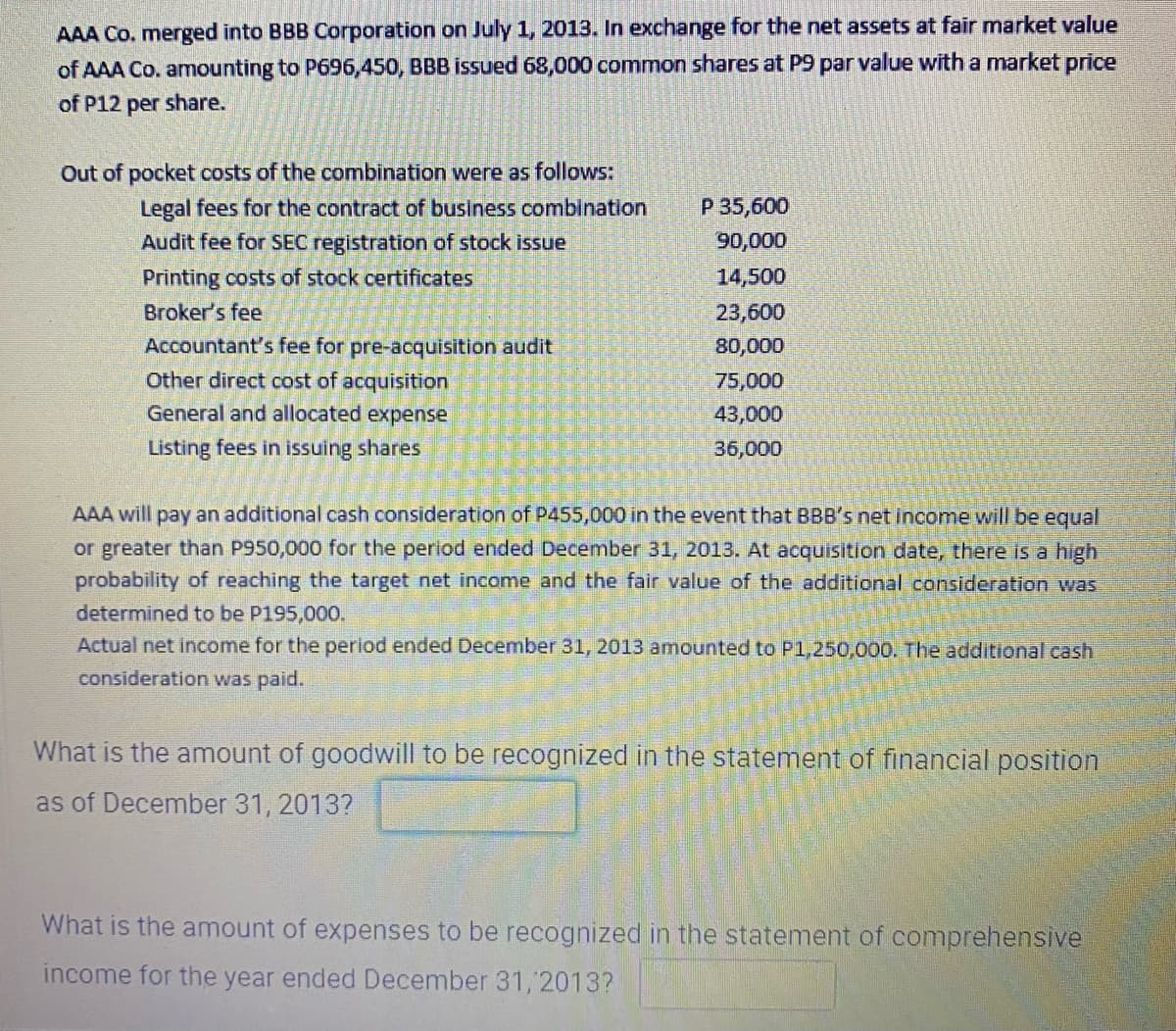

AAA Co. merged into BBB Corporation on July 1, 2013. In exchange tor the net assets at fair market value of AAA Co. amounting to P696,450, BBB issued 68,000 common shares at P9 par value with a market price of P12 per share. Out of pocket costs of the combination were as follows: P 35,600 Legal fees for the contract of business combination Audit fee for SEC registration of stock issue 90,000 Printing costs of stock certificates 14,500 Broker's fee 23,600 Accountant's fee for pre-acquisition audit 80,000 Other direct cost of acquisition 75,000 General and allocated expense 43,000 Listing fees in issuing shares 36,000 AAA will pay an additional cash consideration of P455,000 in the event that BBB's net income will be equal or greater than P950,000 for the period ended December 31, 2013. At acquisition date, there is a high probability of reaching the target net income and the fair value of the additional consideration was determined to be P195,000. Actual net income for the period ended December 31, 2013 amounted to P1,250,000. The additional cash consideration was paid. What is the amount of goodwill to be recognized in the statement of financial position as of December 31, 2013? What is the amount of expenses to be recognized in the statement of comprehensive income for the year ended December 31, 2013?

AAA Co. merged into BBB Corporation on July 1, 2013. In exchange tor the net assets at fair market value of AAA Co. amounting to P696,450, BBB issued 68,000 common shares at P9 par value with a market price of P12 per share. Out of pocket costs of the combination were as follows: P 35,600 Legal fees for the contract of business combination Audit fee for SEC registration of stock issue 90,000 Printing costs of stock certificates 14,500 Broker's fee 23,600 Accountant's fee for pre-acquisition audit 80,000 Other direct cost of acquisition 75,000 General and allocated expense 43,000 Listing fees in issuing shares 36,000 AAA will pay an additional cash consideration of P455,000 in the event that BBB's net income will be equal or greater than P950,000 for the period ended December 31, 2013. At acquisition date, there is a high probability of reaching the target net income and the fair value of the additional consideration was determined to be P195,000. Actual net income for the period ended December 31, 2013 amounted to P1,250,000. The additional cash consideration was paid. What is the amount of goodwill to be recognized in the statement of financial position as of December 31, 2013? What is the amount of expenses to be recognized in the statement of comprehensive income for the year ended December 31, 2013?

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:AAA Co. merged into BBB Corporation on July 1, 2013. In exchange for the net assets at fair market value

of AAA Co. amounting to P696,450, BBB issued 68,000 common shares at P9 par value with a market price

of P12 per share.

Out of pocket costs of the combination were as follows:

Legal fees for the contract of business combination

P 35,600

Audit fee for SEC registration of stock issue

90,000

Printing costs of stock certificates

14,500

Broker's fee

23,600

Accountant's fee for pre-acquisition audit

80,000

Other direct cost of acquisition

General and allocated expense

75,000

43,000

Listing fees in issuing shares

36,000

AAA will pay an additional cash consideration of P455,000 in the event that BBB's net income will be equal

or greater than P950,000 for the period ended December 31, 2013. At acquisition date, there is a high

probability of reaching the target net income and the fair value of the additional consideration was

determined to be P195,000.

Actual net income for the period ended December 31, 2013 amounted to P1,250,000. The additional cash

consideration was paid.

What is the amount of goodwill to be recognized in the statement of financial position

as of December 31, 2013?

What is the amount of expenses to be recognized in the statement of comprehensive

income for the year ended December 31, 2013?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College