According to Excel's sensitivity report for the previous formulated model (Eagle Tavern), the shadow price for the capacity constraint is 00 O 1.25

According to Excel's sensitivity report for the previous formulated model (Eagle Tavern), the shadow price for the capacity constraint is 00 O 1.25

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter16: Bargaining

Section: Chapter Questions

Problem 2MC

Related questions

Question

Only need help with the shadow price for the capacity constraint

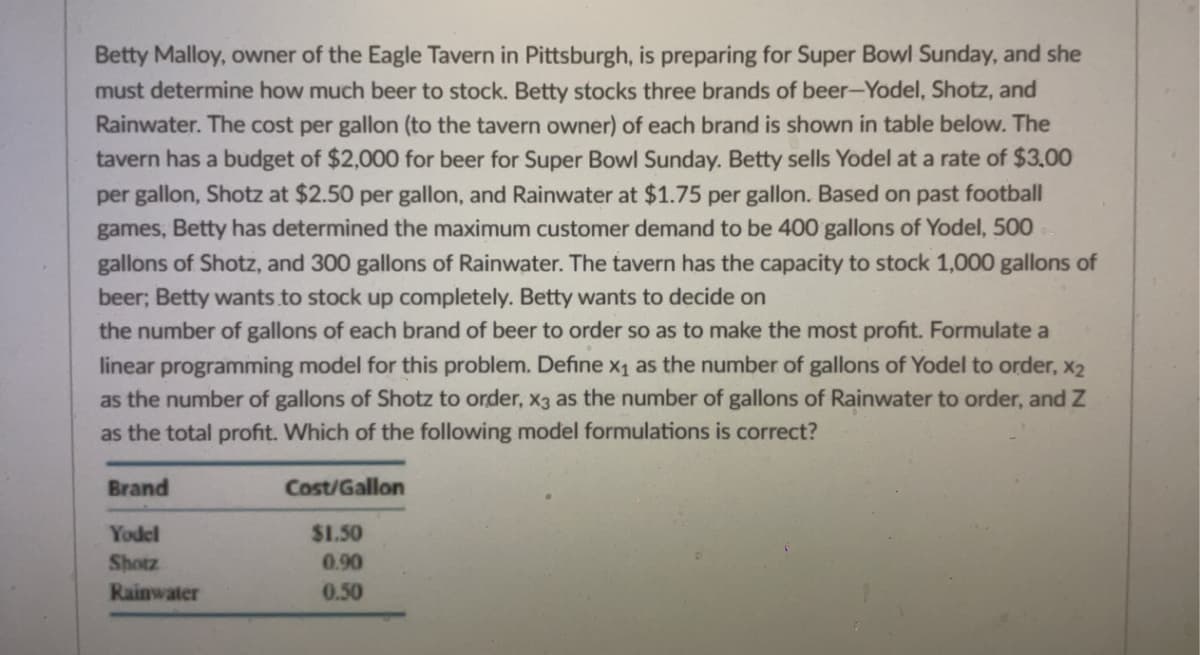

Transcribed Image Text:Betty Malloy, owner of the Eagle Tavern in Pittsburgh, is preparing for Super Bowl Sunday, and she

must determine how much beer to stock. Betty stocks three brands of beer-Yodel, Shotz, and

Rainwater. The cost per gallon (to the tavern owner) of each brand is shown in table below. The

tavern has a budget of $2,000 for beer for Super Bowl Sunday. Betty sells Yodel at a rate of $3,00

per gallon, Shotz at $2.50 per gallon, and Rainwater at $1.75 per gallon. Based on past football

games, Betty has determined the maximum customer demand to be 400 gallons of Yodel, 500

gallons of Shotz, and 300 gallons of Rainwater. The tavern has the capacity to stock 1,000 gallons of

beer; Betty wants to stock up completely. Betty wants to decide on

the number of gallons of each brand of beer to order so as to make the most profit. Formulate a

linear programming model for this problem. Define x₁ as the number of gallons of Yodel to order, x2

as the number of gallons of Shotz to order, x3 as the number of gallons of Rainwater to order, and Z

as the total profit. Which of the following model formulations is correct?

Brand

Cost/Gallon

Yodel

$1.50

Shotz

0.90

Rainwater

0.50

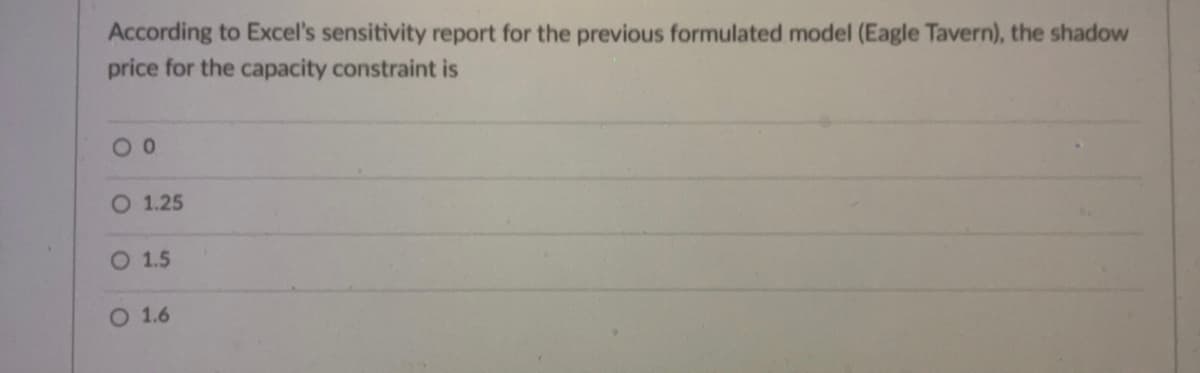

Transcribed Image Text:According to Excel's sensitivity report for the previous formulated model (Eagle Tavern), the shadow

price for the capacity constraint is

0 0

O 1.25

O 1.5

O 1.6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning