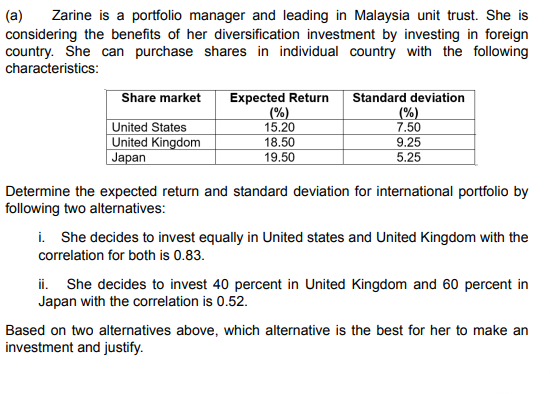

(a) Zarine is a portfolio manager and leading in Malaysia unit trust. She is considering the benefits of her diversification investment by investing in foreign country. She can purchase shares in individual country with the following characteristics: Share market Expected Return Standard deviation (%) (%) United States 15.20 7.50 United Kingdom 18.50 9.25 Japan 19.50 5.25 Determine the expected return and standard deviation for international portfolio by following two alternatives: i. She decides to invest equally in United states and United Kingdom with the correlation for both is 0.83. ii. She decides to invest 40 percent in United Kingdom and 60 percent in Japan with the correlation is 0.52.

(a) Zarine is a portfolio manager and leading in Malaysia unit trust. She is considering the benefits of her diversification investment by investing in foreign country. She can purchase shares in individual country with the following characteristics: Share market Expected Return Standard deviation (%) (%) United States 15.20 7.50 United Kingdom 18.50 9.25 Japan 19.50 5.25 Determine the expected return and standard deviation for international portfolio by following two alternatives: i. She decides to invest equally in United states and United Kingdom with the correlation for both is 0.83. ii. She decides to invest 40 percent in United Kingdom and 60 percent in Japan with the correlation is 0.52.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Transcribed Image Text:(a) Zarine is a portfolio manager and leading in Malaysia unit trust. She is

considering the benefits of her diversification investment by investing in foreign

country. She can purchase shares in individual country with the following

characteristics:

Share market Expected Return

Standard deviation

(%)

(%)

United States

15.20

7.50

United Kingdom

18.50

9.25

Japan

19.50

5.25

Determine the expected return and standard deviation for international portfolio by

following two alternatives:

i. She decides to invest equally in United states and United Kingdom with the

correlation for both is 0.83.

ii. She decides to invest 40 percent in United Kingdom and 60 percent in

Japan with the correlation is 0.52.

Based on two alternatives above, which alternative is the best for her to make an

investment and justify.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill