A tax preparer may be subject to a $540 preparer penalty under IRC 56695(g) Select one: O a. For failure to comply with due diligence requirements limited to a maximum of $540 O b. For each failure to comply with the due diligence requirements OC For failure to file Form 8879 O d For including a Schedule A when filing a return using the standard deduction O e. None of these Jeff is a single taxpayer who sold his home whien he was transferred from NY to Denver by his employer. He purchased the home on January 10 2013 He was sent by his Cempany for temporary assignment to Detroit on February 1, 2016, that lasted for longer and was gone for 16 months in 2016 and 2017, during which time he rented out his home. He moved back into the home on June 3, 2017 He sold the home on March 15, 2020. Jeff can claim an exclusion of gain on the sale up to Select one EO a $500.000 O b. $300,000 OC $250,000 Od so

A tax preparer may be subject to a $540 preparer penalty under IRC 56695(g) Select one: O a. For failure to comply with due diligence requirements limited to a maximum of $540 O b. For each failure to comply with the due diligence requirements OC For failure to file Form 8879 O d For including a Schedule A when filing a return using the standard deduction O e. None of these Jeff is a single taxpayer who sold his home whien he was transferred from NY to Denver by his employer. He purchased the home on January 10 2013 He was sent by his Cempany for temporary assignment to Detroit on February 1, 2016, that lasted for longer and was gone for 16 months in 2016 and 2017, during which time he rented out his home. He moved back into the home on June 3, 2017 He sold the home on March 15, 2020. Jeff can claim an exclusion of gain on the sale up to Select one EO a $500.000 O b. $300,000 OC $250,000 Od so

Chapter17: Tax Practice And Ethics

Section: Chapter Questions

Problem 23P

Related questions

Question

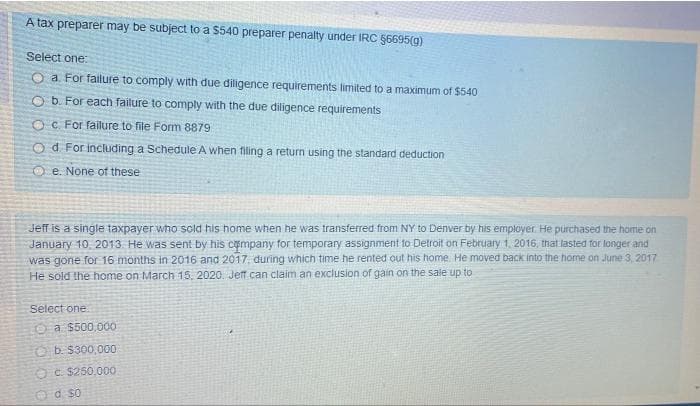

Transcribed Image Text:A tax preparer may be subject to a $540 preparer penalty under IRC 56695(g)

Select one:

O a For failure to comply with due diligence requirements limited to a maximum of $540

O b. For each failure to comply with the due diligence requirements

OC. For failure to file Form 8879

O d For including a Schedule A when filing a return using the standard deduction

O e. None of these

Jeff is a single taxpayer who sold his home when he was transferred from NY to Denver by his employer. He purchased the home on

January 10, 2013 He was sent by his Cempany for temporary assignment to Detroit on February 1, 2016, that lasted for longer and

was gone for 16 months in 2016 and 2017, during which time he rented out his home. He moved back into the home on June 3, 2017

He sold the home on March 15, 2020. Jeff can claim an exclusion of gain on the sale up to

Select one

EO a $500.000

O b. $300,000

O C $250,000

Od so

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT