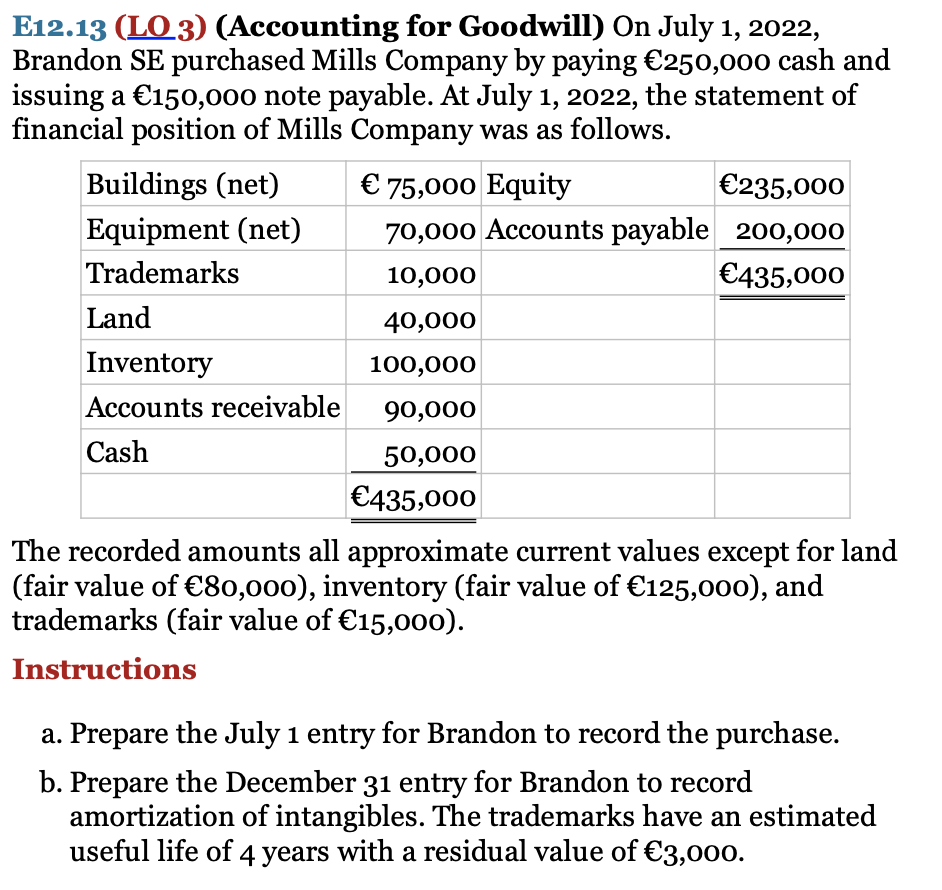

a. Prepare the July 1 entry for Brandon to record the purchase. b. Prepare the December 31 entry for Brandon to record amortization of intangibles. The trademarks have an estimated useful life of 4 years with a residual value of €3,000.

Q: AASB 116 ‘Property, Plant and Equipment’.

A: Recognition - It is pertinent to note that Property , Plant and equipment can be capitalized in the…

Q: Lake Company, organized in 2020, has the following transactions related to intangible assets in that…

A: The question is related to Intangible Assets. The intangible assets will be amortised over a period…

Q: A. On July 1, 2020 ABC Co. purchased a patent for $ 2,400,000. The patent legally protects the owner…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: On September 30, 2018, the Company exchanged old delivery equipment and RM24,000 cash for new…

A: Depreciation is a non-cash expense which is recorded in the books to report the regular wear and…

Q: 2 For the tangible and Intanglble assets acqulred In the preceding transactions, determine the…

A: Depreciation and amortization is a decrease in the value of assets on account of their use in…

Q: A. Manam Co. purchased a Trademark for $ 160,000 on October 1, 2020. The Trademark is legally used…

A: Amortization on Trademark for year 2020 = $160,00010 years ×3 months12 months = $4,000 Yearly…

Q: Oriole Ltd. has these transactions related to intangible assets and goodwill in 2021, its first year…

A: The procedure of entering business transactions for first time in the books of accounts is known as…

Q: Crane Company, organized in 2019, has set up a single account for all intangible assets. The…

A: >Intangible assets are those assets that cannot be seen or touched and have no physical…

Q: Pebbles coatings has acquired a building for its coating process at the beginning of the year at the…

A: Straight line depreciation is an kind of method used to calculate depreciation of various assets.…

Q: Question 7.17 please explained in detail.

A: Assets: Assets are the resources of an organization used for the purpose of business operations.…

Q: On December 31, 2021, the company exchanged old motor vehicles and RM48,000 for new motor vehicles.…

A: Since you have posted a question with multiple sub-parts, we will be solving the first three for…

Q: On January 1, 2018, an entity purchased a machine for P7,200,000 and depreciated it by the…

A: Annual Depreciation = (Cost of the machine - Salvage value) / Expected life of the assets =…

Q: Springer Company had three Intangible assets at the end of 2020 (end of the accounting year): a. A…

A: The company has three intangible assets: Copyright Goodwill Patent The life of the "Copyright" is…

Q: 1. A warehouse building is constructed at a first cost of P7.5M and with an estimated salvage value…

A: Depreciation means the amount of expenses written off from the value of fixed assets used in…

Q: Abby Corporation acquired a new processing machine. Details of the acquisition are as follows:…

A: Capitaliztion is defined as the procedure of converting the stream of income to the capital value of…

Q: TLM Technologies had these transactions related to intangible assets during the year. Jan. 2…

A: A patent seems to be the awarding of a set of rights to an innovator by a governing power. In return…

Q: D. AMORTIZATION OF INTANGIBLE ASSETS Harper Company, established in 2019, has the following…

A: Journal entry: It can be defined as the recording of financial events and transactions that have…

Q: Richie purchased factory equipment on 1 January 2021 with an invoice price of RM80,000. Other costs…

A: >Capitalization of Cost of long term asset. --The accounting principle states that all the cost…

Q: Ze corporation purchased a machine for P1 million. Freight and installation charges amounted to 3%…

A: Depreciation - It refers to the fall in the value of fixed assets due to wear and tear. It's a…

Q: Gled Limited began the construction of a new building on 1 February 2015. The building is a…

A:

Q: Barb Company has provided information on intangible assets as follows:1. A patent was purchased from…

A: The question is related to Measurement and Valuation of Intangible Assets to be shown in the Asset…

Q: On January 1, 20x1, DOC WILLIE Company acquired equipment from Catanduanes Factory Supplies with an…

A: Note: As per the norms of Bartleby, in case of many independent questions, 1 question can be…

Q: On July 1, 2004, Gonzalez Corporation purchased factory equipment for P450,000. Salvage value was…

A: The depreciation expense is charged on fixed assets as reduction in the value of fixed assets with…

Q: The following intangible assets were purchased by Goldstein Corporation: A. A patent with a…

A: An intangible asset is one which cannot be touched or seen and do not have any physical appearance…

Q: X purchased a secondhand machinery on 1-2-2018 for Ro.50,000 paid Ro.11,000 for its overhauling and…

A: Depreciation is a costing technique that allocates the cost of a tangible or physical asset's useful…

Q: Munn Inc. has transactions and other information relating to intangible assets as follows. 1. Munn…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Binson Company has provided information on intangible assets as follows: A patent was purchased…

A: Binson company Intangible section of Balance sheet As on December 31, 2019 Patent, net…

Q: Bramble Company, organized in 2020, has the following transactions related to intangible assets.…

A: SOLUTION WORKING NOTE AMORTIZATION EXPENSE- PATENT (474000/6) = 79000. FRANCHISE (588000/14) /2=…

Q: Janes Company provided the following information on intangible assets: A patent was purchased from…

A: Intangible assets are the assets which are not visible in nature but contains value which generates…

Q: Guru Berhad year end is every 31 December. Guru Berhad acquired a warehouse for RM20 million on 1…

A: Impairment of assets means reducing the book value of assets when carrying amount is more than…

Q: On 1 July 20X7 Brown Ltd bought a machine for GHS 48,000. The machine was depreciated at 25% per…

A: given that, cost of the asset as of 1 July 2007 = GHS48000 Rate of depreciation = 25% the…

Q: January 1, 2020, Caleb Co acquired the following intangible assets: A trademark for…

A: An impairment loss is the carrying amount of an asset that is in excess of its recoverable amount.…

Q: During 2021, ABC Co. purchased intangible assets and debited them all to "Intangible assets".…

A: (a)

Q: Bluestone Company had three intangible assets at the end of the current year: A patent purchased…

A: Intangible Assets According to IAS 38 which specifies the standards for identifying and valuing…

Q: Barb Company has provided information on intangible assets as follows:1. A patent was purchased from…

A: The question is related to Measurement and Valuation of Intangible Assets to be shown in the Asset…

Q: On December 31, it was estimated that a goodwill of $1,500,000was impaired. I addition on…

A: Date General, Journal Debit Credit 31-Dec Loss from impaired Goodwill $1,500,000…

Q: Concord Company, organized in 2020, has the following transactions related to intangible assets.…

A: working notes: Amortization expense patents=(350,000/5)=70,000 Franchise=(360,000/12)*1/2=15,000

Q: Abby Corporation acquired a new processing machine. Details of the acquisition are as follows:…

A: Abby corporation's Acquired new processing machine = P300000 1. Invoice cost = P300000 Discount on…

Q: May I ask for help with this question? I got an answer of 37,500 (Rounded Up) Please check. On…

A: The amortization of expense is the write-off of an intangible asset as per its legal useful life.

Q: SMC purchased an equipment for P53,000 and paid P1,500 for freight and delivery charges to the job…

A: Total value of asset (V) = Purchase cost + Freight and delivery cost = P 53000 + P 1500 = P 54500…

Q: On 1 July 20X7 Brown Ltd bought a machine for GHS 48,000. The machine was depreciated at 25% per…

A: Depreciation is an estimate by the company as to what value of assets is being used each year. This…

Q: On January 2, Bering Co. disposes of a machine costing $44,000 with accumulated depreciation of…

A: Gain (loss) on sale of assets = Sales value of the assets - Net book value of assets where. Net book…

Q: Abby Corporation acquired a new processing machine. Details of the acquisition are as follows:…

A: A fixed asset is the asset which is held for use in the operations or for other administrative uses.…

Q: Klaus, Inc. has the ff. information regarding their intangible assets. Klaus spent P2,600,000 of…

A: Introduction Patent : - It…

Q: Peter M. Dell Co. purchased equipment for $510,000 which was estimated to have a useful life of 10…

A: a. No entry is required to correct the prior Years' depreciation

Q: At the beginning of the year, a company acquired a patent for $830,000, and also a trademark for…

A: Note: Trademark is not amortized because it is considered to have an infinite useful life.

Q: haroah Limited organized late in 2019 and set up a single account for all intangible assets. The…

A: The practice of documenting commercial transactions for the first time in the books of accounts is…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- On 1 November 2020, Bermuda Ltd acquired all the assets and liabilities (other than cash) of Triangle Ltd. The details on the assets and liabilities of Triangle Ltd were as follows: Carrying Amount Fair Value Cash 30,000 30,000 Equipment 120,000 140,000 Accounts Receivable 25,000 25,000 Furniture 35,000 25,000 Accounts Payable 10,000 10,000 Income tax Payable 19,000 19,000 Annual Leave Payable 14,000 14,000 In addition to the above items, Triangle Ltd had an internally generated brand name with a fair value of $75,000 that was not recognized in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition-related costs. The tax rate is 30%. Required: Conduct an acquisition analysis for BermudaOn 1 November 2020, Bermuda Ltd acquired all the assets and liabilities (other than cash) of Triangle Ltd. The details on the assets and liabilities of Triangle Ltd were as follows: Carrying Amount Fair Value Cash 30,000 30,000 Equipment 120,000 140,000 Accounts Receivable 25,000 25,000 Furniture 35,000 25,000 Accounts Payable 10,000 10,000 Income tax Payable 19,000 19,000 Annual Leave Payable 14,000 14,000 In addition to the above items Triangle Ltd had an internally generated brand name with a fair value of $75,000 that was not recognised in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition related costs. Tax rate is 30%.38. On October 1, 2021, a company declared to its shareholders a property dividend in the form of pieces of equipment with carrying amount of P960,000 (acquired on October 1, 2015 for P2,400,000). The dividends are for distribution on January 31, 2022. The company provided the following estimate of the asset’ fair value: October 1, 2021 P1,050,000 December 31, 2021 1,020,000 January 31, 2022 1,110,000 What amount will be reported in 2021 statement of profit or loss as a result of the foregoing transactions?

- Ma2. On May 28, 2024, Pesky Corporation acquired all of the outstanding common stock of Harman, Incorporated, for $420 million. The fair value of Harman's identifiable tangible and intangible assets totaled $512 million, and the fair value of liabilities assumed by Pesky was $150 million. Pesky performed a goodwill impairment test at the end of its fiscal year ended December 31, 2024. Management has provided the following information: Fair value of Harman, Incorporated $ 400 million Fair value of Harman’s net assets (excluding goodwill) 370 million Book value of Harman’s net assets (including goodwill) 410 million Required: Determine the amount of goodwill that resulted from the Harman acquisition. Determine the amount of goodwill impairment loss that Pesky should recognize at the end of 2024, if any. If an impairment loss is required, prepare the journal entry to record the lossL2-4 Awe Company pays CU500,000,000 for a 30% interest in Groy Company on July 1, 19x2 when the book value of Groy Company's net assets equals fair value. Awe Company amortizes any goodwill from this investment over 20 years. Information related to Groy Company is as follows: 31 Desember 19x1 31 Desember 19x2 Share capital, nominal IDR 1,000 Rp600.000.000 Rp600.000.000 Retained earning 400.000.000 500.000.000 Total Shareholders' Equity 1.000.000.000 1.100.000.000 Net profit earned during the year 19x2 200.000.000 Dividend for the year 19x2 (paid on March 1 of Rp. 50,000,000 and September 1 of Rp. 50,000,000) 100.000.000 Required: calculate Awe Company's revenue from Groy Company for the year 19x26. On January 2, 2019, U Co. purchased 75% of the outstanding shares of N Co. resulting to a goodwill of P60,000. On that date, the non-cash assets of N Co. whose book values did not equal their book values were accounts receivable which was overstated by P4,500 and equipment with a remaining 5 year life on the purchase date which was understated by P50,000. For the year 2010, U and N reported net income of P350,000 and P200,000 each respectively. U’s beginning inventory included merchandise purchased from N Company amounting to P39,000 which was sold to them by N at a 30% markup, 80% of these goods were sold during the year. N, on the other hand, included inventory items which they purchased from U Co. amounting to 18,000. These goods were sold by U at a 25% markup. 90% of these goods were sold by N for the year. What is the Noncontrolling interest's share in the Net income of the subsidiary?

- On January 2, 2030, Esko Corp. acquired all the net assets of Tolits Inc. Esko Corp. paid P6,000,000 for the net assets of Tolits Inc. On this date, the following accounts of Tolits, Inc. are as follows: Cash – P150,000; Accounts Receivable – P1,600,000; Inventories – P600,000; Property, plant, and equipment – P2,600,000; Accounts Payable – P1,400,000. On the date of acquisition, it was determined that the fair values of inventories and property, plant, and equipment were P660,000 and P3,400,000, respectively. Esko Corp. has estimated a restructuring provision of P500,000 representing costs of exiting the activity of Tolits Inc., cost of terminating the employees of Tolits Inc. Compute the goodwill or gain from acquisition. * a. P 2,950,000 b. P 1,590,000 c. P 2,090,000 d. P 2,450,000 pls. answer it asap thank you:)7. On January 2, 2019, U Co. purchased 75% of the outstanding shares of N Co. resulting to a goodwill of P60,000. On that date, the non-cash assets of N Co. whose book values did not equal their book values were accounts receivable which was overstated by P4,500 and equipment with a remaining 5 year life on the purchase date which was understated by P50,000. For the year 2010, U and N reported net income of P350,000 and P200,000 each respectively. U’s beginning inventory included merchandise purchased from N Company amounting to P39,000 which was sold to them by N at a 30% markup, 80% of these goods were sold during the year. N, on the other hand, included inventory items which they purchased from U Co. amounting to 18,000. These goods were sold by U at a 25% markup. 90% of these goods were sold by N for the year. Compute for the Equity Shareholder's Net IncomeOn January 30, 2021, XYZ Corporation, a non-VAT registered company, purchased from ABC Corporation, a VAT registered company, goods and paid a total amount P156,800, inclusive of VAT. on February 1, 2021, XYZ Corporation became liable to VAT. The goods were sold on February 28, 2021 for P280,000, VAT inclusive. Compute for the VAT payable P30,000 P13,200 P27,200 P16,800

- Orange Company’s ledger revealed the following account balances as of December 31, 2020: Unamortized discount on bonds payable P120,000; Organization costs P100,000; Losses in early years of company P450,000; Trademarks P750,000 Patents P150,000; Amount set up by BOD as goodwill P300,000. How much should be presented as intangible assets shown In the statement of financial position? * P1,300,000 P1,000,000 P900,000 P0 answer not given16 All the issued and outstanding common stock of MOA Company were brought by Aura Company on October 1, 2020 for P700,000. The assets and liabilities of Aura Company were: Cash 50,000 Accounts receivable (net of P25,000 allowance for bad debts) 250,000 Inventory 150,000 Property & Equipment (net of P100,000, allowance for depreciation) 300,000 Accounts payable 130,000 On October 1, 2020 the fair value of the following assets was as follows: Accounts receivable (net) 235,000 Inventory 130,000 Property & equipment (net) 400,000 There is an unrecorded warranty liability on prior-product sales estimated P20,000 discounted cash flow based on estimated future cash flows. The amount of goodwill as a result of the business combination should be: Group of answer choices 65,000 100,000 35,000 ZeroBlue sky company’s balance sheet dated 12/31/2020 reports 6 million And assets in 2.4 million in liabilities book values for all the firms assets, approximate their fair values except for land which has the book value that is 360,000 lower than it’s fair value on December 31 Horatio corporation pay 6.12 million to acquire blue sky as a result of the purchase, Horacio should record a Goodwill amount of. please give me answer fast