Q: sales of $1.27 million, accounts receivable of $52,000, total assets of $4.96 million (of which $2.7...

A: A financial ratio, also known as an accounting ratio, is the magnitude of two numerical values obtai...

Q: Find the EAR in each of the following cases. (Do not round intermediate calculations and enter your ...

A: An effective annual rate of interest or E.A.R. is the interest which is earned in real times over a ...

Q: Which is a better choice in buying a computer worth $12,700.00? Choose from the following options: ...

A: Time Value of Money: According to the time value of money, a basic financial principle, money receiv...

Q: The prudential oversight of the financial system is clearly needed to prevent financial crises, ther...

A: Introduction : Financial crises refers to the situation in which significant amount of assets of an ...

Q: Grab Co. has a normal operating cycle of 60 days. The average age of inventory is 30 days. The annua...

A: Normal Operating cycle = Age of inventory + Age of Debtors Also, 360/ age of debtors = debtors turno...

Q: In the event of 12.12 Grand Sale, Agigas warehouse gave trade discounts 40%,10% and 2% to their shop...

A: Let the single discount equivalent to given trade discounts = d

Q: Which investments can provide the best protection of capital and offers low risks. * a. savings depo...

A: An investment is an asset that is brought with the intention of earning a return or profit from it.

Q: Provide worded problem about compound interest

A:

Q: A company is considering a project. The project requires new machinery at a cost of £140,000 which i...

A: The accounting rate of return is a capital budgeting ratio that is used to find the profitability of...

Q: Consider the following statement: "If you are 20 years of age and save $1.00 each day for the rest o...

A: The rate of inflation reduces the purchasing power of money due to an increase in the price of commo...

Q: Berman V. Parker is planning to borrow ₱10 Million from NBA Bank, which offers to lend the money at ...

A: Amount to be borrowed (A) = P 10 million Discount rate (i) = 10%

Q: What are the 3 approaches to appraisal valuation?

A: Appraisal valuation deals with valuation of a property. There are diffreent types of property and he...

Q: (Refer to this word problem for items #1-6) Determine the exact and ordinary interest on P15,800 at ...

A: Principal (P) = P 15800 Interest rate (r) = 12% Time for exact interest (n) = Exact number of days b...

Q: detail two procedures which the seller of a futures contract can use to lock in a gain at some time ...

A: A futures contract is a legally binding agreement to acquire or sell a certain commodity, asset, or ...

Q: (Refer to this word problem. Samuel wishes to have P500,000 available for his son's college educatio...

A: Here we have to find the present value so that P 500,000 is available after 14 years.

Q: Use PMT= to determine the regular payment amount, rounded to the nearest dollar. The price of a home...

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first ...

Q: The ABC Corporation is considering opening an office in a new market area that would allow it to inc...

A: The internal rate of return or IRR is the sum of all inflows and outflows that becomes zero during t...

Q: 75 unt rate is 10% Answer the following questions (you HAVE TO W to submit your excel sheet immediat...

A: Given information : Year Project A Project B 0 -65 -75 1 20 55 2 30 20 3 30 20 4 25 15 ...

Q: A customer deposits money into a bank which was able to create $10 000 000 in credit from it. The RR...

A:

Q: Tatsumi invested Php 10,000 now for the college education of his three-year old son. If the fund ear...

A: Amount invested today (A) = Php 10000 Age of son today = 3 years He needs to withdraw for 4 years (m...

Q: e price of a stock is $44 per share, and the October put with an exercise price of $45 is selling fo...

A: The put option gives opportunity to sell the stock but no obligation to sell the stock on expiration...

Q: Ryngaert Inc. recently issued noncallable bonds that mature in 15 years. They have a par value of $1...

A: A bond is a fixed-income investment that symbolises the debt owed by an investor to a third party. A...

Q: 6. A concrete pavement on a street would cost P 20,000 and would last for 5 years with negligible re...

A: Current cost (C) = P 20,000 Period (n) = 5 Years Removal cost (RC) = P 1500 Interest rate (r) = 5%

Q: What are the importance of Financial Market?

