a. How many elements are in this data set? b. Of the following subset of variables, indicate which are categorical and which are quantitative: Exchange ["quantative", "categorical"] , Price/Earnings Ratio ["quantitive", "categorical"] , Gross Profit Margin. ["quantitive", "categorical"] c. Indicate the scale of measurement for the variables: Exchange, Price/Earnings Ratio, Gross Profit Margin (%): Exchange is ["ratio scale", "interval scale", "ordinal scale", "nomial scale"] Price/Earnings Ratio is ["ratio scale", "interval scale", "ordinal scale", "nomial scale"] Gross Profit Margin (%) is ["ratio scale", "interval scale", "ordinal scale", "nomial scale"] .

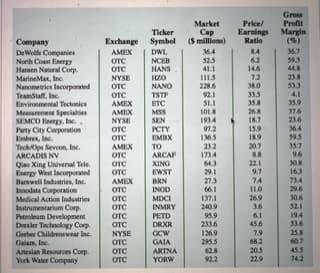

The following table shows a data set containing information for 25 of the shadow stocks tracked by the American Association of Individual Investors (aaii.com, February 2002). Shadow stocks are common stocks of smaller companies that are not closely followed by Wall Street analysts. The data set is also on the website that accompanies the text in the file named Shadow02.

a. How many elements are in this data set?

b. Of the following subset of variables, indicate which are categorical and which are quantitative:

Exchange ["quantative", "categorical"] ,

Price/Earnings Ratio ["quantitive", "categorical"] ,

Gross Profit Margin. ["quantitive", "categorical"]

c.

Indicate the scale of measurement for the variables: Exchange, Price/Earnings Ratio, Gross Profit Margin (%):

Exchange is ["ratio scale", "interval scale", "ordinal scale", "nomial scale"]

Price/Earnings Ratio is ["ratio scale", "interval scale", "ordinal scale", "nomial scale"]

Gross Profit Margin (%) is ["ratio scale", "interval scale", "ordinal scale", "nomial scale"] .

Step by step

Solved in 2 steps