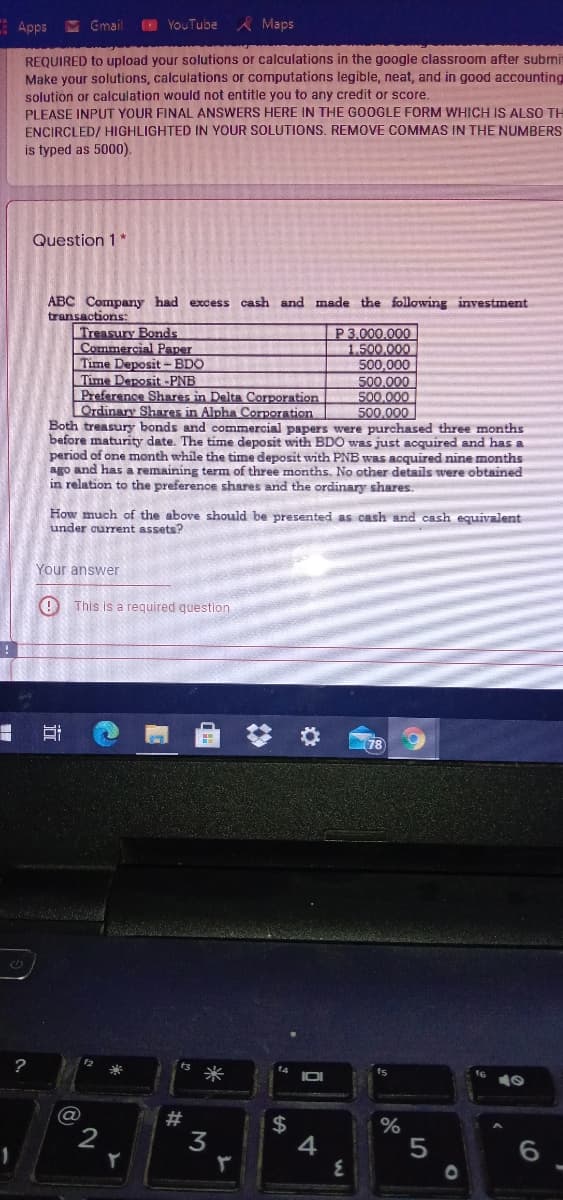

ABC Company had excess cash and made the following investment transactions: Treasury Bonds Commercial Paner Time Deposit-BDO Time Derosit -PNB Preference Shares in Delta Corporation Ordinary Shares in Alpha Corporation Both treasury bonds and commercial papers were purchased three months before maturity date. The time deposit with BD0 was just acquired and has a period of one month while the time deposit with PNB was acquired nine months ago and has a remaining term of three months. No other details were obtained in relation to the preference shares and the ordinary shares. P 3.000.000 1.500,000 500,000 500,000 500.000 500.000 How much of the above should be presented as cash and cash equivalent under current assets?

ABC Company had excess cash and made the following investment transactions: Treasury Bonds Commercial Paner Time Deposit-BDO Time Derosit -PNB Preference Shares in Delta Corporation Ordinary Shares in Alpha Corporation Both treasury bonds and commercial papers were purchased three months before maturity date. The time deposit with BD0 was just acquired and has a period of one month while the time deposit with PNB was acquired nine months ago and has a remaining term of three months. No other details were obtained in relation to the preference shares and the ordinary shares. P 3.000.000 1.500,000 500,000 500,000 500.000 500.000 How much of the above should be presented as cash and cash equivalent under current assets?

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 4TCL: CONDUCTING A FINANCIAL RATIO ANALYSIS ON HP INC. Use online resources to work on this chapters...

Related questions

Question

Transcribed Image Text:E Apps

Gmail

E YouTube

Maps

REQUIRED to upload your solutions or calculations in the google classroom after submit

Make your solutions, calculations or computations legible, neat, and in good accounting

solution or calculation would not entitle you to any credit or score.

PLEASE INPUT YOUR FINAL ANSWERS HERE IN THE GOOGLE FORM WHICH IS ALSO TH

ENCIRCLED/ HIGHLIGHTED IN YOUR SOLUTIONS, REMOVE COMMAS IN THE NUMBERS

is typed as 5000).

Question 1*

ABC Company had excess cash and made the following investment

transactions:

Treasury Bonds

Commercial Paper

Time Deposit -BDO

Time Deposit -PNB

Preference Shares in Delta Corporation

LOrdinary Shares in Alpha Corporation

Both treasury bonds and commercial papers were purchased three months

before maturity date. The time deposit with BDO was just acquired and has a

period of one month while the time deposit with PNB was acquired nine months

ago and has a remaining term of three months. No other details were obtained

in relation to the preference shares and the ordinary shares.

P3.000.000

1.500,000

500,000

500.000

500.000

500.000

How much of the above should be presented as cash and cash equivalent

under current assets?

Your answer

O This is a required question

?

米

16 40

#3

2$

4

3

近

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning