a. Whether you should use a long or short forward contract to hedge the currency risk. Long position in forward contract O Short position in forward contract b. Calculate the no-arbitrage price at which you could enter into a forward contract that expires in 30 days. (Do not round intermediate calculations. Round your answer to 4 decimal places.) No-arbitrage price c. Move forward 10 days. The spot rate is $3.43. Interest rates are unchanged. Calculate the value of your forward position. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Forward position

a. Whether you should use a long or short forward contract to hedge the currency risk. Long position in forward contract O Short position in forward contract b. Calculate the no-arbitrage price at which you could enter into a forward contract that expires in 30 days. (Do not round intermediate calculations. Round your answer to 4 decimal places.) No-arbitrage price c. Move forward 10 days. The spot rate is $3.43. Interest rates are unchanged. Calculate the value of your forward position. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Forward position

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter11: Foreign Exchange, Trade, And Bubbles

Section: Chapter Questions

Problem 7MC

Related questions

Question

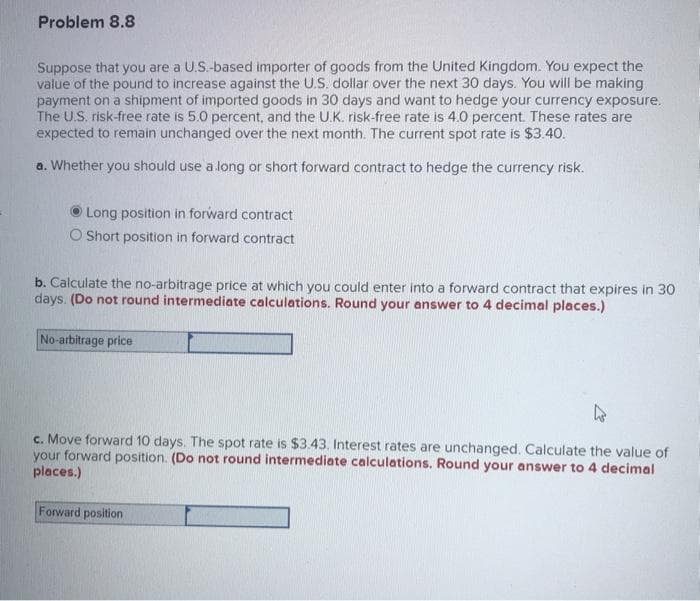

Transcribed Image Text:Problem 8.8

Suppose that you are a U.S.-based importer of goods from the United Kingdom. You expect the

value of the pound to increase against the U.S. dollar over the next 30 days. You will be making

payment on a shipment of imported goods in 30 days and want to hedge your currency exposure.

The U.S. risk-free rate is 5.0 percent, and the U.K. risk-free rate is 4.0 percent. These rates are

expected to remain unchanged over the next month. The current spot rate is $3.40.

a. Whether you should use a long or short forward contract to hedge the currency risk.

Long position in forward contract

O Short position in forward contract

b. Calculate the no-arbitrage price at which you could enter into a forward contract that expires in 30

days. (Do not round intermediate calculations. Round your answer to 4 decimal places.)

No-arbitrage price

c. Move forward 10 days. The spot rate is $3.43. Interest rates are unchanged. Calculate the value of

your forward position. (Do not round intermediate calculations. Round your answer to 4 decimal

places.)

Forward position

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc