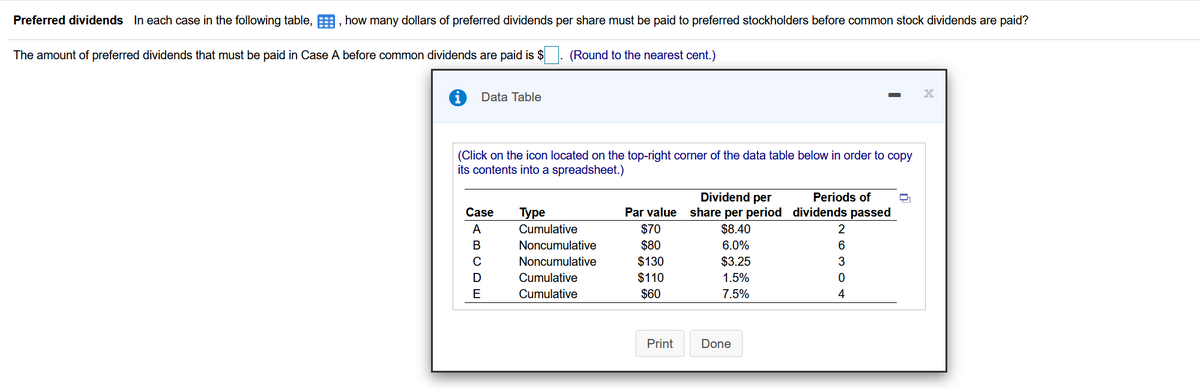

Preferred dividends In each case in the following table, E, how many dollars of preferred dividends per share must be paid to preferred stockholders before common stock dividends are paid? The amount of preferred dividends that must be paid in Case A before common dividends are paid is $. (Round to the nearest cent.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Dividend per Periods of Туре Cumulative Case Par value share per period dividends passed $70 A $8.40 B Noncumulative $80 6.0% 6 Noncumulative $130 $3.25 3 D Cumulative $110 1.5% E Cumulative $60 7.5% Print Done

Preferred dividends In each case in the following table, E, how many dollars of preferred dividends per share must be paid to preferred stockholders before common stock dividends are paid? The amount of preferred dividends that must be paid in Case A before common dividends are paid is $. (Round to the nearest cent.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Dividend per Periods of Туре Cumulative Case Par value share per period dividends passed $70 A $8.40 B Noncumulative $80 6.0% 6 Noncumulative $130 $3.25 3 D Cumulative $110 1.5% E Cumulative $60 7.5% Print Done

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.12E

Related questions

Question

Transcribed Image Text:Preferred dividends In each case in the following table,

how many dollars of preferred dividends per share must be paid to preferred stockholders before common stock dividends are paid?

The amount of preferred dividends that must be paid in Case A before common dividends are paid is $ . (Round to the nearest cent.)

Data Table

(Click on the icon located on the top-right corner of the data table below in order to copy

its contents into a spreadsheet.)

Dividend per

HTT

Periods of

Case

Туре

Par value share per period dividends passed

$70

$80

$130

$110

$60

A

Cumulative

$8.40

2

В

Noncumulative

6.0%

6.

Noncumulative

$3.25

Cumulative

1.5%

E

Cumulative

7.5%

4

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning