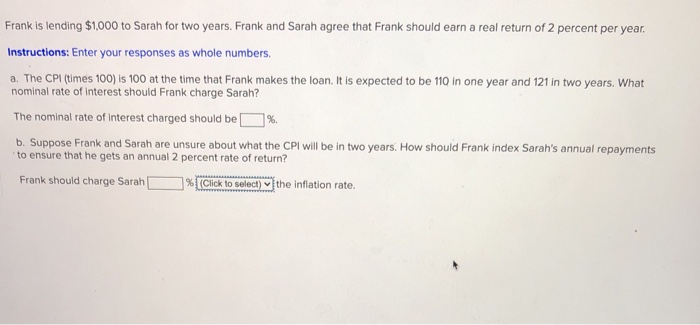

Frank is lending $1,000 to Sarah for two years. Frank and Sarah agree that Frank should earn a real return of 2 percent per year. Instructions: Enter your responses as whole numbers. a. The CPI (times 100) is 100 at the time that Frank makes the loan. It is expected to be 110 in one year and 121 in two years. What nominal rate of interest should Frank charge Sarah? The nominal rate of interest charged should be [ %. b. Suppose Frank and Sarah are unsure about what the CPI will be in two years. How should Frank index Sarah's annual repayments to ensure that he gets an annual 2 percent rate of return? Frank should charge Sarah) g % (Click to select) the inflation rate. med

Frank is lending $1,000 to Sarah for two years. Frank and Sarah agree that Frank should earn a real return of 2 percent per year. Instructions: Enter your responses as whole numbers. a. The CPI (times 100) is 100 at the time that Frank makes the loan. It is expected to be 110 in one year and 121 in two years. What nominal rate of interest should Frank charge Sarah? The nominal rate of interest charged should be [ %. b. Suppose Frank and Sarah are unsure about what the CPI will be in two years. How should Frank index Sarah's annual repayments to ensure that he gets an annual 2 percent rate of return? Frank should charge Sarah) g % (Click to select) the inflation rate. med

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:Frank is lending $1,000 to Sarah for two years. Frank and Sarah agree that Frank should earn a real return of 2 percent per year.

Instructions: Enter your responses as whole numbers.

a. The CPI (times 100) is 100 at the time that Frank makes the loan. It is expected to be 110 in one year and 121 in two years. What

nominal rate of interest should Frank charge Sarah?

The nominal rate of interest charged should be

b. Suppose Frank and Sarah are unsure about what the CPI will be in two years. How should Frank index Sarah's annual repayments

to ensure that he gets an annual 2 percent rate of return?

Frank should charge Sarah [

%(Click to select) the inflation rate.

%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT