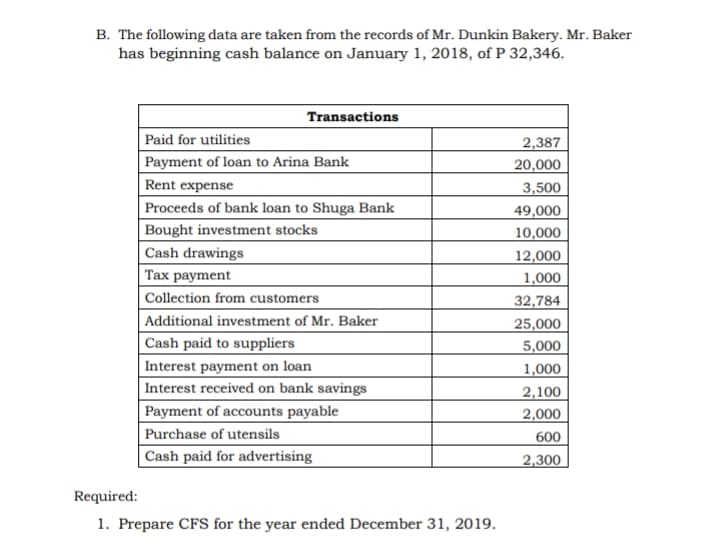

B. The following data are taken from the records of Mr. Dunkin Bakery. Mr. Baker has beginning cash balance on January 1, 2018, of P 32,346. Transactions Paid for utilities 2,387 Payment of loan to Arina Bank 20,000 Rent expense 3,500 Proceeds of bank loan to Shuga Bank 49,000 Bought investment stocks 10,000 Cash drawings 12,000 Tax payment 1,000 Collection from customers 32,784 Additional investment of Mr. Baker 25,000 Cash paid to suppliers 5,000 |Interest payment on loan 1,000 Interest received on bank savings 2,100 Payment of accounts payable 2,000 Purchase of utensils 600 Cash paid for advertising 2,300 Required: 1. Prepare CFS for the year ended December 31, 2019.

B. The following data are taken from the records of Mr. Dunkin Bakery. Mr. Baker has beginning cash balance on January 1, 2018, of P 32,346. Transactions Paid for utilities 2,387 Payment of loan to Arina Bank 20,000 Rent expense 3,500 Proceeds of bank loan to Shuga Bank 49,000 Bought investment stocks 10,000 Cash drawings 12,000 Tax payment 1,000 Collection from customers 32,784 Additional investment of Mr. Baker 25,000 Cash paid to suppliers 5,000 |Interest payment on loan 1,000 Interest received on bank savings 2,100 Payment of accounts payable 2,000 Purchase of utensils 600 Cash paid for advertising 2,300 Required: 1. Prepare CFS for the year ended December 31, 2019.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 16EA: Discuss how each of the following transactions for Watson, International, will affect assets,...

Related questions

Question

100%

Transcribed Image Text:B. The following data are taken from the records of Mr. Dunkin Bakery. Mr. Baker

has beginning cash balance on January 1, 2018, of P 32,346.

Transactions

Paid for utilities

2,387

20,000

Payment of loan to Arina Bank

Rent expense

3,500

Proceeds of bank loan to Shuga Bank

49,000

Bought investment stocks

10,000

Cash drawings

|Таx раyment

12,000

1,000

Collection from customers

32,784

Additional investment of Mr. Baker

25,000

Cash paid to suppliers

5,000

| Interest payment on loan

Interest received on bank savings

1,000

2,100

Payment of accounts payable

2,000

Purchase of utensils

600

| Cash paid for advertising

2,300

Required:

1. Prepare CFS for the year ended December 31, 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning