ansaction below, determine the tax type whether it is subject to Basic Income Tax (BIT), Final Withholding Tax (FWT) or Exempt (E) from income tax. On the tax rate column, write the respective rates of the tax type from 0% to 32% , Exempt or Graduated Tax Rate (GTR).

ansaction below, determine the tax type whether it is subject to Basic Income Tax (BIT), Final Withholding Tax (FWT) or Exempt (E) from income tax. On the tax rate column, write the respective rates of the tax type from 0% to 32% , Exempt or Graduated Tax Rate (GTR).

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter16: Multijurisdictional Taxation

Section: Chapter Questions

Problem 18P

Related questions

Question

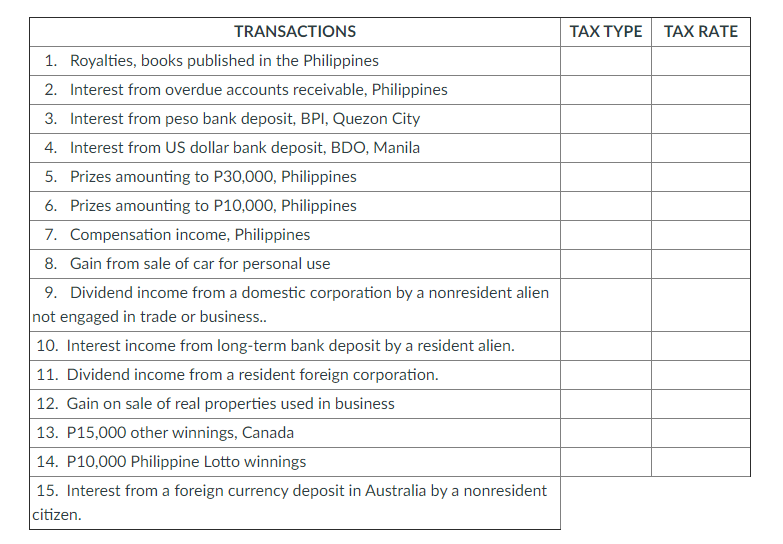

- On each transaction below, determine the tax type whether it is subject to Basic Income Tax (BIT), Final Withholding Tax (FWT) or Exempt (E) from income tax.

- On the tax rate column, write the respective rates of the tax type from 0% to 32% , Exempt or Graduated Tax Rate (GTR).

Transcribed Image Text:TRANSACTIONS

TAX TYPE TAX RATE

1. Royalties, books published in the Philippines

2. Interest from overdue accounts receivable, Philippines

3. Interest from peso bank deposit, BPI, Quezon City

4. Interest from US dollar bank deposit, BDO, Manila

5. Prizes amounting to P30,000, Philippines

6. Prizes amounting to P10,000, Philippines

7. Compensation income, Philippines

8. Gain from sale of car for personal use

9. Dividend income from a domestic corporation by a nonresident alien

not engaged in trade or business.

10. Interest income from long-term bank deposit by a resident alien.

11. Dividend income from a resident foreign corporation.

12. Gain on sale of real properties used in business

13. P15,000 other winnings, Canada

14. P10,000 Philippine Lotto winnings

15. Interest from a foreign currency deposit in Australia by a nonresident

citizen.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you