A: Financial Market: It is the market where financial securities and derivatives are traded by people...

Q: An investment opportunity requires an initial cash outlay of £30,000. Cash flows are expected to be ...

A: Year cashflow pvf 9% Pv 1 (7000) 0.917 (6419) 2 (2000) 0.842 (1684) 3 13000 0.772 10036 4 36...

Q: 6. What is the Cost of Equity for CS3? 7. The weighted average cost of capital for CS1 is 8. The w...

A: CAPM Refers to the capital asset pricing model, under this method cost of equity can be calculated a...

Q: Which best defines Market Value? Group of answer choices: Whatever the market will bear. Most probab...

A: Market Value is the value of the asset in the market place. In other words, it is the value at which...

Q: Owens & Minor (OMI) stock has an expected return of 14 percent. Its standard deviation is 36 percent...

A: The question is to find an interest return and dirty price of a bond. The dirty price is calculated ...

Q: A firm needs a total P30 million in new cash for transaction purposes. The annual interest rate on m...

A: New cash needed (C) = P 30 million r = 12% Fixed cost (F) = P 1000

Q: Given the following spot rates, calculate the value of a 3-year, 6% annual-coupon bond. Spot rates:...

A: Time period is 3 years Annual Coupon rate is 6% To Find: Value of the bond

Q: McCue Inc.'s bonds currently sell for $1,175. They pay a $90 annual coupon, have a 25-year maturity,...

A: Current price = $1175 Face value (F) = $1000 Coupon (C) = $90 Years to maturity (n) = 25 years Calla...

Q: The valuation process includes the following EXEPT A.) understanding the business or asset B.) deci...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: Assume the zero-coupon yields on default-free securities are as summarized in the following table: M...

A: Bond Bonds are debts instruments that are issued by entities to raise funds and meet their capital r...

Q: Describe why financial management within an organization is such a difficult task and importance of ...

A: Financial management (FM) means managing all the activities which are related to funds like financin...

Q: Lala Ltd's stock is currently selling for $5 per share. Lala Ltd paid $0.5 dividend and has growth r...

A: The dividend yield is a financial ratio (dividend/price) that shows how much a company pays out in d...

Q: Lux Co. recently reported sales of P100 million, and net income equal to P5 million. The company ha...

A: Answer - Additional funds needed (AFN )is a financial concept used when a business looks to expand ...

Q: A bond with a par value of P 100,000 and with a bond rate of 9% payable annually is to be redeemed a...

A: Par value = P 100000 Coupon (C) = 9% of 100000 = P 9000 Redemption value (R) = P 105000 n = 6 years ...

Q: Browns Bank pays 8 percent simple interest on its savings account balances, whereas Raiders Bank pay...

A: 1) Browns bank interest rate (r) = 8% simple interest Raiders bank interest rate (i) = 8% compound i...

Q: You are an investment advisor. During a consultation a client says to you "I want to diversify my po...

A: The question is based on the concept of portfolio management and diversification of risk. Diversific...

Q: Mercu Jaya currently has 20 workers who work 8 hours per day and 25 days a month. The labor hours re...

A: Working hours per day = 8 Hours Number of days per month = 25 days Labor hours required to produce o...

Q: You are trying to decide how much to save for retirement. Assume you plan to save $4,500 per year wi...

A: a. Use the Excel FV function with the following inputs to determine the value of investment on the r...

Q: Solve the following problem PV= $24,376; n = 101; i= 0.026; PMT = ? PMT= $ (Round two decimal places...

A: The above problem can be solved using the Present Value of ordinary annuity formula. Ordinary annuit...

Q: ABC’s semiannual bond has a clean price of $1013. It paid its last coupon of $50 65 days ago. Calc...

A: Current yield is the ratio of annual dividend to the current price per bond.

Q: Explain the difference between expected rate of return, required rate of return, and historical rate...

A: Return Return is also referred to as the money lost or made over a specific period of time. It can b...

Q: 4. (Present value of an ordinary annuity) What is the present value of the following annuities? c. $...

A: c) Annual payment (A) = $280 n = 7 years r = 6%

Q: A firm is considering an investment opportunity. At a discount rate of 10%, the project has a positi...

A: IRR = Lower Interest rate + (Higher Interest rate - Lower Interest rate) * Lower NPV / (Higher NPV -...

Q: Claire needs to borrow $7000 to pay for NHL season tickets for her family. She borrows from a credit...

A: Savings are the resources that remain after expenditure and other obligations have been deducted fro...

Q: Which of the type of insurance pays benefits to workers who suffer an injury on the job? Select the ...

A: Insurance is an agreement in which an individual or organization obtains financial security or compe...

Q: 1. How do you use the Johnson & Scholes framework to determine the optimal strategy choice? 2. How d...

A: (Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new que...

Q: the company the working fairies make tablecloths but the whole tablecloth is rectangular and measure...

A: The cost of production and markup: The cost of production is made up of the costs of direct material...

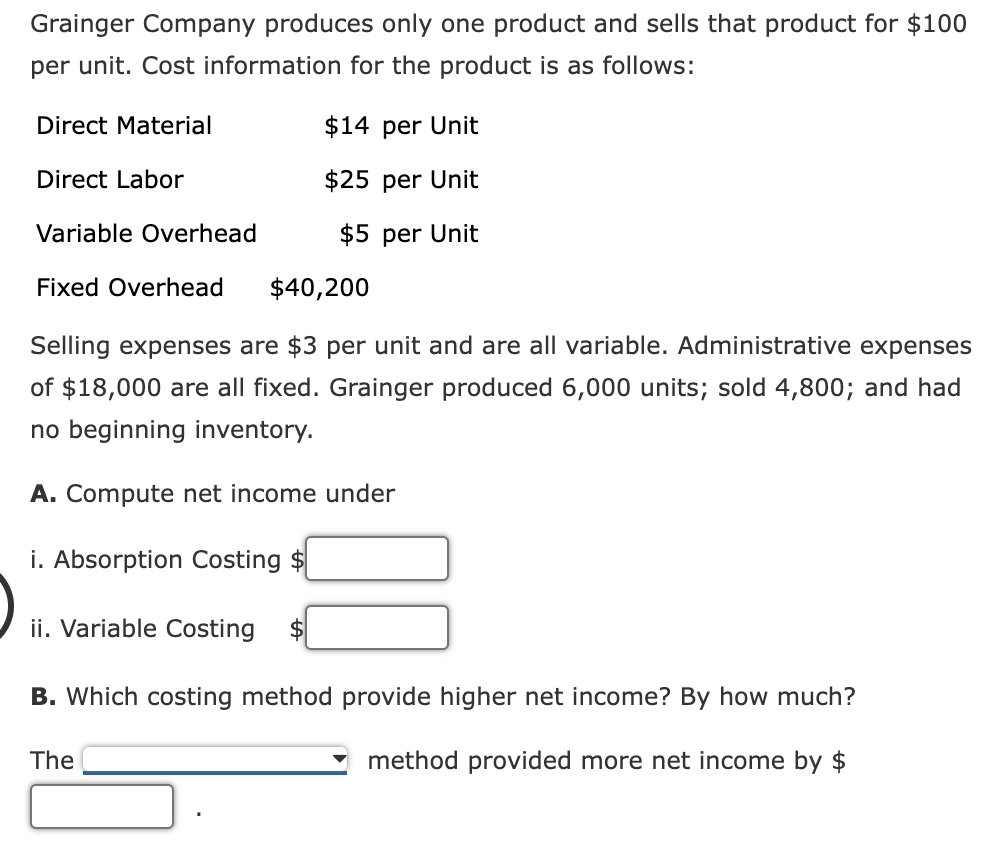

The variable costing method and absorption costing are two methods of costing to find the cost of sales. Direct costs are those costs involved in the cost of goods sold, and indirect costs are those costs included in calculating the operating profit of a company. They are not directly associated with manufacturing. Variable costing takes only the variable costs associated with production, whereas absorption costing absorbs fixed costs into the cost of finished goods.

Step by step

Solved in 4 steps

- Last year, Orsen Company produced 25,000 juicers and sold 26,500 juicers for 60 each. The actual variable unit cost is as follows: Fixed overhead was 320,000. Fixed selling expenses consisted of advertising copayments totaling 110,000. Fixed administrative expenses were 236,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 148,000 for 4,000 juicers. The value of ending inventory reported on the financial statements was Refer to the information in 2.24. The gross margin percentage for last year was a. 12.57% b. 55.67% c. 28.95% d. 38.33%Submarine Company produces only one product and sells that product for $150 per unit. Cost information for the product is as follows: Selling expenses are $2 per unit and are all variable. Administrative expenses of $15,000 are all fixed, Submarine produced 2.000 units and sold 1.800. Grainger had no beginning inventory. A. Compute net income under absorption costing variable costing B. Reconcile the difference between the income under absorption and variable costing.Pattison Products, Inc., began operations in October and manufactured 40,000 units during the month with the following unit costs: Fixed overhead per unit = 280,000/40,000 units produced = 7. Total fixed factory overhead is 280,000 per month. During October, 38,400 units were sold at a price of 24, and fixed marketing and administrative expenses were 130,500. Required: 1. Calculate the cost of each unit using absorption costing. 2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing? 3. Prepare an absorption-costing income statement for Pattison Products, Inc., for the month of October. 4. What if November production was 40,000 units, costs were stable, and sales were 41,000 units? What is the cost of ending inventory? What is operating income for November?

- The following information pertains to Vladamir, Inc., for last year: There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from one year to the next. Required: 1. How many units are in ending inventory? 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income. 3. Assume the selling price per unit is 29. Prepare an income statement using (a) variable costing and (b) absorption costing.Grainger Company produces only one product and sells that product for $100 per unit. Cost information for the product is: Selling expenses are $4 per unit and are all variable. Administrative expenses of $20,000 are all fixed. Grainger produced 5,000 units; sold 4,000; and had no beginning inventory. A. Compute net income under absorption costing variable costing B. Reconcile the difference between the income under absorption and variable costing.The following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?

- Cool Pool has these costs associated with production of 20,000 units of accessory products: direct materials, $70; direct labor, $110; variable manufacturing overhead, $45; total fixed manufacturing overhead, $800,000. What is the cost per unit under both the variable and absorption methods?Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?Kildeer Company makes easels for artists. During the last calendar year, a total of 30,000 easels were made, and 31,000 were sold for 52 each. The actual unit cost is as follows: The selling expenses consisted of a commission of 1.30 per unit sold and advertising copayments totaling 95,000. Administrative expenses, all fixed, equaled 183,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 132,600 for 3,400 easels. Required: 1. Calculate the number and the dollar value of easels in ending finished goods inventory. 2. Prepare a cost of goods sold statement. 3. Prepare an absorption-costing income statement. Add a column for percentage of sales.

- Bethany Company has just completed the first month of producing a new product but has not yet shipped any of this product. The product incurred variable manufacturing costs of 5,000,000, fixed manufacturing costs of 2,000,000, variable marketing costs of 1,000,000, and fixed marketing costs of 3,000,000. Under the variable costing concept, the inventory value of the new product would be: a. 5,000,000. b. 6,000,000. c. 8,000,000. d. 11,000,000.Moleno Company produces a single product and uses a standard cost system. The normal production volume is 120,000 units; each unit requires 5 direct labor hours at standard. Overhead is applied on the basis of direct labor hours. The budgeted overhead for the coming year is as follows: At normal volume. During the year, Moleno produced 118,600 units, worked 592,300 direct labor hours, and incurred actual fixed overhead costs of 2,150,400 and actual variable overhead costs of 1,422,800. Required: 1. Calculate the standard fixed overhead rate and the standard variable overhead rate. 2. Compute the applied fixed overhead and the applied variable overhead. What is the total fixed overhead variance? Total variable overhead variance? 3. CONCEPTUAL CONNECTION Break down the total fixed overhead variance into a spending variance and a volume variance. Discuss the significance of each. 4. CONCEPTUAL CONNECTION Compute the variable overhead spending and efficiency variances. Discuss the significance of each.Roper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)