a. Outstanding checks, $670. b. Deposits in transit, $1,500. C. NSF check from customer, no. 548, for $175. d. Bank collection of note receivable of $800, and interest of $80. e. Interest earned on bank balance, $20. f. Service charge, $10. g. The business credited Cash for $200. The correct amount was $2,000. h. The bank incorrectly decreased the business's by $350 for a check written by another business.

a. Outstanding checks, $670. b. Deposits in transit, $1,500. C. NSF check from customer, no. 548, for $175. d. Bank collection of note receivable of $800, and interest of $80. e. Interest earned on bank balance, $20. f. Service charge, $10. g. The business credited Cash for $200. The correct amount was $2,000. h. The bank incorrectly decreased the business's by $350 for a check written by another business.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 11EB: Using the following information, prepare a bank reconciliation. Bank balance: $12,565. Book...

Related questions

Question

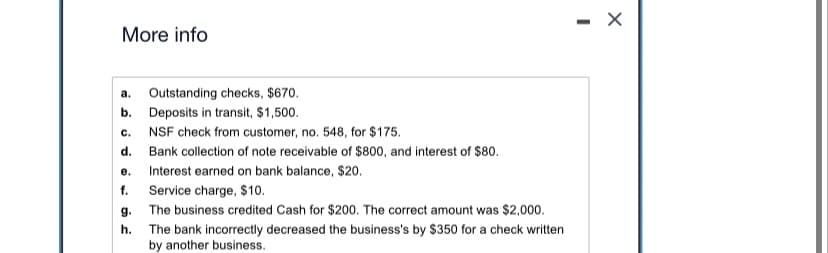

Transcribed Image Text:More info

a.

Outstanding checks, $670.

b. Deposits in transit, $1,500.

C.

NSF check from customer, no. 548, for $175.

d. Bank collection of note receivable of $800, and interest of $80.

Interest earned on bank balance, $20.

e.

f.

g.

h.

Service charge, $10.

The business credited Cash for $200. The correct amount was $2,000.

The bank incorrectly decreased the business's by $350 for a check written

by another business.

X

Transcribed Image Text:The following items could appear on a bank reconciliation:

Click the icon to view the items.)

Classify each item as (1) an addition to the book balance, (2) a subtraction from the book balance, (3) an addition to

the bank balance, or (4) a subtraction from the bank balance.

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage