[The following information applies to the questions displayed below. Pumpworks Inc. and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of the merger agreement, the companies reported the following data: Pumpworks Balance Sheet Items Assets Cash & Receivables Inventory Land Plant & Equipment Less: Accumulated Depreciation Total Assets Liabilities & Equities Current Liabilities Capital Stock Capital in Excess of Par Value Retained Earnings Total Liabilities & Equities Book Value $ 96,000 113,000 113,000 405,000 (140,000) $ 587,000 $ 66,000 324,000 21,000 176,000 $ 587,000 Fair Value Book Value $ 96,000 165,000 Seaworthy Rope Company 144,000 311,000 $716,000 $ 66,000 $ 16,000 26,000 6,000 218,000 (67,000) $199,000 $ 20,000 72,000 6,000 101,000 $199,000 Fair Value $ 16,000 38,000 11,000 127,000 $192,000 $ 20,000 Pumpworks has 10,800 shares of its $30 par value shares outstanding on January 1, 20X3, and Seaworthy has 4,800 shares of $15 par value stock outstanding. The market values of the shares are $210 and $60. respectively.

[The following information applies to the questions displayed below. Pumpworks Inc. and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of the merger agreement, the companies reported the following data: Pumpworks Balance Sheet Items Assets Cash & Receivables Inventory Land Plant & Equipment Less: Accumulated Depreciation Total Assets Liabilities & Equities Current Liabilities Capital Stock Capital in Excess of Par Value Retained Earnings Total Liabilities & Equities Book Value $ 96,000 113,000 113,000 405,000 (140,000) $ 587,000 $ 66,000 324,000 21,000 176,000 $ 587,000 Fair Value Book Value $ 96,000 165,000 Seaworthy Rope Company 144,000 311,000 $716,000 $ 66,000 $ 16,000 26,000 6,000 218,000 (67,000) $199,000 $ 20,000 72,000 6,000 101,000 $199,000 Fair Value $ 16,000 38,000 11,000 127,000 $192,000 $ 20,000 Pumpworks has 10,800 shares of its $30 par value shares outstanding on January 1, 20X3, and Seaworthy has 4,800 shares of $15 par value stock outstanding. The market values of the shares are $210 and $60. respectively.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter16: Advanced Topics Concerning Complex Auditing Judgments

Section: Chapter Questions

Problem 21MCQ

Related questions

Topic Video

Question

Accounting

Transcribed Image Text:4

A

s

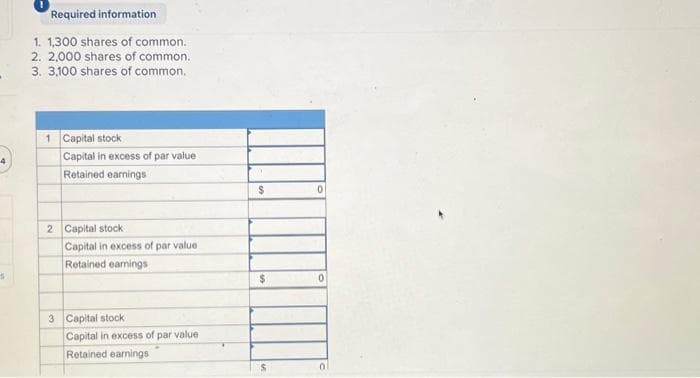

Required information

1. 1,300 shares of common.

2. 2,000 shares of common.

3. 3,100 shares of common.

1 Capital stock

Capital in excess of par value

Retained earnings

2 Capital stock

Capital in excess of par value.

Retained earnings

3 Capital stock

Capital in excess of par value

Retained earnings

$

$

S

0

0

![кequirea information

[The following information applies to the questions displayed below.]

Pumpworks Inc. and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of

the merger agreement, the companies reported the following data:

Pumpworks

Balance Sheet Items

Assets

Cash & Receivables

Inventory

Land

Plant & Equipment

Less: Accumulated Depreciation

Total Assets

Liabilities & Equities

Current Liabilities

Capital Stock

Capital in Excess of Par Value

Retained Earnings

Total Liabilities & Equities

Book Value

$ 96,000

113,000

113,000

405,000

(140,000)

$ 587,000

$ 66,000

324,000

21,000

176,000

$ 587,000

Fair Value

$ 96,000

165,000

144,000.

311,000

$716,000

$ 66,000

Seaworthy Rope Company

Book Value

$ 16,000

26,000

6,000

218,000

(67,000)

$199,000

$20,000.

72,000

6,000

101,000

$199,000

Fair Value

$ 16,000

38,000

11,000

127,000

$192,000

$ 20,000

Pumpworks has 10,800 shares of its $30 par value shares outstanding on January 1, 20X3, and

Seaworthy has 4,800 shares of $15 par value stock outstanding. The market values of the shares are

$310 and $60, respectively.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fd7b6ce77-7d1f-42c7-90fc-6e082dc1db1b%2F6492ca5a-2745-463e-bdaa-4acd51332b00%2Feh7il9n_processed.jpeg&w=3840&q=75)

Transcribed Image Text:кequirea information

[The following information applies to the questions displayed below.]

Pumpworks Inc. and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of

the merger agreement, the companies reported the following data:

Pumpworks

Balance Sheet Items

Assets

Cash & Receivables

Inventory

Land

Plant & Equipment

Less: Accumulated Depreciation

Total Assets

Liabilities & Equities

Current Liabilities

Capital Stock

Capital in Excess of Par Value

Retained Earnings

Total Liabilities & Equities

Book Value

$ 96,000

113,000

113,000

405,000

(140,000)

$ 587,000

$ 66,000

324,000

21,000

176,000

$ 587,000

Fair Value

$ 96,000

165,000

144,000.

311,000

$716,000

$ 66,000

Seaworthy Rope Company

Book Value

$ 16,000

26,000

6,000

218,000

(67,000)

$199,000

$20,000.

72,000

6,000

101,000

$199,000

Fair Value

$ 16,000

38,000

11,000

127,000

$192,000

$ 20,000

Pumpworks has 10,800 shares of its $30 par value shares outstanding on January 1, 20X3, and

Seaworthy has 4,800 shares of $15 par value stock outstanding. The market values of the shares are

$310 and $60, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning