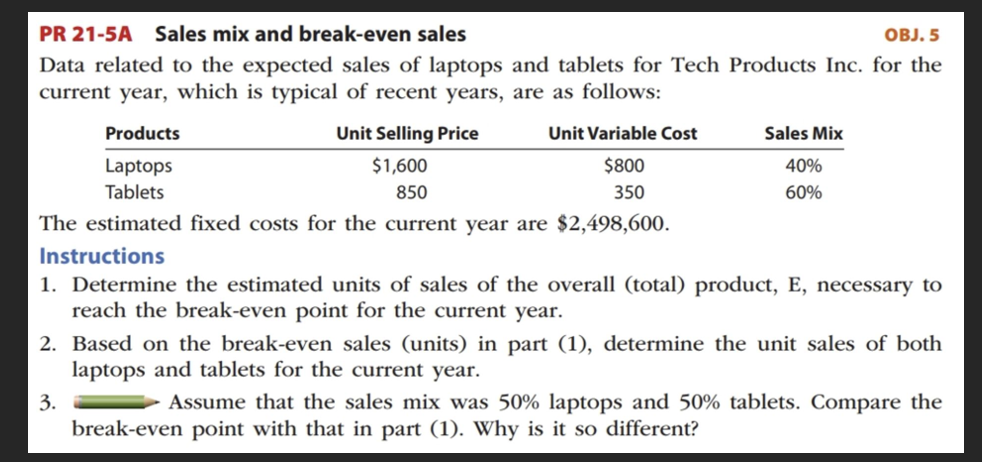

Transcribed Image Text:PR 21-5A Sales mix and break-even sales

OBJ. 5

Data related to the expected sales of laptops and tablets for Tech Products Inc. for the

current year, which is typical of recent years, are as follows:

Products

Laptops

Unit Selling Price

$1,600

850

Tablets

The estimated fixed costs for the current year are $2,498,600.

Unit Variable Cost

$800

350

Sales Mix

40%

60%

Instructions

1. Determine the estimated units of sales of the overall (total) product, E, necessary to

reach the break-even point for the current year.

3.

2. Based on the break-even sales (units) in part (1), determine the unit sales of both

laptops and tablets for the current year.

Assume that the sales mix was 50% laptops and 50% tablets. Compare the

break-even point with that in part (1). Why is it so different?

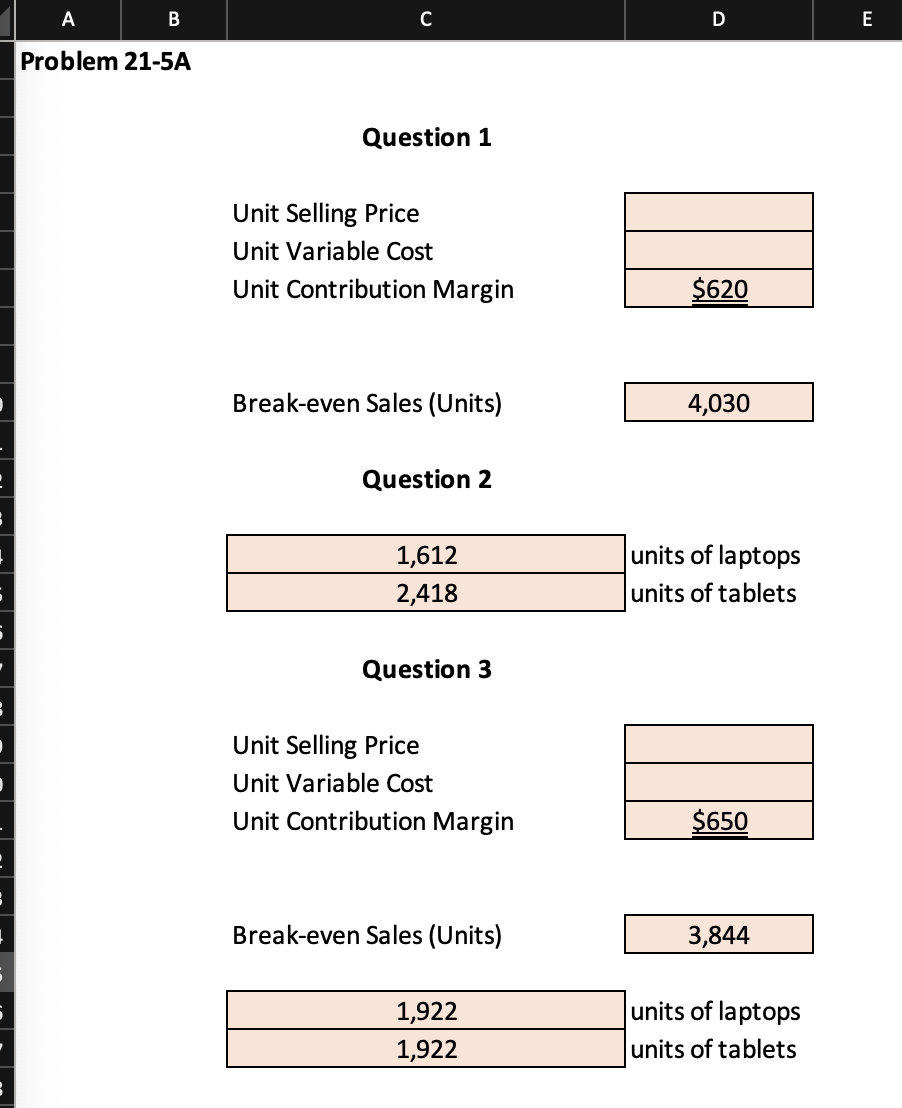

Transcribed Image Text:A

Problem 21-5A

B

C

Question 1

Unit Selling Price

Unit Variable Cost

Unit Contribution Margin

Break-even Sales (Units)

Question 2

1,612

2,418

Question 3

Unit Selling Price

Unit Variable Cost

Unit Contribution Margin

Break-even Sales (Units)

1,922

1,922

D

$620

4,030

units of laptops

units of tablets

$650

3,844

units of laptops

units of tablets

E

Expert Solution

Step 1

BREAKEVEN POINT

Break Even means the volume of production or sales where there is no profit or loss.

In other words, Break Even Point is the volume of production or sales where total costs are equal to revenue.

Breakeven Point in Units

= Fixed Cost ÷ Contribution Margin Per Unit

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning