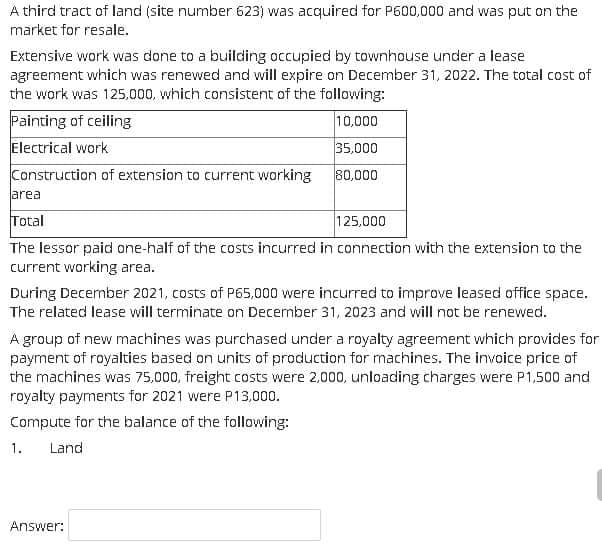

A third tract of land (site number 623) was acquired for P600,000 and was put on the market for resale. Extensive work was done to a building occupied by townhouse under a lease agreement which was renewed and will expire on December 31, 2022. The total cost of the work was 125,000, which consistent of the following: Painting of ceiling Electrical work 10,000 35,000 Construction of extension to current working area 80,000 Total 125,000 The lessor paid one-half of the costs incurred in connection with the extension to the current working area. During December 2021, costs of P65,000 were incurred to improve leased office space. The related lease will terminate on December 31, 2023 and will not be renewed. A group of new machines was purchased under a royalty agreement which provides for payment of royalties based on units of production for machines. The invoice price of the machines was 75,000, freight costs were 2,000, unloading charges were P1,500 and royalty payments for 2021 were P13,000. Compute for the balance of the following: 1. Land Answer:

A third tract of land (site number 623) was acquired for P600,000 and was put on the market for resale. Extensive work was done to a building occupied by townhouse under a lease agreement which was renewed and will expire on December 31, 2022. The total cost of the work was 125,000, which consistent of the following: Painting of ceiling Electrical work 10,000 35,000 Construction of extension to current working area 80,000 Total 125,000 The lessor paid one-half of the costs incurred in connection with the extension to the current working area. During December 2021, costs of P65,000 were incurred to improve leased office space. The related lease will terminate on December 31, 2023 and will not be renewed. A group of new machines was purchased under a royalty agreement which provides for payment of royalties based on units of production for machines. The invoice price of the machines was 75,000, freight costs were 2,000, unloading charges were P1,500 and royalty payments for 2021 were P13,000. Compute for the balance of the following: 1. Land Answer:

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:A third tract of land (site number 623) was acquired for P600,000 and was put on the

market for resale.

Extensive work was done to a building occupied by townhouse under a lease

agreement which was renewed and will expire on December 31, 2022. The total cost of

the work was 125,000, which consistent of the following:

Painting of ceiling

Electrical work

10,000

35,000

Construction of extension to current working

80,000

area

Total

125,000

The lessor paid one-half of the costs incurred in connection with the extension to the

current working area.

During December 2021, costs of P65,000 were incurred to improve leased office space.

The related lease will terminate on December 31, 2023 and will not be renewed.

A group of new machines was purchased under a royalty agreement which provides for

payment of royalties based on units of production for machines. The invoice price of

the machines was 75,000, freight costs were 2,000, unloading charges were P1,500 and

royalty payments for 2021 were P13,000.

Compute for the balance of the following:

1.

Land

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning