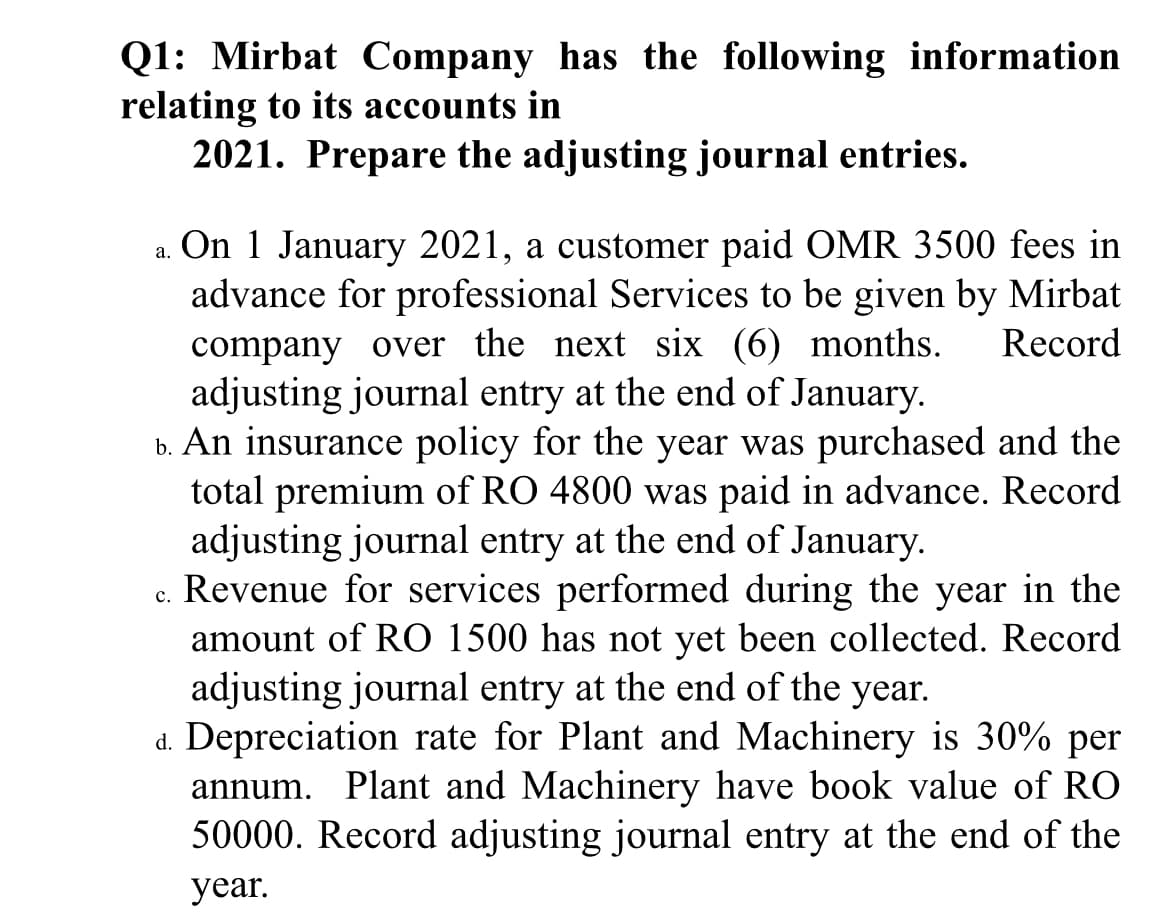

a. On 1 January 2021, a customer paid OMR 3500 fees in advance for professional Services to be given by Mirbat company over the next six (6) months. adjusting journal entry at the end of January. ». An insurance policy for the year was purchased and the total premium of RO 4800 was paid in advance. Record adjusting journal entry at the end of January. e. Revenue for services performed during the year in the amount of RO 1500 has not yet been collected. Record adjusting journal entry at the end of the year. 1. Depreciation rate for Plant and Machinery is 30% per annum. Plant and Machinery have book value of RO 50000. Record adjusting journal entry at the end of the Record year.

a. On 1 January 2021, a customer paid OMR 3500 fees in advance for professional Services to be given by Mirbat company over the next six (6) months. adjusting journal entry at the end of January. ». An insurance policy for the year was purchased and the total premium of RO 4800 was paid in advance. Record adjusting journal entry at the end of January. e. Revenue for services performed during the year in the amount of RO 1500 has not yet been collected. Record adjusting journal entry at the end of the year. 1. Depreciation rate for Plant and Machinery is 30% per annum. Plant and Machinery have book value of RO 50000. Record adjusting journal entry at the end of the Record year.

Chapter9: Adjusting Entries

Section: Chapter Questions

Problem 2.2C

Related questions

Question

Transcribed Image Text:Q1: Mirbat Company has the following information

relating to its accounts in

2021. Prepare the adjusting journal entries.

a. On 1 January 2021, a customer paid OMR 3500 fees in

advance for professional Services to be given by Mirbat

company over the next six (6) months.

adjusting journal entry at the end of January.

b. An insurance policy for the year was purchased and the

total premium of RO 4800 was paid in advance. Record

adjusting journal entry at the end of January.

Revenue for services performed during the year in the

amount of RO 1500 has not yet been collected. Record

adjusting journal entry at the end of the year.

d. Depreciation rate for Plant and Machinery is 30% per

annum. Plant and Machinery have book value of RO

50000. Record adjusting journal entry at the end of the

Record

с.

year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage