(a) Set up the null and alternative hypotheses needed to attempt to establish that the mean annual expense for stock funds is larger than the mean annual expense for municipal bond funds. Test these hypotheses at the 0.05 level of significance. (Round your sp² answer to 4 decimal places and t-value to 2 decimal places.) HO: μ1 - μ2 s2p HO with a = 0.05 HO: μ1 - μ2 t= versus Ha: µ1 - µ2 > (b) Set up the null and alternative hypotheses needed to attempt to establish that the mean annual expense for stock funds exceeds the mean annual expense for municipal bond funds by more than 0.5 percent. Test these hypotheses at the 0.05 level of significance. (Round your t-value to 2 decimal places and other answers to 1 decimal place.) HO with a = 0.05 4.86 versus Ha : μ1 −μ2 (c) Calculate a 95 percent confidence interval for the difference between the mean annual expenses for stock funds and municipal bond funds. Can we be 95 percent confident that the mean annual expense for stock funds exceeds that for municipal bond funds by more than .5 percent? (Round your answers to 3 decimal places.)

(a) Set up the null and alternative hypotheses needed to attempt to establish that the mean annual expense for stock funds is larger than the mean annual expense for municipal bond funds. Test these hypotheses at the 0.05 level of significance. (Round your sp² answer to 4 decimal places and t-value to 2 decimal places.) HO: μ1 - μ2 s2p HO with a = 0.05 HO: μ1 - μ2 t= versus Ha: µ1 - µ2 > (b) Set up the null and alternative hypotheses needed to attempt to establish that the mean annual expense for stock funds exceeds the mean annual expense for municipal bond funds by more than 0.5 percent. Test these hypotheses at the 0.05 level of significance. (Round your t-value to 2 decimal places and other answers to 1 decimal place.) HO with a = 0.05 4.86 versus Ha : μ1 −μ2 (c) Calculate a 95 percent confidence interval for the difference between the mean annual expenses for stock funds and municipal bond funds. Can we be 95 percent confident that the mean annual expense for stock funds exceeds that for municipal bond funds by more than .5 percent? (Round your answers to 3 decimal places.)

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

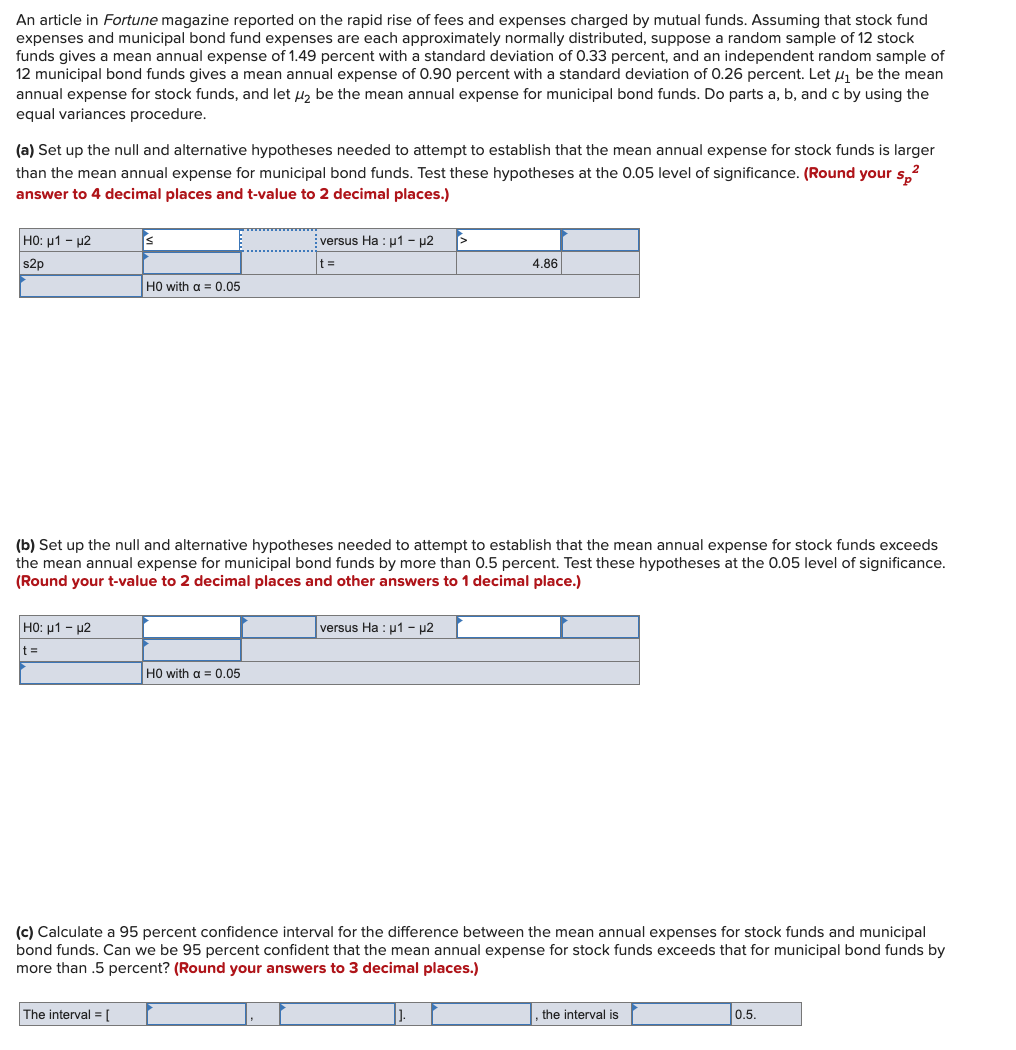

Transcribed Image Text:An article in Fortune magazine reported on the rapid rise of fees and expenses charged by mutual funds. Assuming that stock fund

expenses and municipal bond fund expenses are each approximately normally distributed, suppose a random sample of 12 stock

funds gives mean annual expense of 1.49 percent with a standard deviation of 0.33 percent, and an independent random sample of

12 municipal bond funds gives a mean annual expense of 0.90 percent with a standard deviation of 0.26 percent. Let ₁ be the mean

annual expense for stock funds, and let ₂ be the mean annual expense for municipal bond funds. Do parts a, b, and c by using the

equal variances procedure.

(a) Set up the null and alternative hypotheses needed to attempt to establish that the mean annual expense for stock funds is larger

than the mean annual expense for municipal bond funds. Test these hypotheses at the 0.05 level of significance. (Round your sp²

answer to 4 decimal places and t-value to 2 decimal places.)

HO: μ1 - μ2

s2p

HO: μ1 - μ2

t=

S

HO with a = 0.05

The interval = [

(b) Set up the null and alternative hypotheses needed to attempt to establish that the mean annual expense for stock funds exceeds

the mean annual expense for municipal bond funds by more than 0.5 percent. Test these hypotheses at the 0.05 level of significance.

(Round your t-value to 2 decimal places and other answers to 1 decimal place.)

versus Ha: µ1 - µ2

t=

HO with a = 0.05

4.86

versus Ha: μ1 - µ2

(c) Calculate a 95 percent confidence interval for the difference between the mean annual expenses for stock funds and municipal

bond funds. Can we be 95 percent confident that the mean annual expense for stock funds exceeds that for municipal bond funds by

more than .5 percent? (Round your answers to 3 decimal places.)

the interval is

0.5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman