Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $203,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $65.000. If the projected operating expense for the equipment is S65,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 21%, and the after-tax MARR is 13% per year Click the icon to view the GDS Recovery Rates () for the 5-year property class. A Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year

Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $203,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $65.000. If the projected operating expense for the equipment is S65,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 21%, and the after-tax MARR is 13% per year Click the icon to view the GDS Recovery Rates () for the 5-year property class. A Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 10C

Related questions

Question

Solve it correctly please. I

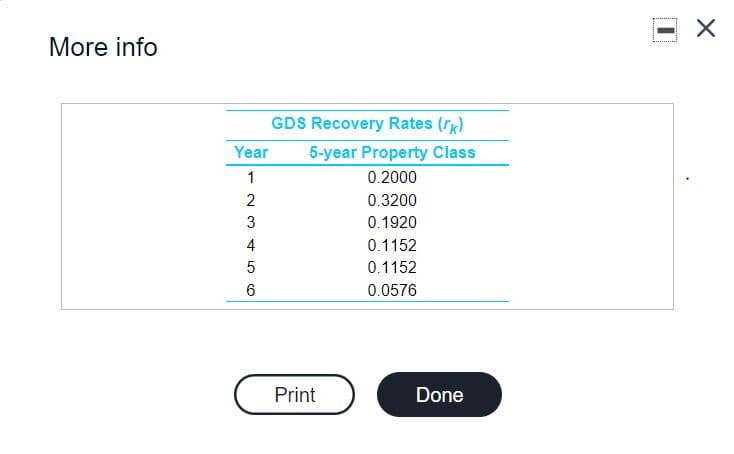

Transcribed Image Text:More info

GDS Recovery Rates (r)

Year

5-year Property Class

1

0.2000

2

0.3200

3

0.1920

4

0.1152

0.1152

6

0.0576

Print

Done

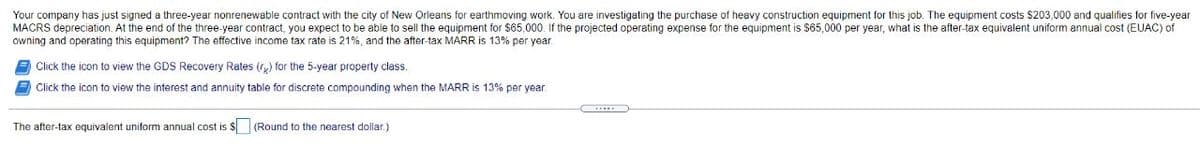

Transcribed Image Text:Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $203,000 and qualifies for five-year

MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $65,000. If the projected operating expense for the equipment is $65,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of

owning and operating this equipment? The effective income tax rate is 21%, and the after-tax MARR is 13% per year.

Click the icon to view the GDS Recovery Rates () for the 5-year property class.

Click the icon t

view the interest and annuity table for discrete compounding when the MARR is 13% per year

The after-tax equivalent uniform annual cost is $ (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College