Required: a. Explain with reasons, whether the withholding tax provisions are applicable for each of the payments above. Compute the amount payable to the tax authority if the withholding tax for installation fees is remitted on 15 May 2020. b. Briefly explain to Sabar Sdn. Bhd. on the types of penalties imposed by the Inland Revenue Board (IRB) on withholding tax.

Required: a. Explain with reasons, whether the withholding tax provisions are applicable for each of the payments above. Compute the amount payable to the tax authority if the withholding tax for installation fees is remitted on 15 May 2020. b. Briefly explain to Sabar Sdn. Bhd. on the types of penalties imposed by the Inland Revenue Board (IRB) on withholding tax.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Solve please.

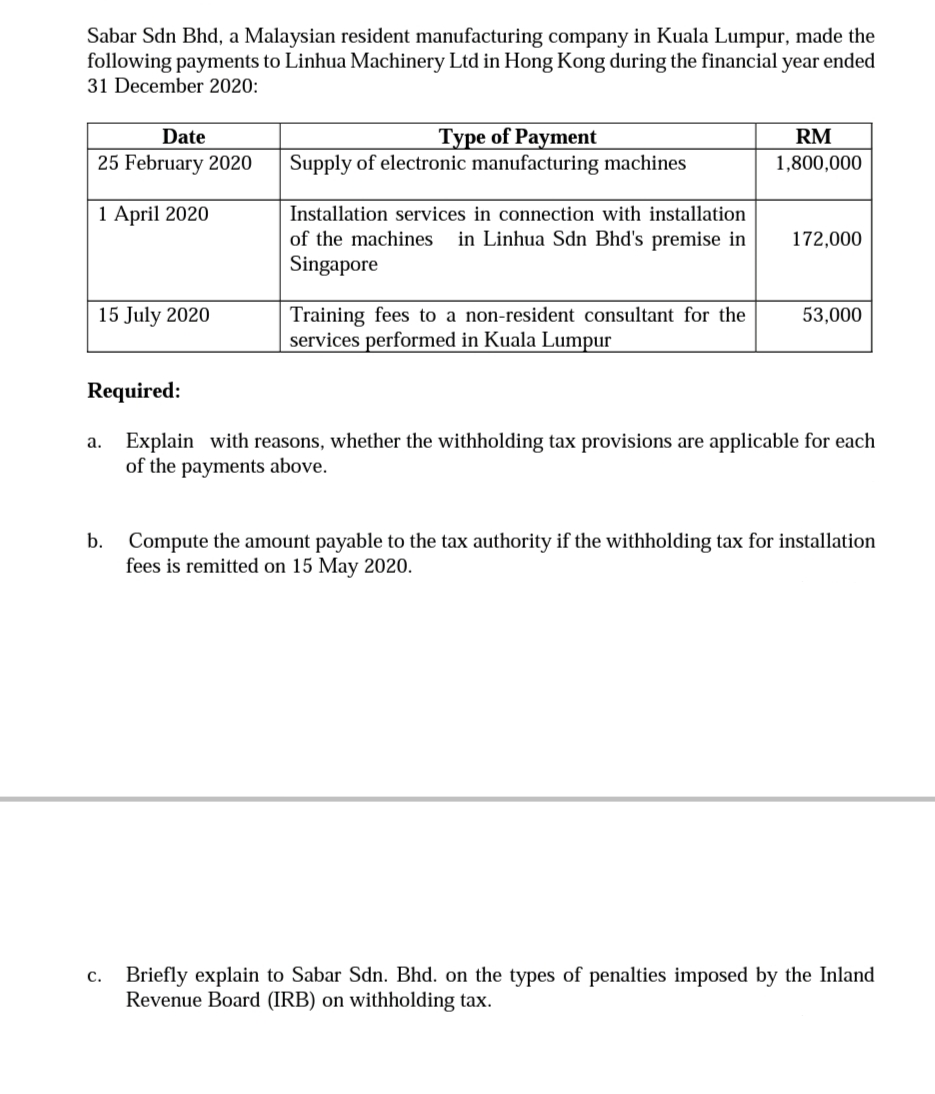

Transcribed Image Text:Sabar Sdn Bhd, a Malaysian resident manufacturing company in Kuala Lumpur, made the

following payments to Linhua Machinery Ltd in Hong Kong during the financial year ended

31 December 2020:

Type of Payment

Supply of electronic manufacturing machines

Date

RM

25 February 2020

1,800,000

1 April 2020

Installation services in connection with installation

of the machines

in Linhua Sdn Bhd's premise in

172,000

Singapore

Training fees to a non-resident consultant for the

services performed in Kuala Lumpur

15 July 2020

53,000

Required:

Explain with reasons, whether the withholding tax provisions are applicable for each

of the payments above.

а.

Compute the amount payable to the tax authority if the withholding tax for installation

fees is remitted on 15 May 2020.

b.

Briefly explain to Sabar Sdn. Bhd. on the types of penalties imposed by the Inland

Revenue Board (IRB) on withholding tax.

С.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education