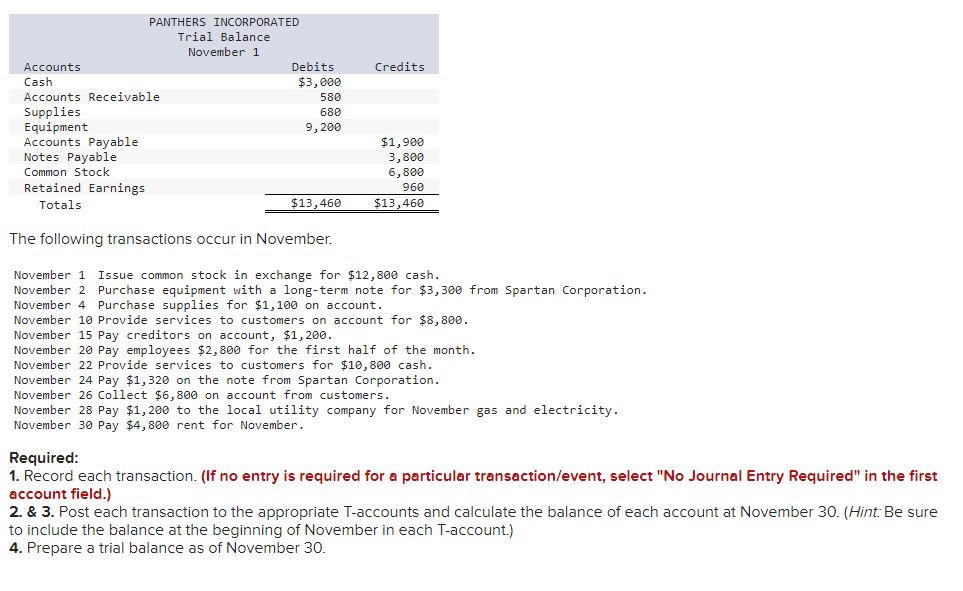

PANTHERS INCORPORATED Trial Balance November 1 Accounts Cash Accounts Receivable Supplies Equipment Accounts Payable Debits $3,000 580 680 9,200 Credits $13,460 $1,900 3,800 6,800 960 $13,460 Notes Payable Common Stock Retained Earnings Totals The following transactions occur in November. November 1 Issue common stock in exchange for $12,800 cash. November 2 Purchase equipment with a long-term note for $3,300 from Spartan Corporation. November 4 Purchase supplies for $1,100 on account. November 10 Provide services to customers on account for $8,800. November 15 Pay creditors on account, $1,200. November 20 Pay employees $2,800 for the first half of the month. November 22 Provide services to customers for $10,800 cash. November 24 Pay $1,320 on the note from Spartan Corporation. November 26 Collect $6,800 on account from customers. November 28 Pay $1,200 to the local utility company for November gas and electricity. November 30 Pay $4,800 rent for November. Required: 1. Record each transaction. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) 2. & 3. Post each transaction to the appropriate T-accounts and calculate the balance of each account at November 30. (Hint: Be sure to include the balance at the beginning of November in each T-account.) 4. Prepare a trial balance as of November 30.

PANTHERS INCORPORATED Trial Balance November 1 Accounts Cash Accounts Receivable Supplies Equipment Accounts Payable Debits $3,000 580 680 9,200 Credits $13,460 $1,900 3,800 6,800 960 $13,460 Notes Payable Common Stock Retained Earnings Totals The following transactions occur in November. November 1 Issue common stock in exchange for $12,800 cash. November 2 Purchase equipment with a long-term note for $3,300 from Spartan Corporation. November 4 Purchase supplies for $1,100 on account. November 10 Provide services to customers on account for $8,800. November 15 Pay creditors on account, $1,200. November 20 Pay employees $2,800 for the first half of the month. November 22 Provide services to customers for $10,800 cash. November 24 Pay $1,320 on the note from Spartan Corporation. November 26 Collect $6,800 on account from customers. November 28 Pay $1,200 to the local utility company for November gas and electricity. November 30 Pay $4,800 rent for November. Required: 1. Record each transaction. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) 2. & 3. Post each transaction to the appropriate T-accounts and calculate the balance of each account at November 30. (Hint: Be sure to include the balance at the beginning of November in each T-account.) 4. Prepare a trial balance as of November 30.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 6PB: Single-step income Statement and balance sheet Selected accounts and related amounts for Kanpur Co....

Related questions

Question

sd

subjet-Accounting

Transcribed Image Text:PANTHERS INCORPORATED

Trial Balance

November 1

Accounts

Cash

Accounts Receivable

Supplies

Equipment

Accounts Payable

Notes Payable

Common Stock

Retained Earnings

Totals

Debits

$3,000

580

680

9, 200

$13,460

The following transactions occur in November.

Credits

$1,900

3,800

6,800

960

$13,460

November 1 Issue common stock in exchange for $12,800 cash.

November 2 Purchase equipment with a long-term note for $3,300 from Spartan Corporation.

November 4 Purchase supplies for $1,100 on account.

November 10 Provide services to customers on account for $8,800.

November 15 Pay creditors on account, $1,200.

November 20 Pay employees $2,800 for the first half of the month.

November 22 Provide services to customers for $10,800 cash.

November 24 Pay $1,320 on the note from Spartan Corporation.

November 26 Collect $6,800 on account from customers.

November 28 Pay $1,200 to the local utility company for November gas and electricity.

November 30 Pay $4,800 rent for November.

Required:

1. Record each transaction. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first

account field.)

2. & 3. Post each transaction to the appropriate T-accounts and calculate the balance of each account at November 30. (Hint: Be sure

to include the balance at the beginning of November in each T-account.)

4. Prepare a trial balance as of November 30.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning