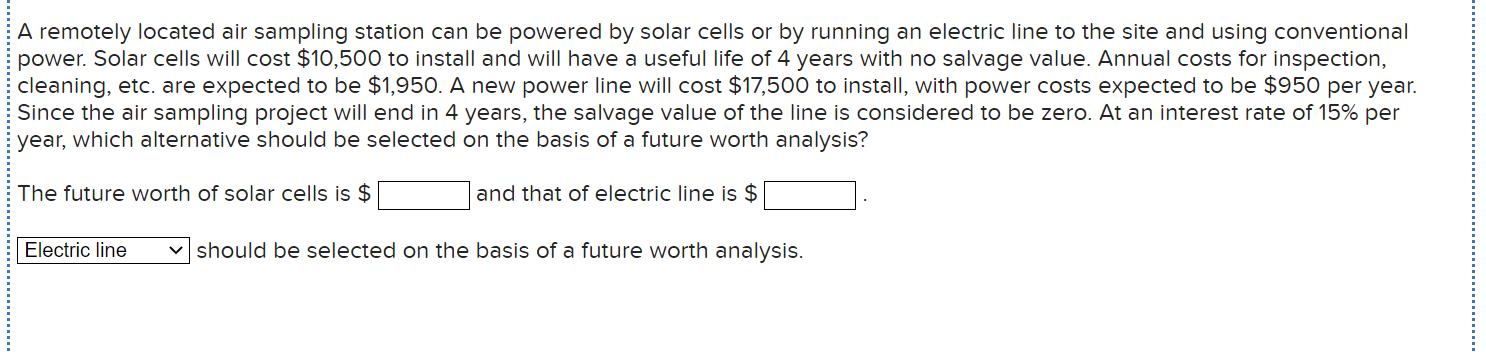

A remotely located air sampling station can be powered by solar cells or by running an electric line to the site and using conventional power. Solar cells will cost $10,500 to install and will have a useful life of 4 years with no salvage value. Annual costs for inspection, cleaning, etc. are expected to be $1,950. A new power line will cost $17,500 to install, with power costs expected to be $950 per year. Since the air sampling project will end in 4 years, the salvage value of the line is considered to be zero. At an interest rate of 15% per year, which alternative should be selected on the basis of a future worth analysis? The future worth of solar cells is $ and that of electric line is $ Electric line v should be selected on the basis of a future worth analysis.

A remotely located air sampling station can be powered by solar cells or by running an electric line to the site and using conventional power. Solar cells will cost $10,500 to install and will have a useful life of 4 years with no salvage value. Annual costs for inspection, cleaning, etc. are expected to be $1,950. A new power line will cost $17,500 to install, with power costs expected to be $950 per year. Since the air sampling project will end in 4 years, the salvage value of the line is considered to be zero. At an interest rate of 15% per year, which alternative should be selected on the basis of a future worth analysis? The future worth of solar cells is $ and that of electric line is $ Electric line v should be selected on the basis of a future worth analysis.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 14P

Related questions

Question

7

Transcribed Image Text:A remotely located air sampling station can be powered by solar cells or by running an electric line to the site and using conventional

power. Solar cells will cost $10,500 to install and will have a useful life of 4 years with no salvage value. Annual costs for inspection,

cleaning, etc. are expected to be $1,950. A new power line will cost $17,500 to install, with power costs expected to be $950 per year.

Since the air sampling project will end in 4 years, the salvage value of the line is considered to be zero. At an interest rate of 15% per

year, which alternative should be selected on the basis of a future worth analysis?

The future worth of solar cells is $

and that of electric line is $

Electric line

v should be selected on the basis of a future worth analysis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College