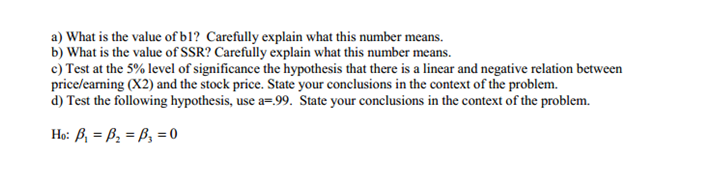

a) What is the value of b1? Carefully explain what this number means. b) What is the value of SSR? Carefully explain what this number means. c) Test at the 5% level of significance the hypothesis that there is a linear and negative relation between price/earning (X2) and the stock price. State your conclusions in the context of the problem. d) Test the following hypothesis, use a=99. State your conclusions in the context of the problem. Ho: ß, = Bz = B, = 0

a) What is the value of b1? Carefully explain what this number means. b) What is the value of SSR? Carefully explain what this number means. c) Test at the 5% level of significance the hypothesis that there is a linear and negative relation between price/earning (X2) and the stock price. State your conclusions in the context of the problem. d) Test the following hypothesis, use a=99. State your conclusions in the context of the problem. Ho: ß, = Bz = B, = 0

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section5.3: The Natural Exponential Function

Problem 40E

Related questions

Question

100%

Answer the following question

Transcribed Image Text:a) What is the value of b1? Carefully explain what this number means.

b) What is the value of SSR? Carefully explain what this number means.

c) Test at the 5% level of significance the hypothesis that there is a linear and negative relation between

price/earning (X2) and the stock price. State your conclusions in the context of the problem.

d) Test the following hypothesis, use a=.99. State your conclusions in the context of the problem.

Họ: B, = Bz = B3 = 0

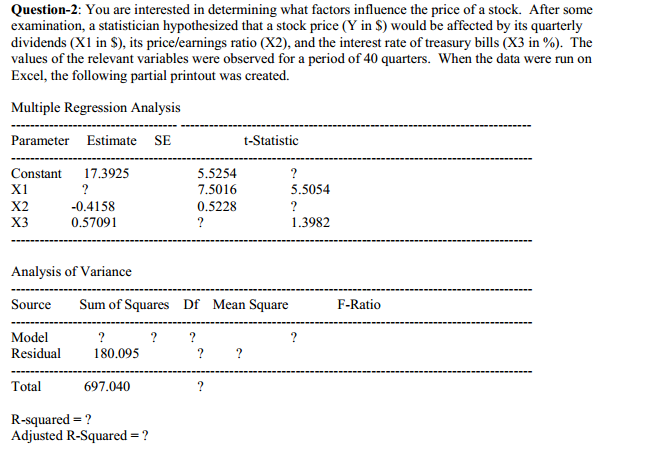

Transcribed Image Text:Question-2: You are interested in determining what factors influence the price of a stock. After some

examination, a statistician hypothesized that a stock price (Y in $) would be affected by its quarterly

dividends (X1 in $), its price/earnings ratio (X2), and the interest rate of treasury bills (X3 in %). The

values of the relevant variables were observed for a period of 40 quarters. When the data were run on

Excel, the following partial printout was created.

Multiple Regression Analysis

Parameter Estimate SE

t-Statistic

Constant

17.3925

5.5254

?

X1

?

7.5016

5.5054

X2

-0.4158

0.5228

?

X3

0.57091

?

1.3982

Analysis of Variance

Source

Sum of Squares Df Mean Square

F-Ratio

Model

?

?

?

Residual

180.095

?

?

Total

697.040

?

R-squared = ?

Adjusted R-Squared = ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning