On July 1, 2019, Oriole Co. pays $ 27,300 to Skysong Insurance Co. for a 4-year insurance contract. Both companies have fiscal years ending December 31. For Oriole Co., journalize and post the entry on July 1 and the adjusting entry on December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, eg. 5,275.) Date Account Titles and Explanation Debit Credit >

On July 1, 2019, Oriole Co. pays $ 27,300 to Skysong Insurance Co. for a 4-year insurance contract. Both companies have fiscal years ending December 31. For Oriole Co., journalize and post the entry on July 1 and the adjusting entry on December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, eg. 5,275.) Date Account Titles and Explanation Debit Credit >

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 5PB: Reece Financial Services Co., which specializes in appliance repair services, is owned and operated...

Related questions

Question

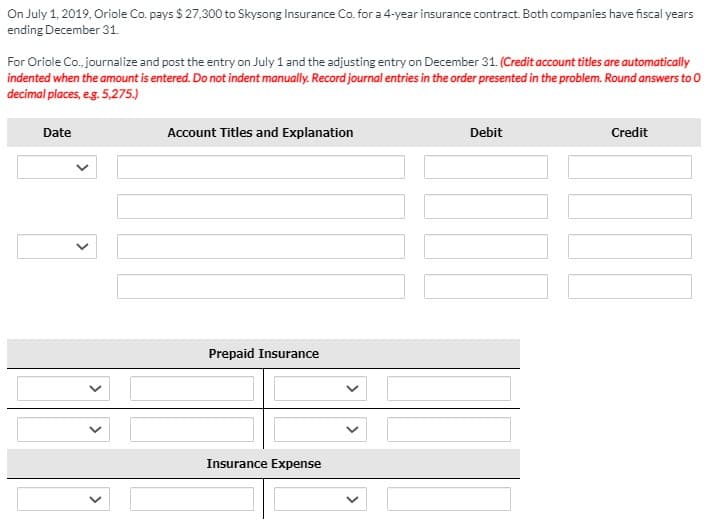

Transcribed Image Text:On July 1, 2019, Oriole Co. pays $ 27,300 to Skysong Insurance Co. for a 4-year insurance contract. Both companies have fiscal years

ending December 31.

For Oriole Co., journalize and post the entry on July 1 and the adjusting entry on December 31. (Credit account titles are automatically

indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0

decimal places, eg. 5,275.)

Date

Account Titles and Explanation

Debit

Credit

Prepaid Insurance

Insurance Expense

>

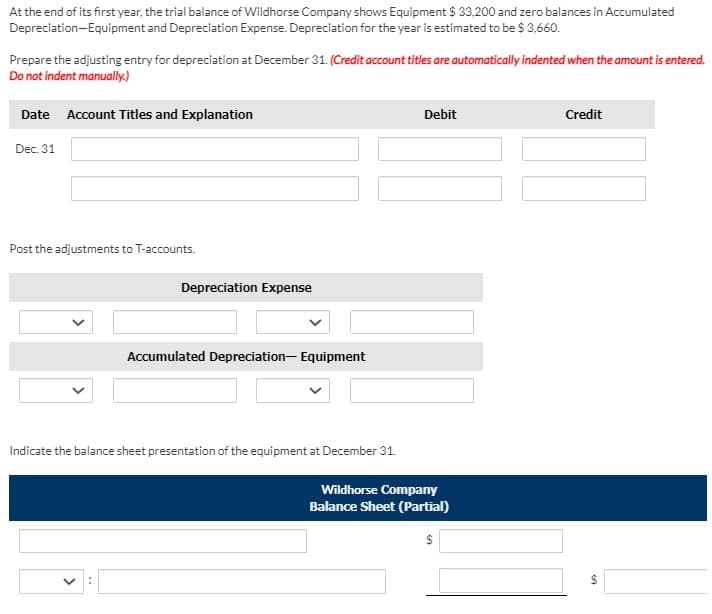

Transcribed Image Text:At the end of its first year, the trial balance of Wildhorse Company shows Equipment $ 33,200 and zero balances in Accumulated

Depreciation-Equipment and Depreciation Expense. Depreciation for the year is estimated to be $ 3,660.

Prepare the adjusting entry for depreciation at December 31. (Credit account titles are automatically indented when the amount is entered.

Do not indent manually.)

Date Account Titles and Explanation

Debit

Credit

Dec. 31

Post the adjustments to T-accounts.

Depreciation Expense

Accumulated Depreciation- Equipment

Indicate the balance sheet presentation of the equipment at December 31.

Wildhorse Company

Balance Sheet (Partial)

$

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning