RCISES . The management of Sisa Fitness Center is planning to replace an old P30,000. The old machine has been depreciated to its salvage value slimming machine which was acquired 5 years ago at a cost of of P4,000. Sisa has found a buyer who is willing to purchase the old slimming machine for P6,000. The new machine will cost P50,000. Incidental costs of installation, freight and insurance will have to be incurred at total cost P10,000. Should the company decide the retain the old slimming machine, the same must be upgraded and subjected to major repairs. The estimated cost of this repairs expense amounts to P8,000. The

RCISES . The management of Sisa Fitness Center is planning to replace an old P30,000. The old machine has been depreciated to its salvage value slimming machine which was acquired 5 years ago at a cost of of P4,000. Sisa has found a buyer who is willing to purchase the old slimming machine for P6,000. The new machine will cost P50,000. Incidental costs of installation, freight and insurance will have to be incurred at total cost P10,000. Should the company decide the retain the old slimming machine, the same must be upgraded and subjected to major repairs. The estimated cost of this repairs expense amounts to P8,000. The

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 4PROB

Related questions

Question

Transcribed Image Text:XERCISES

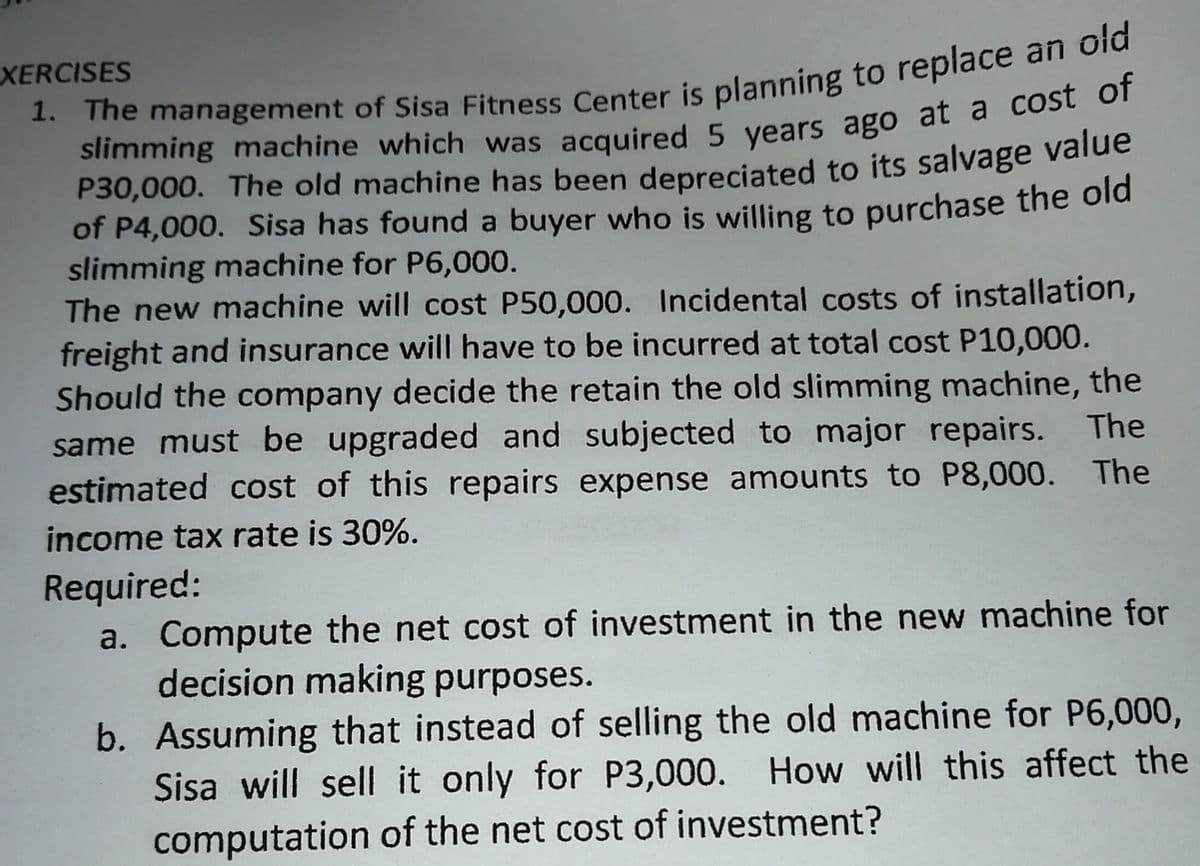

1. The management of Sisa Fitness Center is planning to replace an old

slimming machine which was acquired 5 years ago at a cost of

P30,000. The old machine has been depreciated to its salvage value

of P4,000. Sisa has found a buyer who is willing to purchase the old

slimming machine for P6,000.

The new machine will cost P50,000. Incidental costs of installation,

freight and insurance will have to be incurred at total cost P10,000.

Should the company decide the retain the old slimming machine, the

same must be upgraded and subjected to major repairs. The

estimated cost of this repairs expense amounts to P8,000. The

income tax rate is 30%.

Required:

a. Compute the net cost of investment in the new machine for

decision making purposes.

b. Assuming that instead of selling the old machine for P6,000,

Sisa will sell it only for P3,000. How will this affect the

computation of the net cost of investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College