a. Provide the Journal entries

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 7EA: Homeland Plus specializes in home goods and accessories. In order for the company to expand its...

Related questions

Question

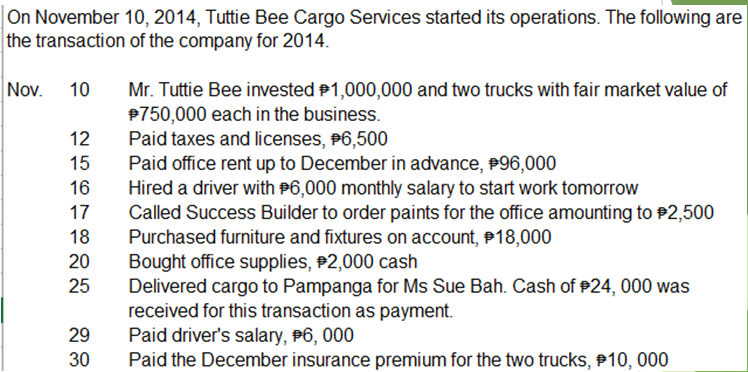

Transcribed Image Text:On November 10, 2014, Tuttie Bee Cargo Services started its operations. The following are

the transaction of the company for 2014.

Nov. 10

Mr. Tuttie Bee invested 1,000,000 and two trucks with fair market value of

$750,000 each in the business.

12

Paid taxes and licenses, #6,500

15

Paid office rent up to December in advance, 96,000

16

Hired a driver with #6,000 monthly salary to start work tomorrow

17

Called Success Builder to order paints for the office amounting to $2,500

Purchased furniture and fixtures on account, $18,000

18

20

Bought office supplies, #2,000 cash

25

Delivered cargo to Pampanga for Ms Sue Bah. Cash of $24,000 was

received for this transaction as payment.

29

Paid driver's salary, #6, 000

30

Paid the December insurance premium for the two trucks, #10, 000

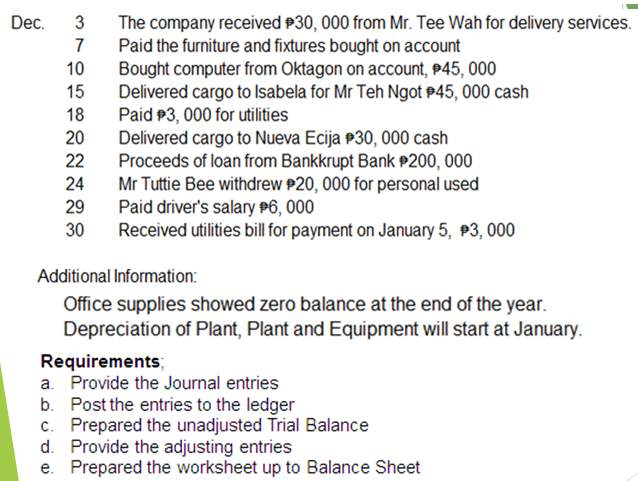

Transcribed Image Text:Dec.

3

The company received #30, 000 from Mr. Tee Wah for delivery services.

Paid the furniture and fixtures bought on account

7

10

Bought computer from Oktagon on account, $45, 000

15

Delivered cargo to Isabela for Mr Teh Ngot $45,000 cash

Paid $3,000 for utilities

18

20

22

Delivered cargo to Nueva Ecija #30, 000 cash

Proceeds of loan from Bankkrupt Bank $200,000

Mr Tuttie Bee withdrew $20,000 for personal used

Paid driver's salary $6,000

24

29

30

Received utilities bill for payment on January 5, $3,000

Additional Information:

Office supplies showed zero balance at the end of the year.

Depreciation of Plant, Plant and Equipment will start at January.

Requirements;

a. Provide the Journal entries

b. Post the entries to the ledger

c.

Prepared the unadjusted Trial Balance

d. Provide the adjusting entries

e. Prepared the worksheet up to Balance Sheet

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning