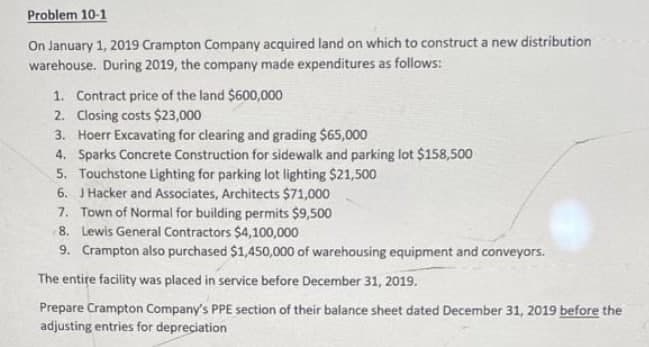

On January 1, 2019 Crampton Company acquired land on which to construct a new distribution warehouse. During 2019, the company made expenditures as follows: 1. Contract price of the land $600,000 2. Closing costs $23,000 3. Hoerr Excavating for clearing and grading $65,000 4. Sparks Concrete Construction for sidewalk and parking lot $158,500 5. Touchstone Lighting for parking lot lighting $21,500 6. J Hacker and Associates, Architects $71,000 7. Town of Normal for building permits $9,500 8. Lewis General Contractors $4,100,000 9. Crampton also purchased $1,450,000 of warehousing equipment and conveyors. The entire facility was placed in service before December 31, 2019. Prepare Crampton Company's PPE section of their balance sheet dated December 31, 2019 before the adjusting entries for depreciation

On January 1, 2019 Crampton Company acquired land on which to construct a new distribution warehouse. During 2019, the company made expenditures as follows: 1. Contract price of the land $600,000 2. Closing costs $23,000 3. Hoerr Excavating for clearing and grading $65,000 4. Sparks Concrete Construction for sidewalk and parking lot $158,500 5. Touchstone Lighting for parking lot lighting $21,500 6. J Hacker and Associates, Architects $71,000 7. Town of Normal for building permits $9,500 8. Lewis General Contractors $4,100,000 9. Crampton also purchased $1,450,000 of warehousing equipment and conveyors. The entire facility was placed in service before December 31, 2019. Prepare Crampton Company's PPE section of their balance sheet dated December 31, 2019 before the adjusting entries for depreciation

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 40P

Related questions

Question

Transcribed Image Text:Problem 10-1

On January 1, 2019 Crampton Company acquired land on which to construct a new distribution

warehouse. During 2019, the company made expenditures as follows:

1. Contract price of the land $600,000

2. Closing costs $23,000

3. Hoerr Excavating for clearing and grading $65,000

4. Sparks Concrete Construction for sidewalk and parking lot $158,500

5. Touchstone Lighting for parking lot lighting $21,500

6. J Hacker and Associates, Architects $71,000

7. Town of Normal for building permits $9,500

8. Lewis General Contractors $4,100,000

9. Crampton also purchased $1,450,000 of warehousing equipment and conveyors.

The entire facility was placed in service before December 31, 2019.

Prepare Crampton Company's PPE section of their balance sheet dated December 31, 2019 before the

adjusting entries for depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,