a. Identify whether each of the above payments by PSB to APL are subjected to withholding tax. Give your reasons. b. State the due dates for PSB to remit the withholding tax to the Inland Revenue Board. c. Compute the amount of withholding tax payable by PSB to the Inland Revenue Board including penalties (if any).

a. Identify whether each of the above payments by PSB to APL are subjected to withholding tax. Give your reasons. b. State the due dates for PSB to remit the withholding tax to the Inland Revenue Board. c. Compute the amount of withholding tax payable by PSB to the Inland Revenue Board including penalties (if any).

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Solve all this

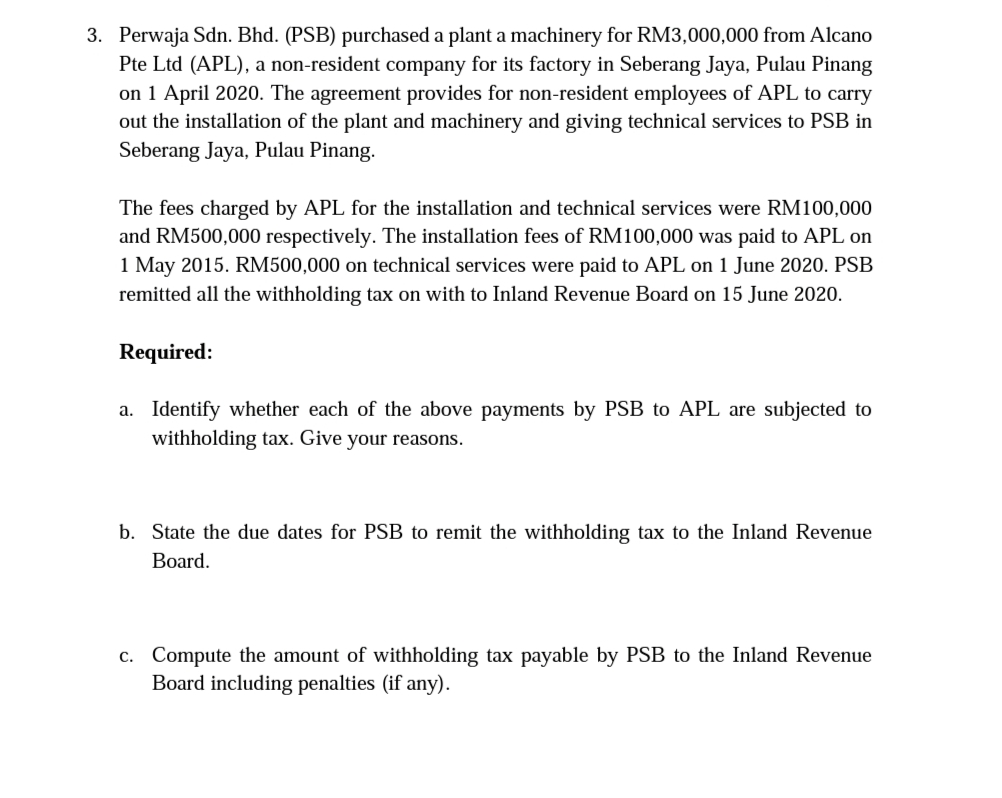

Transcribed Image Text:3. Perwaja Sdn. Bhd. (PSB) purchased a plant a machinery for RM3,000,000 from Alcano

Pte Ltd (APL), a non-resident company for its factory in Seberang Jaya, Pulau Pinang

on 1 April 2020. The agreement provides for non-resident employees of APL to carry

out the installation of the plant and machinery and giving technical services to PSB in

Seberang Jaya, Pulau Pinang.

The fees charged by APL for the installation and technical services were RM100,000

and RM500,000 respectively. The installation fees of RM100,000 was paid to APL on

1 May 2015. RM500,000 on technical services were paid to APL on 1 June 2020. PSB

remitted all the withholding tax on with to Inland Revenue Board on 15 June 2020.

Required:

a. Identify whether each of the above payments by PSB to APL are subjected to

withholding tax. Give your reasons.

b. State the due dates for PSB to remit the withholding tax to the Inland Revenue

Board.

c. Compute the amount of withholding tax payable by PSB to the Inland Revenue

Board including penalties (if any).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education