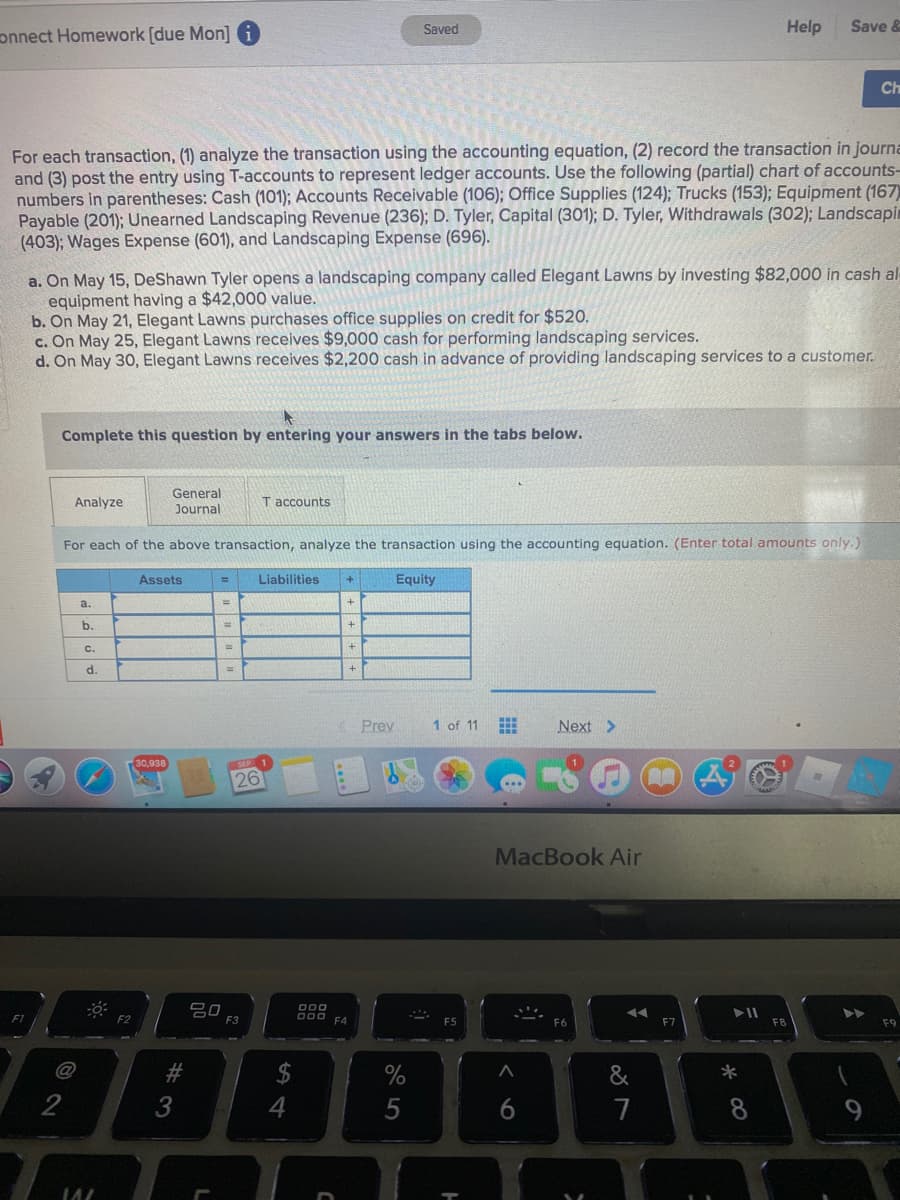

a. On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $82,000 in cash a equipment having a $42,000 value. b. On May 21, Elegant Lawns purchases office supplies on credit for $520. c. On May 25, Elegant Lawns receives $9,000 cash for performing landscaping services. d. On May 30, Elegant Lawns receives $2,200 cash in advance of providing landscaping services to a customer. Complete this question by entering your answers in the tabs below. General Analyze T accounts Journal

Q: Arnina established a service business to be known as Arnina Photography on July 1, 2021. During the…

A: Your journal entries may not be seen if you use accounting software or outsource your accounting,…

Q: a On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $85,000 in…

A: The journal entries are prepared to record daily transactions of the business.

Q: Ms. May Putok opened her business, "Putok Accounting Service" in the month of March 2022. March 3 –…

A: Journal Entry The purpose preparing the journal entry to enter the required transaction into debit…

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: The bank reconciliation statement is prepared to adjust the balances of cash book and pass book with…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Journal entry is the process of recording the business transactions in the accounting books for the…

Q: On August 1, 2003, Mary Woo opens Woo Computer Consulting. During the business’s first ten days of…

A: 1. Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Tollow ansacti books of • Mr. Anwar decide to start a business of Computer Service Business that…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: On July 1, 2020, Matthew Victor opened a retail postal store. During July, the following…

A: 1. Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: The financial statements of the business include the income statement and balance sheet of the firm.

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: Bank reconciliation statement is used to determine the differences between the bank statement…

Q: Jan 2 Received $11,000 cash from Ruiz, and issued common stock to him. 2 Paid monthly office rent,…

A: Following are the requisite financial statement

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: A ledger is a log or list of accounts that keeps track of account transfers. A general ledger…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: The financial statements of the business include the income statement and balance sheet of the firm.

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: Journal Entry 1) Bank/Cash A/c ......Dr PHP 150,000 TO Lopez, Capital PHP…

Q: Required: 1.Prepare Statement of Financial Performance

A: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

Q: a. On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $78,000 in…

A: Accounting equation is also called balance sheet equation in which assets are equal to liabilities…

Q: March 1. Jamili deposited P200,000 in a bank account in the name of the business. 2. Jamili invested…

A: Journal entries are used to record the transactions of the business in a chronological order.

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: The income statement is prepared by the business organizations so as to determine how much amount of…

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: SOLUTION - Bank Reconciliation is the process of identifying the Difference that exits between the…

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: Merchandise inventory refers to the value of goods in stock, whether it's finished goods or raw…

Q: Mohammed started a delivery company in Muscat in June 2018 (Mohammed Delivery Service). During the…

A: The accounting equation states that assets equal to sum of liabilities and equity.

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: Journal Entry 1) Bank/Cash A/c ......Dr PHP 150,000 TO Lopez, Capital PHP…

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: Merchandise inventory refers to the value of goods in stock, whether it's finished goods or raw…

Q: Domingo Company started its business on January 1, 2019. The following transactions occurred during…

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: hristine opened a tour and travel business, “Tine Travels” on June 01, 2021. 1 Christine…

A: Income statements show the performance of the entity during the year. It indicates how the resources…

Q: Carla Quentin started her own consulting firm, Quentin Consulting, on May 1, 2020. The following…

A: SOLUTION- JOURNAL ENTRY IS USED TO RECORD A BUSINESS TRANSACTION IN THE ACCOUNTING RECORDS OF A…

Q: Arnina established a service business to be known as Arnina Photography on July 1, 2021. During the…

A: The procedure of entering business transactions for the first time in the books of accounts is known…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Adjusting entries are those entries that are passed at the end of the period in order to accurately…

Q: relanado established the EG Travels on May 15. 2019 The following transactions occurred during the…

A: Journal entries are recording of the transaction in the accounting journal in a chronological order.…

Q: On April 5, Timothy established an interior decorating business, Tim's Design, with a cash investmen…

A: Introduction: Journal entries: Recording of a business transactions in a chronological order. First…

Q: Mr. Naveed decided to start a courier service Business in Ibra that named as Courier delivery…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.

Q: Mr. Lopez opened a mini grocery store with business name Lopez Fiesta Mart. Operations began on…

A: JOURNAL ENTRY :— journal entry is the process of Recording financial transactions. A journal entry…

Q: Mr. Arish opened Arish's Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Introduction: Ledgers: Second step in the preparation of final accounts is ledger accounts. All the…

Q: B. The following data are taken from the records of Mr. Dunkin Bakery. Mr. Baker has beginning cash…

A: The cash flow statement is prepared to estimate the net cash inflow or outflow from the business…

Q: Dyle Lagomo, Attorney-at-Law, opened his office on September 1, 2019. The following transactions…

A: As per accounting equation of the business, total assets must be equal to total liabilities and…

Q: Prepare the journal entries. If an amount box does not require an entry, leave it blank.

A: Journal entries are the initial form of recording a transaction for having financial records in a…

Q: Carmen Ramos started a business under the name of Perfect Cleaning. The following transactions…

A: Journal Entry The purpose of recording Jounral entry to make the clear picture about the transaction…

Q: Mr. Arish opened Arish's Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: On 1-1-2020, Mr. A started business of dealing in electric fans by investing cash Rs. 200000 and…

A: Accounting Equation shows a relationship between assets , liability and equity . it is based on…

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: Merchandise inventory refers to the value of goods in stock, whether it's finished goods or raw…

Q: On November 2, 2006, Mark established an interior decorating business flourishing designs. During…

A: Journal entries recording is the first step of accounting in business. Then transactions are…

Q: aaArnina established a service business to be known as Arnina Photography on July 1, 2021. During…

A: Journal entry refers to the process of recording commercial transactions for the first time in the…

Q: Mr. lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: journal entry of above transaction are as follows

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Journal entries are those where the transactions into the books of company and it is the very…

Q: Sharon Samson starts a plumbing service named Reliable Waterworks. Selected transactions are…

A: Assets: These are the resources owned and controlled by business and used to produce benefits for…

Q: On 1st April 2021, Jazni established an interior decorating business, JazniDeco. During the month,…

A: In the context of the given question, we are required to determine the effect of each transaction on…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: The financial statements of the business include the income statement and balance sheet of the firm.

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: Perpetual inventory system is a form of inventory system under which all transactions that is…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

- On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.Hajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.

- Inner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- A business has the following transactions: The business is started by receiving cash from an investor in exchange for common stock $20,000 The business purchases supplies on account $500 The business purchases furniture on account $2,000 The business renders services to various clients on account totaling $9,000 The business pays salaries $2,000 The business pays this months rent $3,000 The business pays for the supplies purchased on account. The business collects from one of its clients for services rendered earlier in the month $1,500. What is total income for the month?P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Krespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received customer payments of $965 B. supplies purchased on account $435 C. services worth $850 performed, 25% is paid in cash the rest will be billed D. corporation pays $275 for an ad in the newspaper E. bill is received for electricity used $235. F. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.