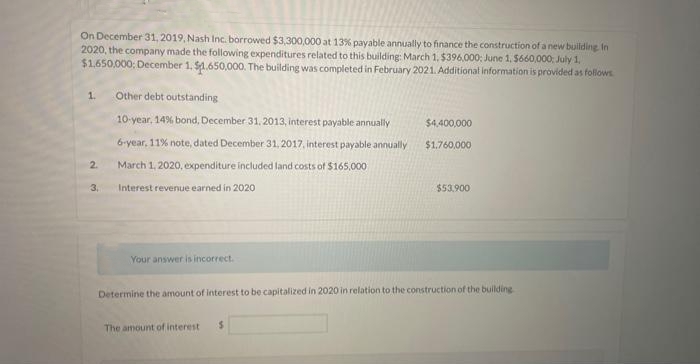

On December 31, 2019, Nash Inc. borrowed $3,300,000 at 13% payable annually to finance the construction of a new building in 2020, the company made the following expenditures related to this building: March 1, $396.000: June 1, $660,000: July 1, $1,650,000: December 1. $1.650,000. The building was completed in February 2021. Additional information is provided as follows 1. 2 Other debt outstanding 10-year, 14% bond, December 31, 2013, interest payable annually 6-year, 11% note, dated December 31, 2017, interest payable annually March 1, 2020, expenditure included land costs of $165,000 3. Interest revenue earned in 2020 Your answer is incorrect. $4,400,000 $1,760,000 The amount of interest $53,900 Determine the amount of interest to be capitalized in 2020 in relation to the construction of the building

On December 31, 2019, Nash Inc. borrowed $3,300,000 at 13% payable annually to finance the construction of a new building in 2020, the company made the following expenditures related to this building: March 1, $396.000: June 1, $660,000: July 1, $1,650,000: December 1. $1.650,000. The building was completed in February 2021. Additional information is provided as follows 1. 2 Other debt outstanding 10-year, 14% bond, December 31, 2013, interest payable annually 6-year, 11% note, dated December 31, 2017, interest payable annually March 1, 2020, expenditure included land costs of $165,000 3. Interest revenue earned in 2020 Your answer is incorrect. $4,400,000 $1,760,000 The amount of interest $53,900 Determine the amount of interest to be capitalized in 2020 in relation to the construction of the building

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:On December 31, 2019, Nash Inc. borrowed $3,300,000 at 13% payable annually to finance the construction of a new building. In

2020, the company made the following expenditures related to this building: March 1, $396,000: June 1, $660,000: July 1,

$1,650,000: December 1, $1.650,000. The building was completed in February 2021. Additional information is provided as follows

1.

2.

3.

Other debt outstanding

10-year, 14% bond, December 31, 2013, interest payable annually

6-year, 11% note, dated December 31, 2017, interest payable annually

March 1, 2020, expenditure included land costs of $165,000

Interest revenue earned in 2020

Your answer is incorrect.

$4,400,000

$1,760,000

The amount of interest $

$53.900

Determine the amount of interest to be capitalized in 2020 in relation to the construction of the building.

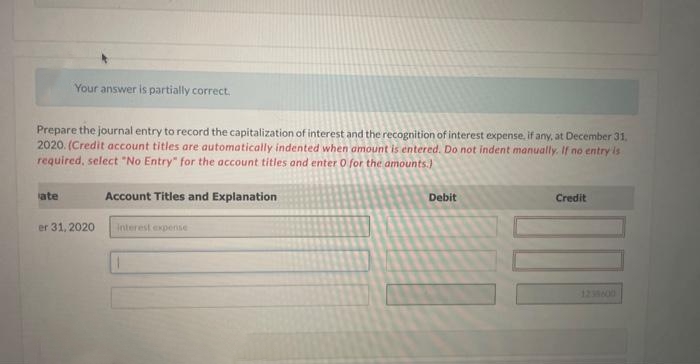

Transcribed Image Text:Your answer is partially correct.

Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31,

2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter 0 for the amounts.)

ate

er 31, 2020

Account Titles and Explanation

interest expense

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT