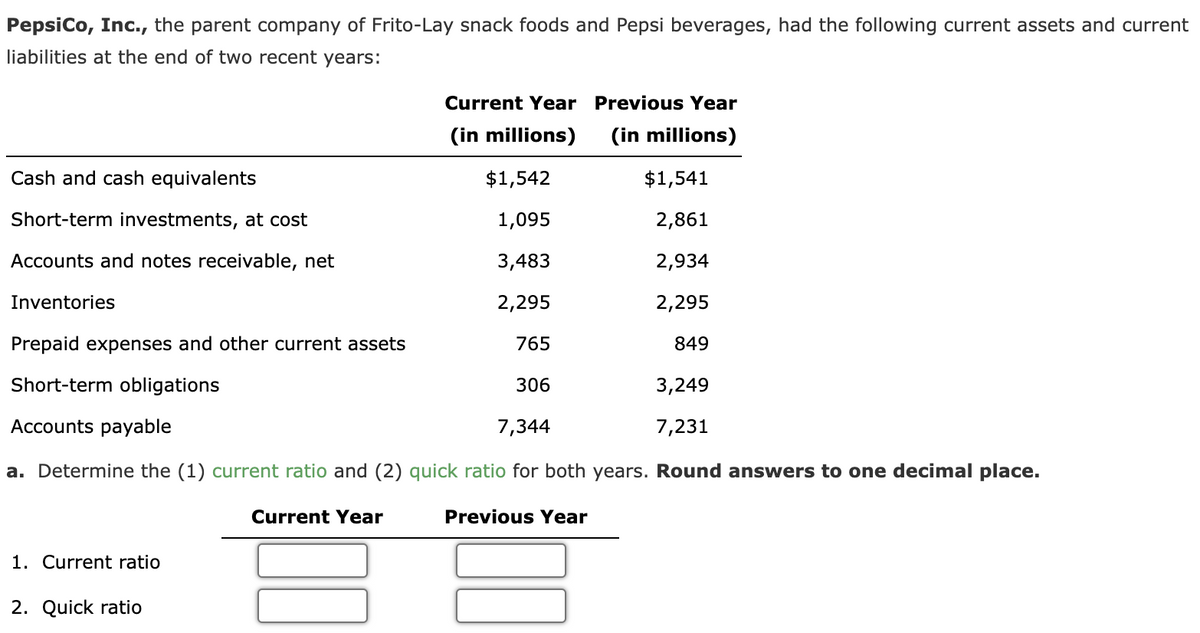

a. Determine the (1) current ratio and (2) quick ratio for both years. Round answers to one decimal place. Current Year Previous Year 1. Current ratio 2. Quick ratio

Q: H plc owns 80% of the the voting shares of S plc. S plc is a subsidiary of H plc. The most recent…

A: Consolidated Accounting Statements: The accounting statement which are formed by holding and…

Q: The following data are available for the Firempong Corporation for a recent month: Product 1 Product…

A: Break-even point = Fixed costs /Weighted Average Contribution margin per unit where, Contribution…

Q: New Berlin Corporation has annual fixed costs of $800,000, variable costs of $48 per unit, and a…

A: The contribution margin is calculated as difference between sales and variable costs. The…

Q: Ivanhoe Manufacturing Co.s static budget at 13,500 units of production includes $87,750 for direct…

A: Direct material cost per unit = $20250/13500 =$1.50 per unit

Q: Balance sheet and income statement data indicate the following: Bonds payable, 12% (due in 15…

A: Times Interest Earned - Times interest earned ratio shows the operating income earned by the company…

Q: Pool Company's variable expenses are 36% of sales. Pool is contemplating an advertising campaign…

A: Solution... Variable cost = 36% of sales Fixed costs = Advertisement = $20,000 Sales =…

Q: A $288,000 bond was redeemed at 98 when the carrying amount of the bond was $280,800. The entry to…

A: Lets understand the basics. For calculating gain/loss on redemption of carrying value of bond, we…

Q: Ltd for $80,000. During the current tax year on 10 January 2022, Greg sold these items as follows: •…

A: The net capital gain or loss is given as,

Q: 7. Your project is expected to run for three consecutive years. Your organization is introducing…

A: BAC: - BAC stands for Budget At Completion. BAC is the total estimate of the project. It has the…

Q: Why is the distinction between current and long term liabilities important? What would you say about…

A: The Assets are the resource that is Paramount to generate revenue. the classifications of assets…

Q: A major disclosure items for public companies is: lack of internal controls pension…

A:

Q: E9-17 (Algo) Computing a Present Value Involving an Annuity and a Single Payment LO 9-7 You have…

A: Present value = (PMT*(1-(1+r)^-n)/r) + (FV*(1+r)^-n)

Q: What is gross operating income over the next year to the nearest dollar for an apartment building…

A: The gross operating Income will be gross amount to be collected less the amount of allowance for…

Q: Your Company's residual income was $13.500. Net income was $67.500 and average operating assets were…

A: Residual income = Net income - Minimum profit required where, Minimum profit required = Average…

Q: State six users of accounting information and explain how each uses the information

A: Accounting information includes financial statements produced by bookkeeping and accounting methods,…

Q: A $375,000 bond issue on which there is an unamortized discount of $40,000 is redeemed for $320,000.…

A: Formula: Gain (loss) on bonds redemption = Face value of bonds - Redemption value - Unamortized…

Q: Hall Company sells merchandise with a one-year warranty. In the current year, sales consisted of…

A: Introduction: An income statement is a critical financial record for every company. It illustrates…

Q: What is gross operating income over the next year to the nearest dollar for an apartment building…

A: The gross operating Income will be gross Revenue less the amount of allowance for credit loss.…

Q: asset nabllity year End Beginning Cash $ 62,000 $73,000 Accounts receivable (net) 75,000 60,000…

A: Cash flow from operating activities refers to the money a company makes from ongoing, regular…

Q: Question 1 Yellow Trading sells various brands of lamps and lights. The following is the trial…

A: Profit and loss account represents profits or loss of the business during the period as specified in…

Q: Prepare entries to record the following: a. Issued 1,000 shares of $10 par common stock at $56. If…

A: Journal entries are being made for each and every transaction which is took place in the business.…

Q: U2 Ltd is considering whether to offer trade credit to A1 Ltd. The ratio from A1's accounts that…

A: Ratio Analysis is one of the various tools of analyzing financial statements.

Q: Calculate per unit cost for A001 and A002

A: Activity Based Costing method is a method of overhead cost allocation using the various activities…

Q: The following present value factors are provided for use in this problem. Present Value Present…

A: The question is related to Capital Budgeting. The Net Present Value is calculated with the help of…

Q: A Company issues four-year bonds with a $114,000 par value on January 1, 2021, at a price of…

A: Interest expense = 114000 x 5% x 6/12 = 2850 bond amortisation = (114000-109870)/8 = 516.25

Q: Funnel Manufacturing Company has provided the follwoing information: Month Budgeted Sales January $…

A: Accounts payable means accounts of those suppliers from whom credit purchases are made and amount…

Q: A company reports the following: Net income $233,000 Preferred dividends $13,000 Shares of common…

A: Formulas: Earnings per share on common stock = (Net income - Preferred dividend) / Shares of common…

Q: Transaction costs incurred the effective interest rate to be used for amortization of an investment…

A: Costs incurred during buying and selling any good or a service are generally referred to as…

Q: Copperhead Company has provided you with the following information regarding its inventory of copper…

A: Lower of cost or net realizable value(LCNRV): It is the method to reflect the decline of inventory…

Q: . How much of these pools?

A: Given as, Plant manager's salary= $150, 000 and Depreciation= $65, 000.

Q: A fumiture salesperson can sell 60 pieces of furniture over an entire year. To hold onto the…

A: the minimum inventory cost at the cost that is to be incurred irrespective of the level of inventory…

Q: What is gross operating income over the next year to the nearest dollar for an apartment building…

A: GIVEN An apartment building that has 10 units each having an advertised rent of $2000 / month ?…

Q: In preparing a company's statement of cash flows using the Indirect method, the following…

A: Statement of Cash flows is a Summary of all expected cash inflows and cash outflows incurred during…

Q: Stahman, Inc., estimates its hidden external failure costs using the Taguchi loss function.Stahlman…

A: It was considered that hidden costs (opportunity losses resulting from faulty items) exist for…

Q: Wonder Sales is authorized to issue 100,000 shares of 2%, $100 par preferred stock and 1,000,000…

A: Paid in capital excess of par- preferred stock on January 2 nd = 5000 shares ×$10 = $50000

Q: A company had net cash flows from operations of $140,000, cash flows from financing of $370,000,…

A: The cash flow on total assets is calculated as cash flow from operations divided by average total…

Q: Question 7 Z scores are: A. Used to evaluate the quality of imaged files B. Used to identify…

A: Introduction:- It describes a value's relationship to the mean of a group of values. Z score is…

Q: e following totals for the month of June were taken from the payroll register of Arcon Company:…

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: True or False If a property’s market value becomes 0, the owner has no right to sell it at a value…

A: As per the Accounting terms , if a property's market value becomes 0 , then…

Q: Required information [The following information applies to the questions displayed below.) A…

A: Formulas: Return on investment = Net income / Average Assets Profit margin = Income / Sales…

Q: should order units times a year. he minimum inventory cost is $

A: Given :- Annual demand = D = 3000 UNITS Ordering cost = Co = $50 Annual unit inventory carrying cost…

Q: the accrued payroll journal entries for your company 1, that has a payroll expense of $460,000 every…

A: The accrued salaries are the salaries which are earned by the employees but are not paid yet by the…

Q: A family friend has asked your help in analyzing the operations of three anonymous companies…

A: Formula: Return on Investment = net Operating Income / Average operating assets Residual income =…

Q: H plc is a holding company with a 70% interest in its subsidiary S plc. The following is an extract…

A: Retained Earnings- Retained earnings are the accumulated portion of a company's profits in a fiscal…

Q: Horizontal analysis is used to understand the relative Importance of each financial statement item.…

A: Financial statements are written papers that summaries the commercial activities and financial…

Q: 30. Julian Tan owns a store specializing in rare trinkets which is her only source of income. She…

A: When the gross sales exceed P3000000 then the tax is payable at the regular rate. The regular rate…

Q: On June 1, 2022, GHI Co. acquired P3,000,000 bonds of Z Company at 102 plus transaction costs of…

A:

Q: PRODUCT MIX DECISION 8. ELEMENTAL HERO CORP. makes three products in a single facility. Data…

A: Profit Maximisation with Resource Constraint: In case a company has a resource which is essential…

Q: Fill in the blank. ______ method is a costing method which includes beginning work-in-process…

A: There are various methods for valuation of inventory in cost accounting. Mainly, inventory is found…

Q: Mississippi Products Co. had the following positive cash flows during the current year: received…

A: Cash flows from operating activities: It is a section of the Statement of cash flow that explains…

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps with 3 images

- Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyPepsiCo, Inc., the parent company of Frito-Lay snack foods and Pepsi beverages, had thefollowing current assets and current liabilities at the end of two recent years: Current Year Previous Year (in millions) (in millions)Cash and cash equivalents $ 6,297 $ 4,067Short-term investments, at cost 322 358Accounts and notes receivable, net 7,041 6,912Inventories 3,581 3,827Prepaid expenses and other current assets 1,479 2,277Short-term obligations 4,815 6,205Accounts payable 12,274 11,949a. Determine the (1)…Sherwood, Inc., the parent company of Frito-Lay snack foods and Sherwood beverages, had the following current assets and current liabilities at the end of two recent years: Line Item Description Current Year(in millions) Previous Year(in millions) Cash and cash equivalents $4,611 $4,986 Short-term investments, at cost 3,275 9,259 Accounts and notes receivable, net 10,411 9,497 Inventories 1,445 963 Prepaid expenses and other current assets 481 356 Short-term obligations 385 4,089 Accounts payable 9,245 9,101 a. Determine the (1) current ratio and (2) quick ratio for both years. Round your answers to one decimal place. Line Item Description Current Year Previous Year 1. Current ratio ? ? 2. Quick ratio ? ? slightly over this time period. Both the current and quick ratios have fill in the blank 2 of 4 . Sherwood is a fill in the blank 3 of 4 company with fill in the blank 4 of 4 resources…

- Sherwood, Inc., the parent company of Frito-Lay snack foods and Sherwood beverages, had the following current assets and current liabilities at the end of two recent years: Current Year(in millions) Previous Year(in millions) Cash and cash equivalents $3,155 $3,047 Short-term investments, at cost 2,241 5,659 Accounts and notes receivable, net 7,123 5,803 Inventories 1,445 1,926 Prepaid expenses and other current assets 481 712 Short-term obligations 385 4,089 Accounts payable 9,245 9,101 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Current Year Previous Year 1. Current ratio 2. Quick ratioPepsiCo, Inc., the parent company of Frito-Lay snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: Current Year(in millions) Previous Year(in millions) Cash and cash equivalents $8,721 $10,610 Short-term investments, at cost 272 8,900 Accounts and notes receivable, net 7,142 7,024 Inventories 3,128 2,947 Prepaid expenses and other current assets 2,630 1,546 Accounts payable 18,112 15,017 Other short-term liabilities 4,026 5,485 a. Determine the (1) current ratio and (2) quick ratio for both years. Round answers to one decimal place. Current Year Previous Year 1. Current ratio fill in the blank 1 fill in the blank 2 2. Quick ratio fill in the blank 3 fill in the blank 4 b. The liquidity of PepsiCo has over this time period. The current ratio has and the quick ratio has .epsiCo, Inc. (PEP), the parent company of Frito-Lay snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: Current Year(in millions) Previous Year(in millions) Cash and cash equivalents $21,243 $10,202 Short-term investments, at cost 8,540 5,297 Accounts and notes receivable, net 6,361 6,644 Inventories 2,814 2,801 Prepaid expenses and other current assets 1,602 1,863 Short-term obligations 6,613 3,718 Accounts payable 13,667 12,334 Determine the (1) current ratio and (2) quick ratio for both years. Round your answers to one decimal place. Current Year Previous Year 1. Current ratio 2. Quick ratio

- Sherwood, Inc., had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $4,165 $4,528 Short-term investments, at cost 2,958 8,408 Accounts and notes receivable, net 9,404 8,624 Inventories 1,771 787 Prepaid expenses and other current assets 590 291 Short-term obligations (liabilities) 315 3,342 Accounts payable and other current liabilities 7,453 6,813 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio fill in the blank 1 fill in the blank 2 Quick ratio fill in the blank 3 fill in the blank 4PepsiCo, Inc. (PEP), the parent company of Frito-Lay snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: Current Year(in millions) Previous Year(in millions) Cash and cash equivalents $25,551 $9,216 Short-term investments, at cost 7,238 4,835 Accounts and notes receivable, net 7,097 7,405 Inventories 2,641 2,635 Prepaid expenses and other current assets 1,647 1,805 Short-term obligations 7,425 3,820 Accounts payable 15,345 12,674 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Determine the (1) current ratio and (2) quick ratio for both years. Round your answers to one decimal place. Current Year Previous Year 1. Current ratio fill in the blank 2 fill in the blank 3 2. Quick ratio fill in the blank 4…PepsiCo, Inc. (PEP), the parent company of Frito-LayTM snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $ 9,096 $ 6,134 Short-term investments, at cost 2,913 2,592 Accounts and notes receivable, net 6,437 6,651 Inventories 2,720 3,143 Prepaid expenses and other current assets 1,865 2,143 Short-term obligations (liabilities) 4,071 5,076 Accounts payable and other current liabilities 13,507 13,016 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio ???? ???? Quick ratio ???? ????

- PepsiCo, Inc. (PEP), the parent company of Frito-LayTM snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $ 9,096 $ 6,134 Short-term investments, at cost 2,913 2,592 Accounts and notes receivable, net 6,437 6,651 Inventories 2,720 3,143 Prepaid expenses and other current assets 1,865 2,143 Short-term obligations (liabilities) 4,071 5,076 Accounts payable and other current liabilities 13,507 13,016 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio fill in the blank 1 fill in the blank 2 Quick ratio fill in the blank 3 fill in the blank 4 b. What conclusion can be drawn from these data?Based on the accounting records, the total assets book value as of January 1, 2021 is P1,875,362.99 but due to inflation the current cost is determined to be P1,990,800.21 while the total liabilities is P988,123.54 as of January 1, 2021. The company received additional investments of P651,345.22 during the year while dividends declared and paid is P450,650. At the end of the year, the books reported Total assets of P2,992,748.55 and liabilities of P1,555,661.24. What is the net income (loss) under the physical capital concept?The current assets and current liabilities for RCE and John K Company are as follows: RCE John K, Inc For Year Ending For Year Ending Dec. 31 Dec. 31 ____________________________________________________________________ Current Assets Cash and Cash Equivalents $8,352 $8,546 Short-term Investments 6,034 752 Accounts Receivable 3,029 5,152 Inventories 446 660 Other Current Assets * 2,195 2,829 Toral Current Assets $20,056 $17,939 Current Liabilities Accounts Payable $4,970 $10,430 Accrued and Other Current Liabilities 3,329 6,361 Total Current Liabilities $8,299 $16,791 These represent prepaid expenses and other non-quick current assets. Required: Determine the quick ratio for RCE and John K, Inc. What’s the liquidity difference between the two companies? And what does that mean?