a. The balance in preferred stock after the $0.10 cash dividend is $. (Round to the nearest dollar.) The balance in common stock after the $0.10 cash dividend is $. (Round to the nearest dollar.) The balance in paid-in capital after the $0.10 cash dividend is $ (Round to the nearest dollar.)

a. The balance in preferred stock after the $0.10 cash dividend is $. (Round to the nearest dollar.) The balance in common stock after the $0.10 cash dividend is $. (Round to the nearest dollar.) The balance in paid-in capital after the $0.10 cash dividend is $ (Round to the nearest dollar.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 67E: Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its...

Related questions

Question

Transcribed Image Text:Home

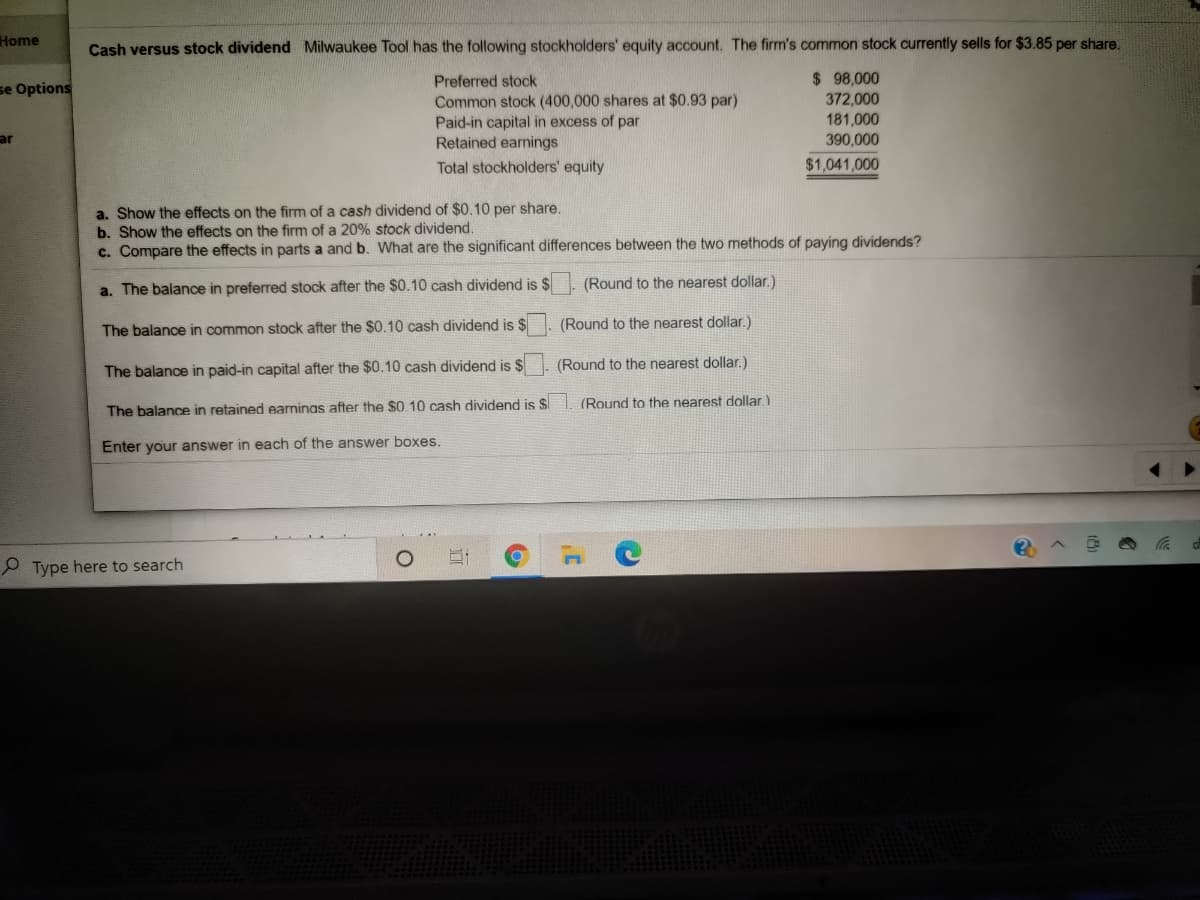

Cash versus stock dividend Milwaukee Tool has the following stockholders' equity account. The firm's common stock currently sells for $3.85 per share.

$ 98,000

372,000

181,000

390,000

Preferred stock

se Options

Common stock (400,000 shares at $0.93 par)

Paid-in capital in excess of par

Retained earnings

ar

Total stockholders' equity

$1,041,000

a. Show the effects on the firm of a cash dividend of $0.10 per share.

b. Show the effects on the firm of a 20% stock dividend.

c. Compare the effects in parts a and b. What are the significant differences between the two methods of paying dividends?

a. The balance in preferred stock after the $0.10 cash dividend is $

(Round to the nearest dollar.)

(Round to the nearest dollar.)

The balance in common stock after the $0.10 cash dividend is $

(Round to the nearest dollar.)

The balance in paid-in capital after the $0.10 cash dividend is $

The balance in retained earnings after the $0.10 cash dividend is $1. (Round to the nearest dollar.)

Enter your answer in each of the answer boxes.

O Type here to search

Transcribed Image Text:e

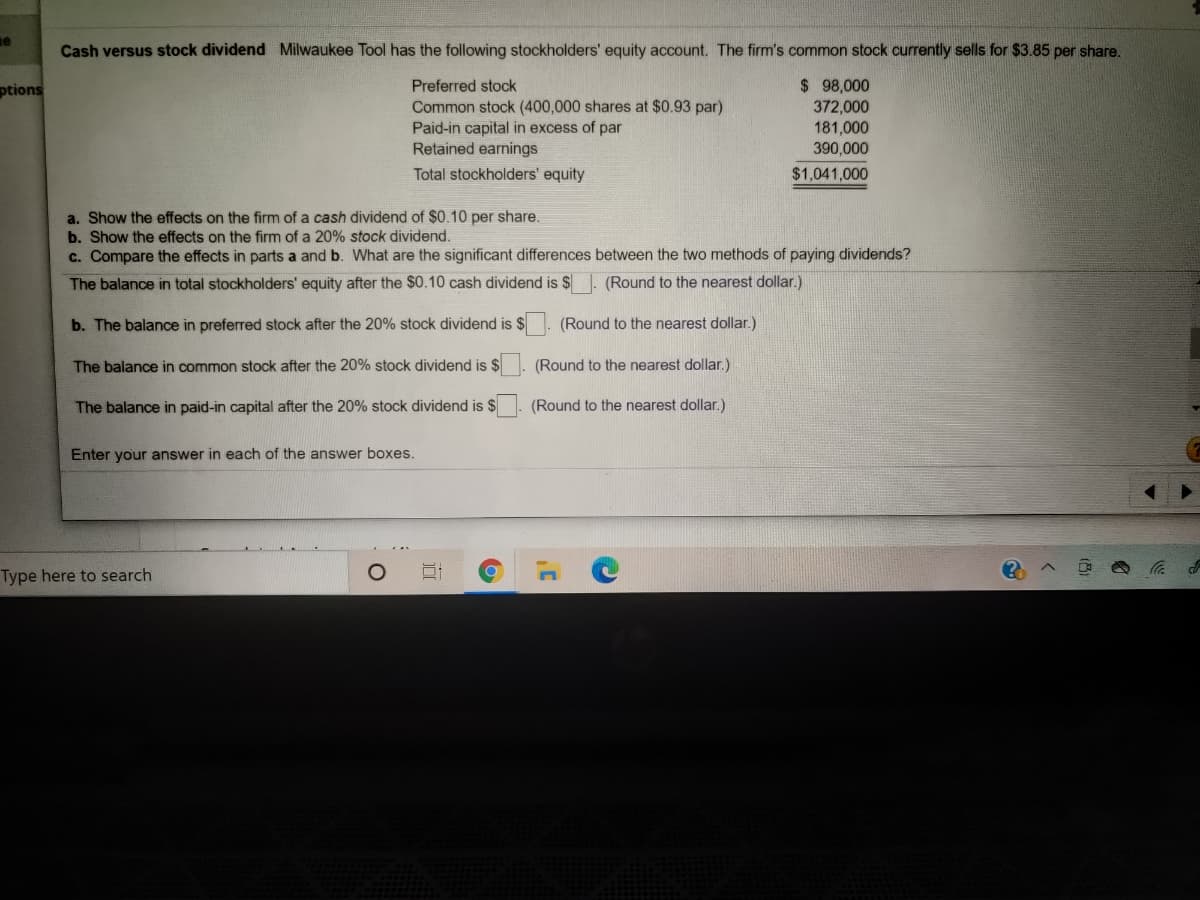

Cash versus stock dividend Milwaukee Tool has the following stockholders' equity account. The firm's common stock currently sells for $3.85 per share.

$ 98,000

372,000

ptions

Preferred stock

Common stock (400,000 shares at $0.93 par)

Paid-in capital in excess of par

Retained earnings

181,000

390,000

Total stockholders' equity

$1,041,000

a. Show the effects on the firm of a cash dividend of $0.10 per share.

b. Show the effects on the firm of a 20% stock dividend.

c. Compare the effects in parts a and b. What are the significant differences between the two methods of paying dividends?

The balance in total stockholders' equity after the $0.10 cash dividend is $ . (Round to the nearest dollar.)

b. The balance in preferred stock after the 20% stock dividend is $

(Round to the nearest dollar.)

The balance in common stock after the 20% stock dividend is $

(Round to the nearest dollar.)

The balance in paid-in capital after the 20% stock dividend is $

(Round to the nearest dollar.)

Enter your answer in each of the answer boxes.

Type here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning