A tiny financial model: To investigate investment strategies, consider the following: You can choose to invest your money in one particular stock or put it in a savings account. Your initial capital is $ 1000. The interest rate r is 0.5% per month and does not change. The initial stock price is $ 100. Your stochastic model for the stock price is as follows: next month the price is the same as this month with probability 1/2, with probability 1/4 it is 5% lower, and with probability 1/4 it is 5% higher. This principle applies for every new month. There are no transaction costs when you buy or sell stock. 560 – HW # 6 Page 1 of 2 Your investment strategy for the next 5 years is: convert all your money to stock when the price drops below $ 95, and sell all stock and put the money in the bank when the stock price exceeds $ 110. Describe how to simulate the results of this strategy for the model given. Note: You will have to generate 60 random variables with distribution U(0,1) to answer this question. Use a C program to generate 60 random numbers. Include list of your random numbers in your HW solution.

A tiny financial model: To investigate investment strategies, consider the following: You can choose to invest your money in one particular stock or put it in a savings account. Your initial capital is $ 1000. The interest rate r is 0.5% per month and does not change. The initial stock price is $ 100. Your stochastic model for the stock price is as follows: next month the price is the same as this month with probability 1/2, with probability 1/4 it is 5% lower, and with probability 1/4 it is 5% higher. This principle applies for every new month. There are no transaction costs when you buy or sell stock. 560 – HW # 6 Page 1 of 2 Your investment strategy for the next 5 years is: convert all your money to stock when the price drops below $ 95, and sell all stock and put the money in the bank when the stock price exceeds $ 110. Describe how to simulate the results of this strategy for the model given. Note: You will have to generate 60 random variables with distribution U(0,1) to answer this question. Use a C program to generate 60 random numbers. Include list of your random numbers in your HW solution.

Operations Research : Applications and Algorithms

4th Edition

ISBN:9780534380588

Author:Wayne L. Winston

Publisher:Wayne L. Winston

Chapter13: Decision Making Under Uncertainty

Section13.2: Utility Theory

Problem 11P

Related questions

Question

Please help with C program. Thank you.

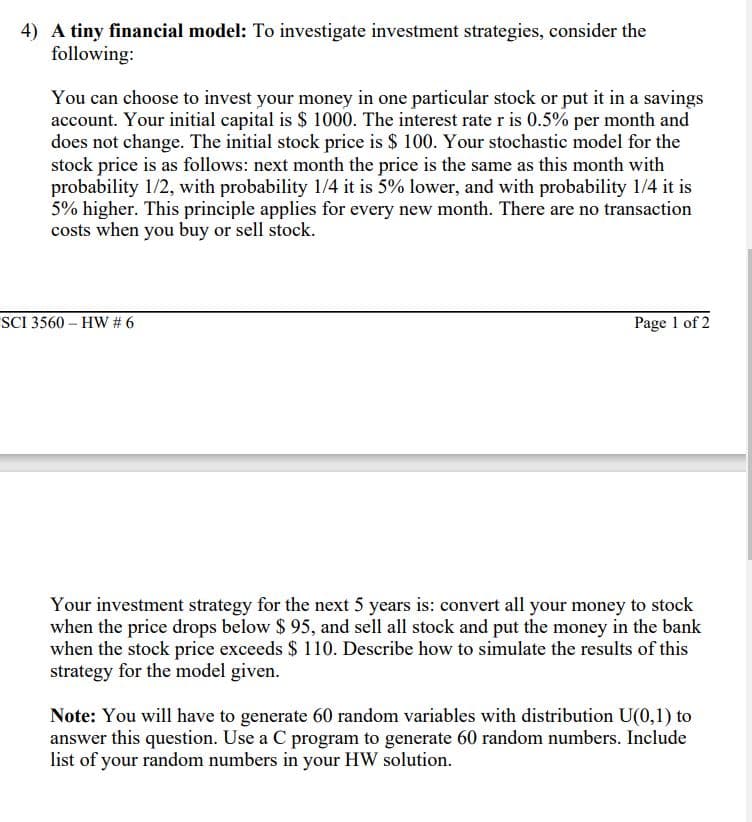

Transcribed Image Text:4) A tiny financial model: To investigate investment strategies, consider the

following:

You can choose to invest your money in one particular stock or put it in a savings

account. Your initial capital is $ 1000. The interest rate r is 0.5% per month and

does not change. The initial stock price is $ 100. Your stochastic model for the

stock price is as follows: next month the price is the same as this month with

probability 1/2, with probability 1/4 it is 5% lower, and with probability 1/4 it is

5% higher. This principle applies for every new month. There are no transaction

costs when you buy or sell stock.

SCI 3560 – HW # 6

Page 1 of 2

Your investment strategy for the next 5 years is: convert all your money to stock

when the price drops below $ 95, and sell all stock and put the money in the bank

when the stock price exceeds $ 110. Describe how to simulate the results of this

strategy for the model given.

Note: You will have to generate 60 random variables with distribution U(0,1) to

answer this question. Use a C program to generate 60 random numbers. Include

list of your random numbers in your HW solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

Operations Research : Applications and Algorithms

Computer Science

ISBN:

9780534380588

Author:

Wayne L. Winston

Publisher:

Brooks Cole

Operations Research : Applications and Algorithms

Computer Science

ISBN:

9780534380588

Author:

Wayne L. Winston

Publisher:

Brooks Cole