Required information [The following information applies to the questions displayed below] The following year-end information is taken from the December 31 adjusted trial balance and other records of Lea Company. Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-factory equipment Raw materials purchases (all direct materials) Maintenance expense-factory equipment Factory utilities Direct labor Indirect labor office salaries expense. Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Sales salaries expense $ 61,000 40,000 41,000 83,000 930,000 45,900 39,600 532,000 80,000 45,000 29,000 70,000 168,000 403,000

Required information [The following information applies to the questions displayed below] The following year-end information is taken from the December 31 adjusted trial balance and other records of Lea Company. Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-factory equipment Raw materials purchases (all direct materials) Maintenance expense-factory equipment Factory utilities Direct labor Indirect labor office salaries expense. Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Sales salaries expense $ 61,000 40,000 41,000 83,000 930,000 45,900 39,600 532,000 80,000 45,000 29,000 70,000 168,000 403,000

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter4: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 5E: Complete the work sheet for Ramey Company, dated December 31, 20, through the adjusted trial balance...

Related questions

Question

![Required information

[The following information applies to the questions displayed below]

The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone

Company.

Advertising expense

Depreciation expense-Office equipment

Depreciation expense-Selling equipment

Depreciation expense-Factory equipment

Raw materials purchases (all direct materials)

Maintenance expense-Factory equipment

Factory utilities

Direct labor

Indirect labor

office salaries expense

Rer expense-Office space

Rent expense-Selling space

Rent expense-Factory building

Sales salaries expense

$ 61,000

40,000

41,000

83,000

930,000

45,900

39,600

532,000

80,000

48,000

29,000

70,000

168,000

403,000](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F531d22d6-41e3-4ab6-9b43-fd8dca83c239%2F324d7944-3a3a-4676-8277-2145cbef88d7%2Fi8w90vr_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below]

The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone

Company.

Advertising expense

Depreciation expense-Office equipment

Depreciation expense-Selling equipment

Depreciation expense-Factory equipment

Raw materials purchases (all direct materials)

Maintenance expense-Factory equipment

Factory utilities

Direct labor

Indirect labor

office salaries expense

Rer expense-Office space

Rent expense-Selling space

Rent expense-Factory building

Sales salaries expense

$ 61,000

40,000

41,000

83,000

930,000

45,900

39,600

532,000

80,000

48,000

29,000

70,000

168,000

403,000

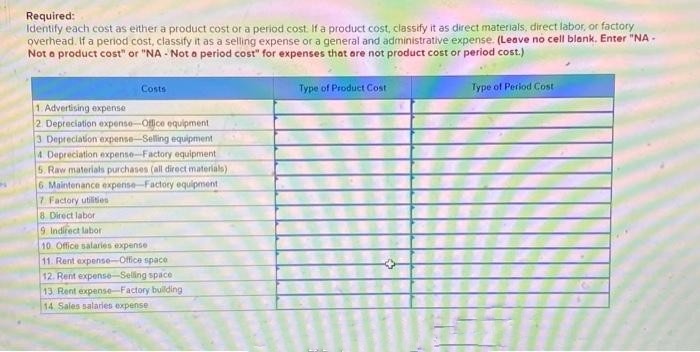

Transcribed Image Text:Required:

Identify each cost as either a product cost or a period cost. If a product cost, classify it as direct materials, direct labor, or factory

overhead. If a period cost, classify it as a selling expense or a general and administrative expense. (Leave no cell blank. Enter "NA-

Not a product cost" or "NA- Not a period cost" for expenses that are not product cost or period cost.)

Costs

1. Advertising expense

2. Depreciation expense-Office equipment

3 Depreciation expense-Selling equipment

4 Depreciation expense-Factory equipment

5. Raw materials purchases (all direct materials)

6. Maintenance expense-Factory equipment

7 Factory utilities

8 Direct labor

9. Indirect labor

10 Office salaries expense

11. Rent expense-Office space

12. Rent expense-Selling space

13 Rent expense-Factory building

14. Sales salaries expense

Type of Product Cost

→

Type of Period Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning