According to the IRS, individuals filing federal income tax returns prior to March 31 received an average refund of $1,088 in 2018. Consider the population of "last-minute" filers who mail their tax return during the last five days of the income tax period (typically April 10 to April 15). a. A researcher suggests that a reason individuals wait until the last five days is that on average these individuals receive lower refunds than do early filers. Develop appropriate hypotheses such that rejection of Ho will support the researcher's contention. Ho: is greater than or equal to 1,088 ✔ S S H₁: is less than 1,088 b. For a sample of 400 individuals who filed a tax return between April 10 and 15, the sample mean refund was $930. Based on prior experience a population standard deviation of a $1,600 may be assumed. What is the p-value (to 4 decimals)? 5814 c. Using a 0.05, can you conclude that the population mean refund for "last minute" filers is less than the population mean refund for early filers? Yes d. Repeat the preceding hypothesis test using the critical value approach. Using a 0.05, what is the critical value for the test statistic (to 3 decimals)? Enter negative value as negative number. -1.645 State the rejection rule: Reject Ho if z is less than or equal to V the critical value. Using the critical value approach, can you conclude that the population mean refund for "last minute filers is less than the population mean refund for early filers? Yes

According to the IRS, individuals filing federal income tax returns prior to March 31 received an average refund of $1,088 in 2018. Consider the population of "last-minute" filers who mail their tax return during the last five days of the income tax period (typically April 10 to April 15). a. A researcher suggests that a reason individuals wait until the last five days is that on average these individuals receive lower refunds than do early filers. Develop appropriate hypotheses such that rejection of Ho will support the researcher's contention. Ho: is greater than or equal to 1,088 ✔ S S H₁: is less than 1,088 b. For a sample of 400 individuals who filed a tax return between April 10 and 15, the sample mean refund was $930. Based on prior experience a population standard deviation of a $1,600 may be assumed. What is the p-value (to 4 decimals)? 5814 c. Using a 0.05, can you conclude that the population mean refund for "last minute" filers is less than the population mean refund for early filers? Yes d. Repeat the preceding hypothesis test using the critical value approach. Using a 0.05, what is the critical value for the test statistic (to 3 decimals)? Enter negative value as negative number. -1.645 State the rejection rule: Reject Ho if z is less than or equal to V the critical value. Using the critical value approach, can you conclude that the population mean refund for "last minute filers is less than the population mean refund for early filers? Yes

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter3: Straight Lines And Linear Functions

Section3.3: Modeling Data With Linear Functions

Problem 22E

Related questions

Question

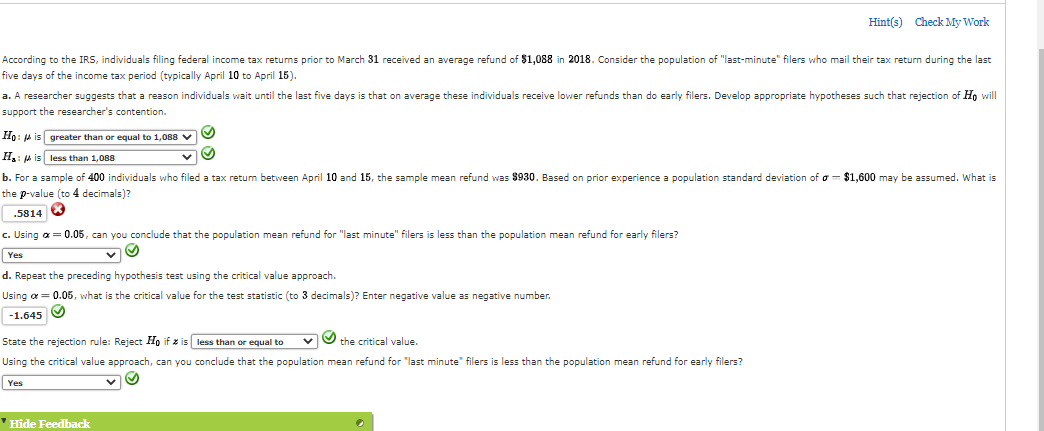

Transcribed Image Text:Hint(s) Check My Work

According to the IRS, individuals filing federal income tax returns prior to March 31 received an average refund of $1,088 in 2018. Consider the population of "last-minute" filers who mail their tax return during the last

five days of the income tax period (typically April 10 to April 15).

a. A researcher suggests that a reason individuals wait until the last five days is that on average these individuals receive lower refunds than do early filers. Develop appropriate hypotheses such that rejection of Ho will

support the researcher's contention.

Ho: is greater than or equal to 1,088 ✔

H₂: A is

less than 1,088

b. For a sample of 400 individuals who filed a tax return between April 10 and 15, the sample mean refund was $930. Based on prior experience a population standard deviation of a $1,600 may be assumed. What is

the p-value (to 4 decimals)?

5814

c. Using a = 0.05, can you conclude that the population mean refund for "last minute" filers is less than the population mean refund for early filers?

Yes

d. Repeat the preceding hypothesis test using the critical value approach.

Using a = 0.05, what is the critical value for the test statistic (to 3 decimals)? Enter negative value as negative number.

-1.645✔✔

State the rejection rule: Reject Ho if z is less than or equal to V

the critical value.

Using the critical value approach, can you conclude that the population mean refund for "last minute" filers is less than the population mean refund for early filers?

✔

Yes

'Hide Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning